A few weeks ago, the PBOC stunned many mainstream observers by reducing the RRR. It cut against the preferred narrative that the central bank was “tightening” in anticipation of an economic and therefore inflationary breakout (labor shortages, don’t you know). It didn’t seem to make sense.

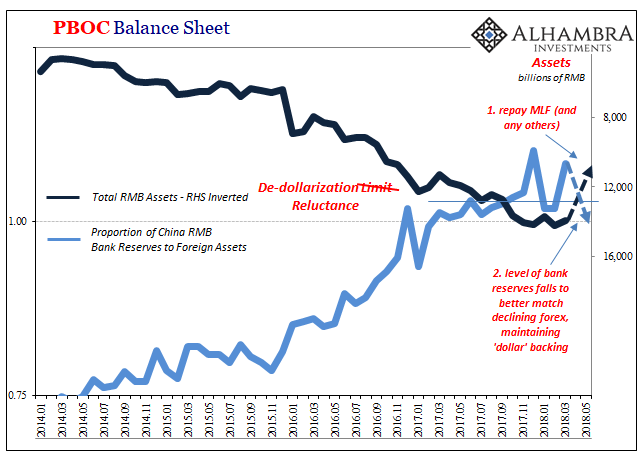

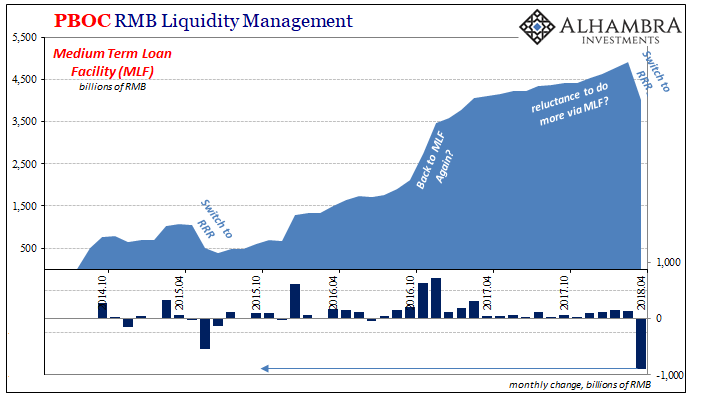

From the perspective of globally synchronized growth, it wouldn’t. Coming at it instead from the point of view of CNY DOWN = BAD, it isn’t that much of a mystery, as I wrote back when the RRR deal was announced. The first step of that plan has taken place, a massive paydown in the MLF which was the requirement for participating banks to obtain the lower RRR.

Our chart of the week, then, is that Step 1:

Rumors persist of more RRR cuts to come. Nothing has yet been officially acknowledged, but that they continue suggests some nontrivial chance these are leaks from inside the official apparatus. Why might they need more non-PBOC liquidity?

Using the RRR is a clumsy technique fraught with innumerable uncertainties – including that banks might hoard that excess liquidity. We need only look back to the experience in 2015 for an example.

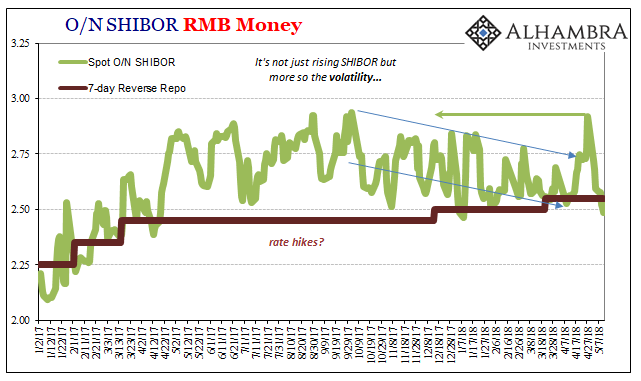

If what this is all about is stable CNY and therefore stable (if low growth of the “L”) economy, then volatility in RMB won’t cut it. Thinking further down the road, this might even propose yet another shift in policy (away from Hong Kong) still trying to deal with the same stubborn issue – the dollar shortage and China’s dollar short.

Stay In Touch