As it turns out, those “transitory” inflation factors were worth only about 25 bps on the core CPI rate. This isn’t at all surprising and was as usual entirely predictable. But when you don’t have any answers there is a lamentable tendency toward denial or deliberate evasion, even if that leads toward the ridiculous.

Base effects are a part of economics (small “e”). The real world isn’t smooth. The attempt to make it so is understandable but calculations will always be fraught with lumpiness. There is just no way around it. How we treat that unevenness does matter, however, demonstrating as always that interpretation is usually what’s at issue.

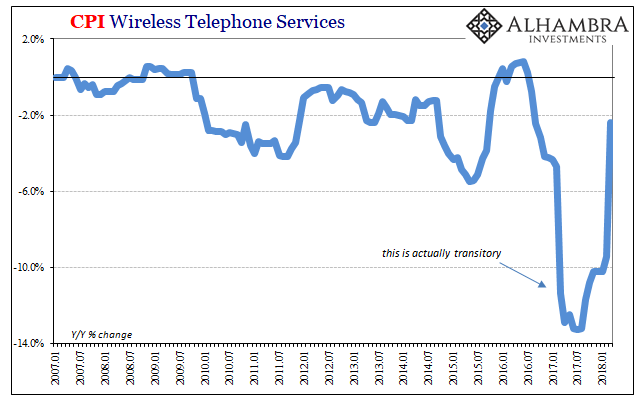

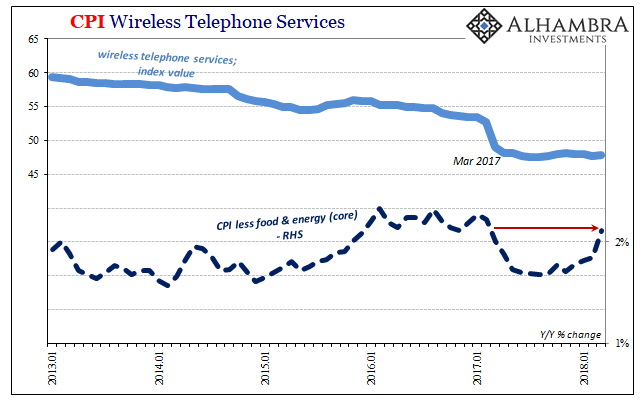

Verizon Wireless entered the cellphone wars in March 2017; or, that’s when their rollout of unlimited data across their plans registered in the CPI components for wireless telephone services. The index for that small piece of the consumer “bucket” was 52.679 in February 2017 (not seasonally adjusted), then dropped to 49.002 upon the introduction of this actually transitory factor.

The year-over-year change here went from -4.7% last February to -11.4% last March. At the same time, the core CPI which had increased 2.22% in February 2017 over February 2016 gained only 2.00% in March. Two months later, Verizon was to hit the Fed’s meeting minutes, the latest factor to have registered for the FOMC as “transitory.”

March 2018 marks an entire calendar year since all that, meaning that any lingering base effects are now removed. The CPI for wireless telephone services dropped 9.4% year-over-year in February but was only -2.4% last month. The core CPI rate which had increased 1.85% two months ago rose by 2.12% in March. About 25 bps, give or take, each way.

It’s not quite how this was made out to be, or how it was supposed to go. The implication of using the word “transitory” is clear enough; that when it is expunged from the record the result will be conformity in every sense. If this temporary problem is to blame for still another year of undershooting inflation, then passing beyond its reach should do what?

Most people might answer that by this construction inflation would rocket off as many have been proposing since the middle of last year. Remove the impediment and the natural economic forces of globally synchronized growth would ignite the very nature of consumer pricing.

That’s not what Yellen et. al. were actually saying, though. You’d be forgiven for thinking they did because in the end that’s what they wanted. It was in their interest to buy time, offering even nonsense to try to explain why in 2017 their inflation scenario wasn’t happening even though they spent a good deal of 2016 (at first confused about 2015) predicting last year was going to be the year.

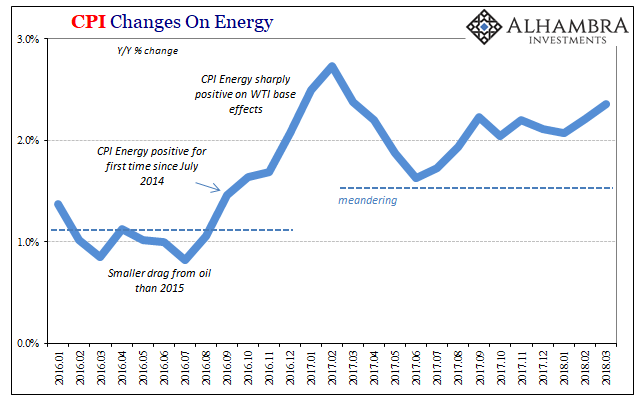

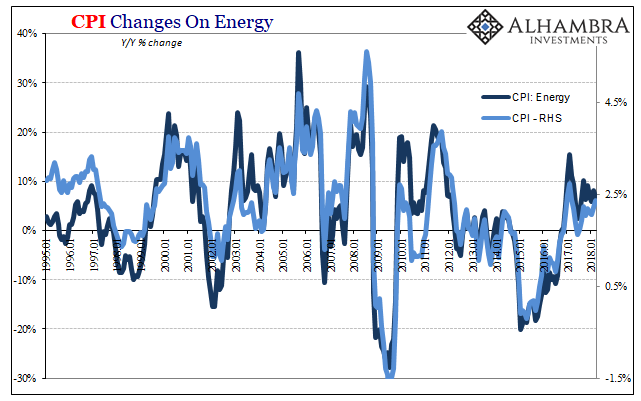

In other words, Economists began to use an actually transitory statistical base effect as if it was some real phenomenon undermining the base inflationary case in the real economy. The drop in wireless telephone services prices had no reach farther than those consumers benefiting from competition. It distorted only by a little headline figures. Those headlines never really changed much when taking all this into consideration. What’s still moving the CPI in small increments is what always does – oil.

But if you believed otherwise, then less pressure for the FOMC in both explaining yet another miserable forecast while at the same time giving them some additional margin to carry on with just a few “rate hikes” even though there wasn’t the slightest hint of overheating. Believing as they do in the unemployment rate, if less than 4.5% doesn’t bring about accelerating inflation then Verizon gave them a convenient and disingenuous opportunity for scapegoating.

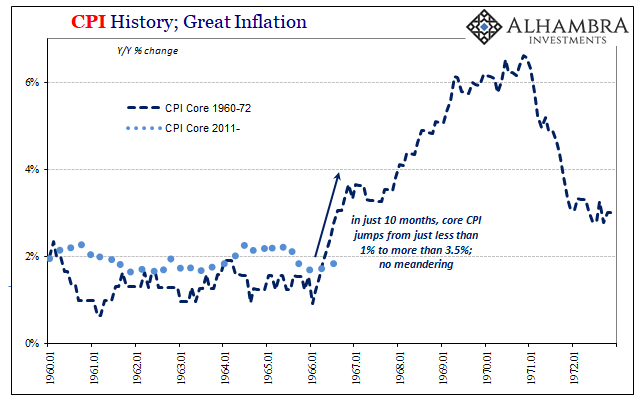

Once the transitory statistical issue was cleared up, the CPI rates have all gone back to where they were before. That is to say, not accelerating at all but meandering as they have since 2011 when uninterrupted by the deflationary forces of the eurodollar. In short, by the count of the CPI nothing has changed underlying in the real economy. After months and months of constant stories about labor shortages and whatnot, cue the mainstream surprise.

Stay In Touch