Another global bank CEO is given his walking papers. John Cryan’s tenure at Deutsche Bank was unsurprisingly brief. He began it by being realistic. Upon being hired for the top job, Cryan predicted his stay there would, “[depend] on how well we deliver on strategy, impress clients and reduce complexity.” It’s that last one nobody seems able to truly comprehend.

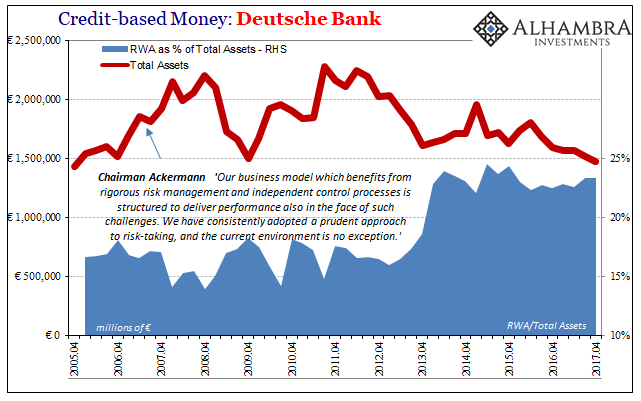

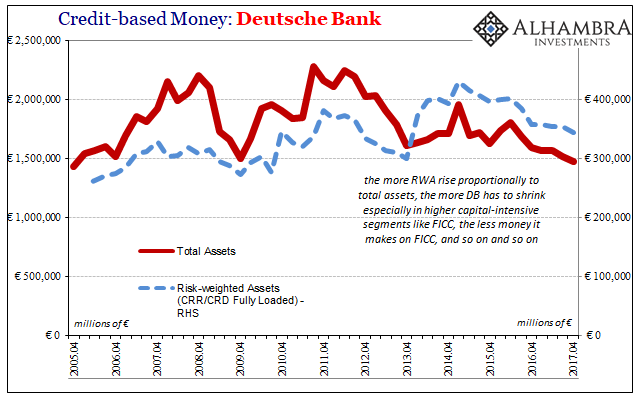

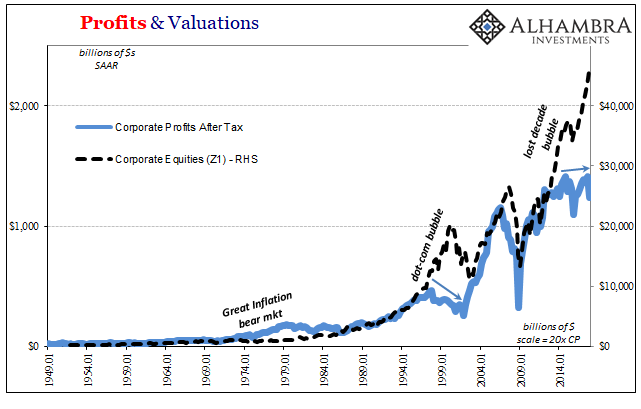

Modern eurodollar money is the very product of complexity. Balance sheet capacity is the Webster’s definition of it. But to make money inside this system you really can’t do so by getting smaller. Yet, the current climate demands only that. It brings about a chicken and egg sort of problem; banks need opportunity derived from a real rather than imagined recovery; to get that recovery requires banks to engage in risky practices of the old byzantine variety.

It’s not really a paradox, though. We would thoroughly celebrate this continued demise of the old ways if someone had thought ahead when that inflection was first awakened ten years ago. Instead, the old system remains chronically unstable and dysfunctional, and the mainstream can’t figure out why banks are reluctant to act as if the world was getting better as “everyone” knows it is (must be regulations!)

Since part of the job is symbolism, it’s perfectly appropriate to look as close as possible at who it is now replacing Cryan. What does this latest switch potentially mean for DB and global eurodollar banking?

Before that, however, we should review why it was Cryan replaced co-CEO’s (of sorts) Anshu Jain and Jürgen Fitschen in 2015. The latter pair had been brought on in 2012 under very different circumstances at DB. By the end at that infamous shareholder meeting in May that year, the two tried to lay blame for their unpopularity on scandal. Board Chairman Paul Achleitner would claim, “The public image of Deutsche Bank is heavily tarnished and damaged.”

That was true, but irrelevant to the problems inside the bank and its balance sheet. What was haunting DB already by then was the “rising dollar” and its already considerable effects on what Jain and Fitschen’s strategy had been up until that time. I think my summary of it written in October 2015 stands up well:

What Deutsche did to restore balance in the wake of 2013’s changed QE profit circumstances was almost unique (Credit Suisse would try something similar). The bank loaded additional capital early last year, under circumstances that remain somewhat unclear, and then plowed ahead into as much risk as it could possibly source. In its press publications displaying those forward intentions in May 2014, the bank (this is somewhat unbelievable in hindsight, far more so than it was then) openly discussed how it expected to drive returns while maintaining leverage from new ventures into US junk and leveraged loans as well as emerging market debt. Given that the price inflection seems to have occurred as the “dollar” turned only a month or so later, Deutsche seems to have placed all its chips right at the top.

In other words, they proved the paradox. They went all risk in 2014 on the premise the opportunity was being presented in the surefire global economic resurrection everyone in position of authority was talking about. And they got burned for it, again.

Cryan was called upon to clean up the mess, as best he might be able. Lasting less than three years, what does that say?

The new guy is a longtime DB employee Christian Sewing. Sewing can’t have been unaware of what went on during those years. He was in 2012 and 2013 the bank’s Deputy Chief Risk Officer. From June 2013 to February 2015, he had been Head of Group Audit.

And during the height of the eurodollar era, Sewing had worked outside Deutsche for the only time in his career. Interestingly, from 2005 to early 2007 he served on the Management Board of one of Germany’s largest cooperative financial institutions, Deutsche Genossenschafts-Hypothekenbank (DG HYP).

Though he left in May 2007 just as the monetary crisis heated up, there is no way he could have been in the dark on what DG HYP was up to. Mere months later, the cooperative called off a merger with Münchener Hypothekenbank and then exited the residential real estate business altogether (pushing their assets in the space off on another segment of the cooperative, Bausparkasse Schwäbisch Hall).

Ironically, in its 2008 annual report DG HYP essentially predicts what John Cryan and the rest of the global eurodollar banks would be going through throughout the last lost decade.

As a result of the crisis on the financial markets, traditional lending business is gaining in importance, whilst complex capital market transactions are being pushed into the background. One effect of the crisis will be that lending will once again be viewed as a demanding and complex product area, and as a product that must come with a price – with the recognition that loans that cannot simply be produced in as high a quantity as possible, like a commodity. This requires a high degree of individual attention and quality in the form of responsibility and trust.

It wasn’t ever regulation that pushed banks to shrink, it was the all-at-once realization of the costs that would arise over their prior unhinged behavior(s). What was perceived as riskless returns before August 2007 was brought crashing down, morphing into returnless risk thereafter. Except for a few outliers like DB during reflation #2, that view has prevailed as it can only prevail.

So, what does Christian Sewing do with DB now? He was part of the machinery that made the crude mistake in 2013 and 2014. Sewing had also left DG HYP before its stunningly prescient prediction about banking as a whole. Is Deutsche about to go back to the Jain/Fitschen model of embracing risk at the apex of another “reflation?”

Perhaps, but I doubt it. The problem isn’t, as I see it, how new management is insufficiently chastened by this troubled reality. It’s the shareholders who aren’t. Understandable if lamentable, the mainstream is awash in recovery rhetoric (again). DB’s investors are impatient for the commentary without having appreciated the reality DG HYP described a decade ago, this grand mismatch that bank CEO’s have been fired over repeatedly as results never seem to match the words.

It’s perfectly emblematic of the stock bubble as a whole, though in the one place it is most appropriate – modern bank complexity, or eurodollar balance sheet capacity as money. The bubble view is the monetary system as it is doesn’t matter, QE’s and the Fed (or ECB) after all. John Cryan knew that it did, especially after seeing what happened under the prior regime. Cryan isn’t being ousted because he was wrong, but because he was right.

Stay In Touch