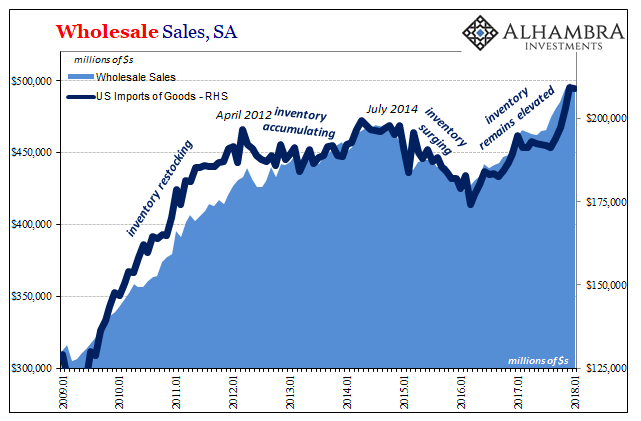

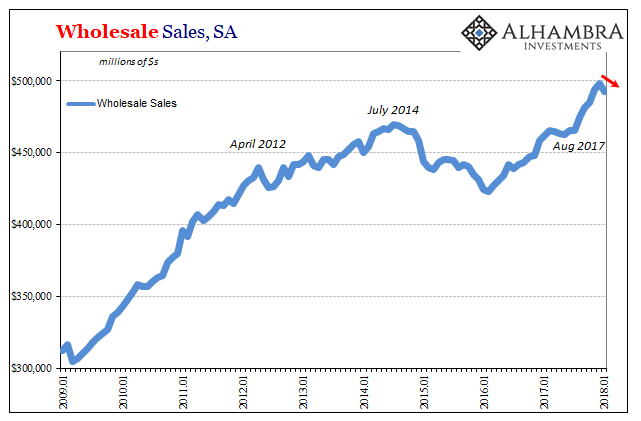

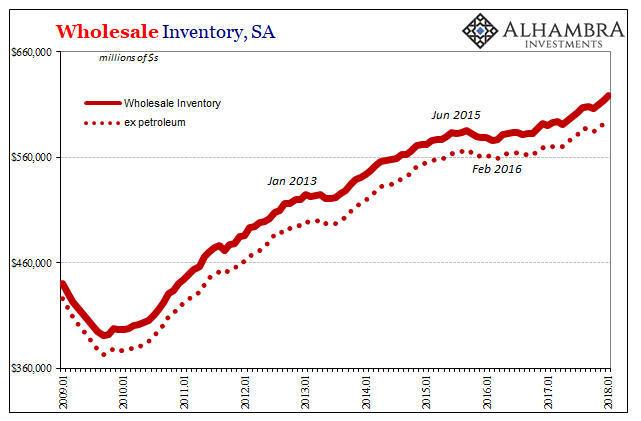

Wholesale sales were up 10% year-over-year in January. But like every other economic account, the bulk of those gains were registered in the aftermath of Harvey and Irma. Seasonally-adjusted, wholesale sales predictably declined in January. Compared to other data points like imports, it’s literally the same pattern.

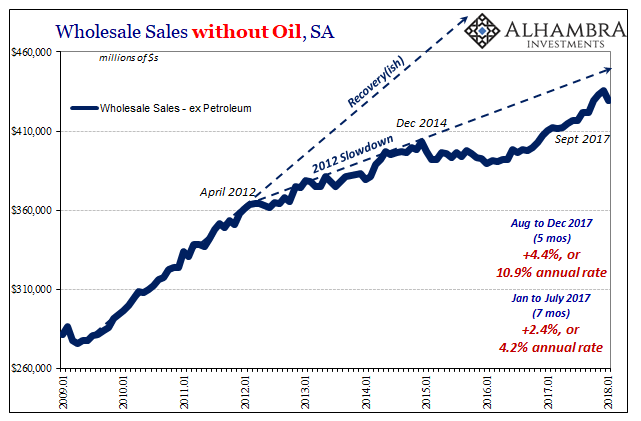

Petroleum sales do account for a lot of the increase, however. In August 2017, for instance, nearly all of the rise in wholesale sales was due to oil and oil prices. Excluding petroleum, the hurricane effects appear smaller but no less clear.

In the 5 months up to and including December 2017, wholesale sales rose 4.4%. That’s an annual rate of nearly 11%. Over the seven months prior to the storms, wholesale sales without petroleum were rising at just a 4.2% annual rate – a level more consistent with, if slightly behind, the 2014 upturn.

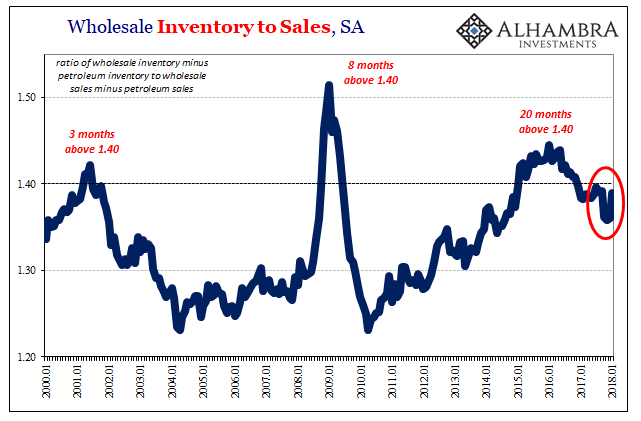

If the hurricane effects are the cause of the acceleration, and it appears consistently that they have been, then that proposes two problems at the wholesale level representing the same downside imbalance as the last three years continuously.

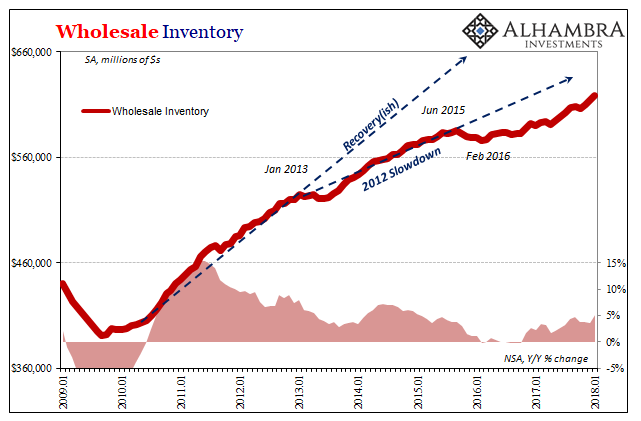

For a few months late last year, wholesale sales dramatically broke with inventories. That’s what a recovery scenario would look like; rising sales that thin out retail and wholesale inventories to the point that the whole supply chain begins to order more production so as to restock. That pickup in production consolidates the sales gains as the virtuous economic circle of Economics theory.

Inventories appear to be rising with Harvey and Irma, both with and without petroleum. That would propose the drop in the inventory-to-sales ratio was more artificial than economic boom. With seasonally-adjusted sales declining significantly in January, and inventory still rising, the inventory-to-sales ratio is right back where it was before the tropical weather intruded.

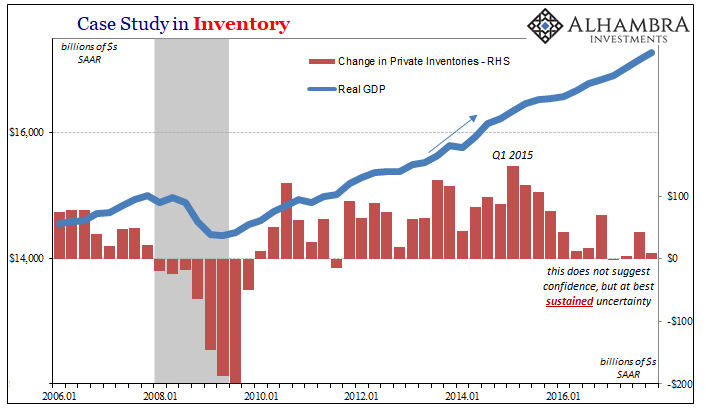

It would leave the goods economy (which the services economy largely still depends upon, moving, managing, and selling goods) with sales potentially more like early 2017 and inventory still far too elevated. The combination of those factors is continued lackluster growth rather than inflationary acceleration. Inventory has been a persistent drag from the very start of this current upturn. Without an inventory restocking boost, the manufacturing and industrial sectors won’t pick up; can’t pick up.

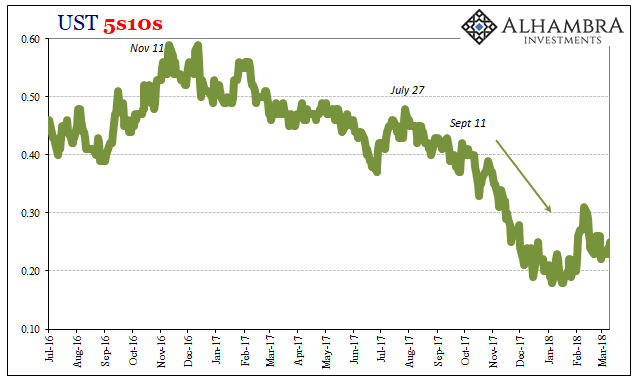

Market-based “reflation” sentiment has noticeably paused here over the past five or six weeks. Some of that, I believe, has been more obvious liquidity pressures (global liquidations will tend to get everyone’s attention, and not in the good way). The balance is surely this possibility of the economy rolling over after the hurricanes’ boost is more completely digested. I don’t think it coincidence that markets were most enthralled by the idea (if still lacking full conviction) when economic statistics were at their most distorted.

Take away the distortions, neither inflation nor a boom look like such good prospects – particularly given the history of the past few years. When evaluating these things, we keep asking ourselves, “what has changed?” If the only rational answer is Harvey and Irma, then bond market’s stubborn resistance at the long end makes perfect sense the last six months or so. The short-end was obliged (money substitutes) to trade on how the FOMC would receive this incoming data, while the long end priced it as if nothing has changed.

Stay In Touch