Why are bond yields falling again? There are, as always, a few reasons mostly related to perceived risks (with liquidity always right at the top, at least since August 2007). Those were more easily set aside, or at least more gently reconsidered, when inflation hysteria raged across the internet. But after talking about it for months, at some point it either shows up or bonds go back to sorting risk priorities again.

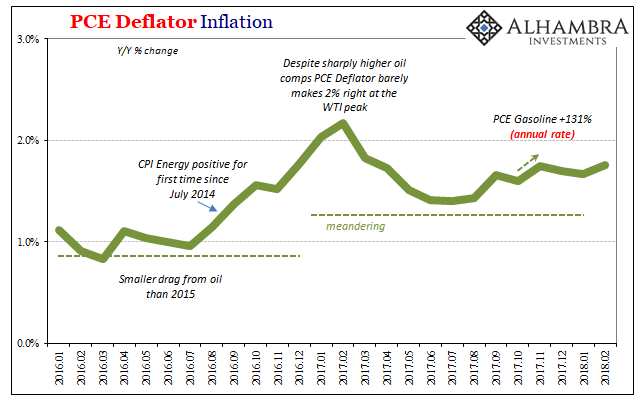

Another month in, and there is no acceleration for consumer prices indicated anywhere. Inflation rates, whatever you may make of calculated indices, continue to display a distinct lack of get-go. In addition to confirming another year of amped up residual seasonality, on the strength of distinct persistent weakness in labor incomes, no less, the BEA also reports today that the PCE Deflator “transitorily” undershot its official policy target for the 68th time out of the last 70 months.

More immediately, after registering 2% just twice last year (the second on a benchmark revision), the PCE Deflator has begun a new streak of misbehaving that has stretched to a full year all over again (and counting). The current index places consumer price inflation at 1.75%, not appreciably different than any other calculation over those twelve months.

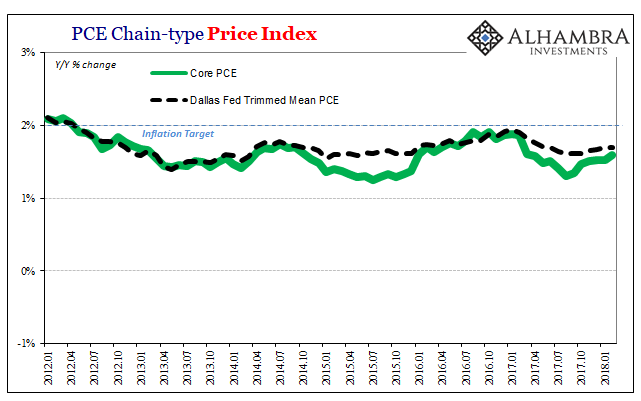

At the same time, so-called core rates (the index that strips out food and energy, as well as the Dallas Fed’s stunted number that precludes outlier basket items at both the top and bottom) display no conspicuous tendencies that would make one believe this will change anytime soon. An economy moving toward overheating already having been at, supposedly, full employment for as many as three years would not be so tenacious about its unurgency.

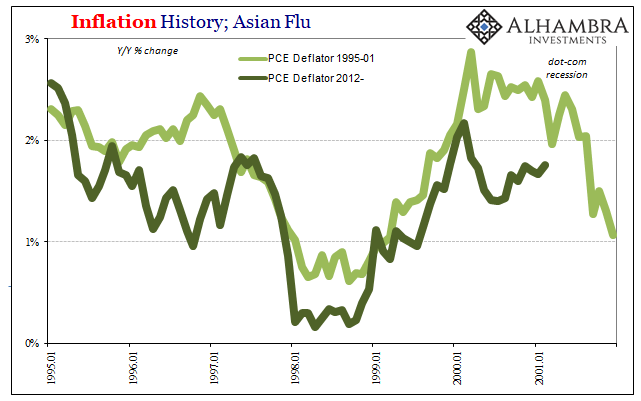

As noted recently in discussion of other inflation rates in the US, the monetary policy and overall price environment of the current period match up quite familiarly with the terminal stage of the dot-com era. Only then, unlike now, consumer prices were far more energetic particularly at the point where the Greenspan Fed felt compelled to step in.

The FOMC then was tilting at a mirage, and so there is again every indication they are merely repeating the same ill-informed presumptions. This is not at all surprising given that the fundamental link between inflation and money cannot be adequately processed where there is no official definition of money and furthermore there hasn’t been any attempt to address this intellectual deficiency since the seventies.

That is in some ways counterintuitive, and at the same time proposes the great danger about our current era. If we look at the economic statistics (honestly), the economy of the last ten years has drastically underperformed that of the Great Inflation across all economic dimensions – it’s not even close. Everyone agrees that the fifteen to seventeen years of wretched economy taken place under that label was wretched in every way.

Yet, because it was inflation that was out of control everyone could also agree, or at least enough of a consensus could be formed, that it was the central bank and economic policies deploying it that were at fault (as well as some bedrock assumptions attempting to mobilize a classical Keynesian foundation in monetary policy; i.e., the exploitable Phillips Curve).

Over this last lost decade, by contrast, there is very little awareness of the problem especially during these intermittent upswings (the economy is booming!) and even less honest effort directed toward understanding it. It has been this way even though both undershooting inflation (marked by commodity price crashes) as well as persistently low bond rates (interest rate fallacy) direct our focus into none but the monetary arena.

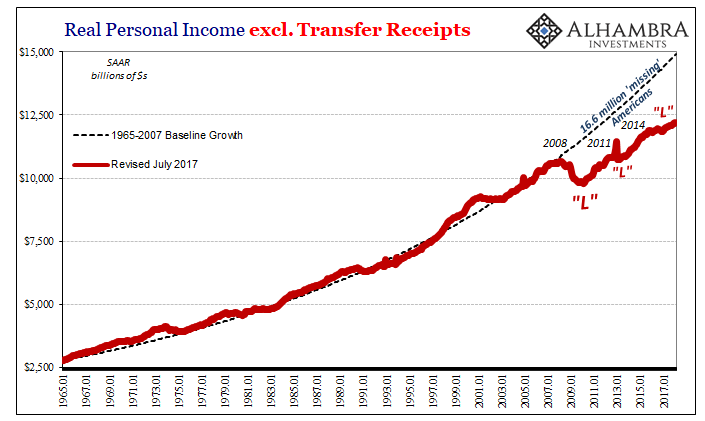

Real Personal Income excluding Transfer Receipts fell off, and never rebounded, exactly during a global monetary panic by accident, complete coincidence to the arrival of mass Baby Boomer retirement and the flooding of heroin into the US?

It’s an utterly absurd thesis, but we are asked to believe exactly that. It’s all “they” have aside from having so abused the word “transitory” particularly with respect to the PCE Deflator and its nearly six full years of downward waywardness. A legitimate inquiry would make something of the timing; national labor income collapses during 2008 and then refuses to get back to normal, perhaps whatever it was that happened in 2008 might propose a more reasonable and consistent explanation for 2018?

Nothing ever goes in a straight line, so we might forgive the Treasury market for its sporadic flight from such reason. After all, investors even in UST’s might occasionally start to think that eventually, possibly one of these days one of these central bankers might be right about something. But that’s the thing; eventually isn’t forever. At some point, the boom better boom.

Stay In Touch