Does a year matter? It seems like a sufficient length of time whereby solid conclusions might be reached. While that may be true in a lot of disciplines, it is not so in Economics.

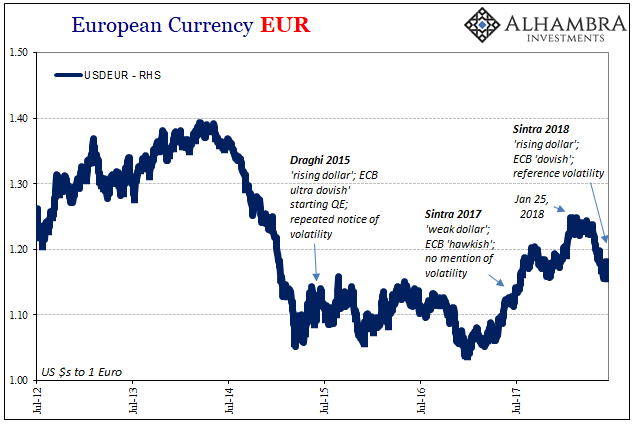

Recall that in late June 2017, ECB President Mario Draghi kicked up a minor fury over presumed “hawkish” comments. It triggered a worldwide BOND ROUT!!! as his speech at the central bank’s annual central banker conference in Sintra, Portugal, was widely quoted.

We can be confident that our policy is working and its full effects on inflation will gradually materialize. But for that, our policy needs to be persistent, and we need to be prudent in how we adjust its parameters to improving economic conditions.

As if he might have left too much in doubt, he followed by assuring everyone, “All the signs now point to a strengthening and broadening recovery in the euro area.” The leading edges of the coming inflation hysteria were beginning to be visible right then.

Now a year later, again in Portugal hosting the ECB’s central banker conference, the word “gradual” once more makes its prominent appearance.

We will remain patient in determining the timing of the first rate rise and will take a gradual approach to adjusting policy thereafter.

That terms applies to a whole lot more than just monetary policy. Here’s what the IMF’s 2017 report on Europe had to say just in time for last year’s Sintra gathering:

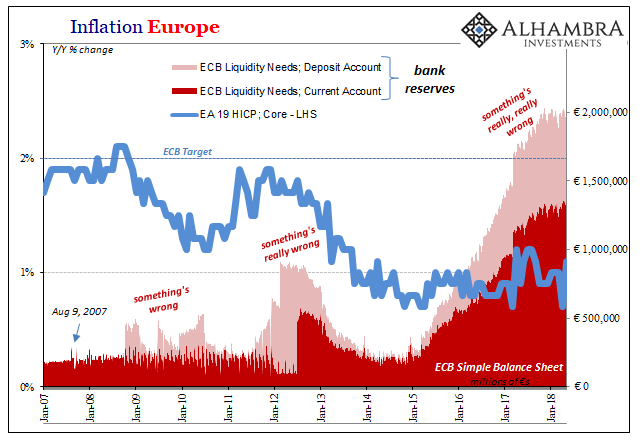

Subdued wage growth and underlying inflation suggest there is a long way to go before headline inflation durably meets the ECB’s objective. The ECB has rightly committed to keep policy rates low for an extended period, well past the horizon of net asset purchases. No changes to this forward guidance should be made until there is strong backing from the performance of actual inflation or a firm assessment that the inflation outlook has improved decisively.

Everything contained within that quote can be applied for June 2018, too. It quite accurately describes conditions this year just as much as last year, an interpretation the ECB apparently shares. As noted last week, Europe’s policymaking body very publicly pushed back the anticipated start date for rate hikes. This changed so-called forward guidance, in the wrong direction, is characterized as “dovish” when in fact it is something else entirely.

That something else Mario Draghi made reference to in his latest conference remarks.

The downside risks to the outlook come from three main sources. The threat of increased global protectionism prompted by the imposition of steel and aluminum tariffs by the U.S.; rising oil prices triggered by geopolitical risks in the Middle East; and the possibility for persistent heightened financial market volatility.

Make what you will of the first two, but what was that last one? Heightened financial market volatility? We’ve heard this one before, too.

Three years ago, in June 2015, Draghi testified before the European Parliament’s Economic and Monetary Affairs Committee. He told them:

Over recent weeks, financial markets have registered a measurable trend reversal in prices and a surge in volatility, with the fixed-income market the epicentre of the correction.

Draghi then blamed his own QE, of all things, somehow claiming, “a period of higher volatility is a phenomenon that is frequently observed not long after the start of a large quantitative programme.” I don’t know how most people remember the summer of 2015, but almost none of the volatility had anything to whatsoever do with the ECB’s bond buying. It was instead the opposite of what that bond buying was supposed to accomplish.

What we are talking about in all these years is, of course, “dollar.” When volatility was referenced during 2015 it was “rising” and would that August shock the whole world by completely overrunning the PBOC just as it had the SNB earlier that year. We find at least the same odor beginning to spread across markets this year, though not to the same extent.

At least not yet, which is what the latest Sintra reference really means. Draghi may appear more “dovish” in 2018 when compared to 2017 because there is one very clear difference between this year and last year.

Economists like Draghi are never made to answer for the year of time in between. QE is superpowerful, he will often say, but it was begun over three years ago. It just doesn’t seem to be what everyone thinks, yet time isn’t ever a factor in mainstream analysis.

Neither is “dollar” for that matter, even though it is the one thing that matters above all else. Even in Europe and euros. In fact, the ECB’s credibility is every bit as relevant to eurodollar conditions as the Fed’s. European banks, the very basis of global credit-based money, factor Mario Draghi’s confidence in what he says, and does not say, as much as for anyone else.

Repeating last week’s synopsis:

In very broad and general terms, that’s what the dollar and by consequence most of the rest of the world’s currencies have moved on. The “weak dollar” of reflation and globally synchronized growth was banks extending dollar funding (and financial entities buying up Eurobonds by the handfuls) on the expectation of opportunity and the lower perceived risks to those prospects.

Those beliefs were challenged later last year (especially to European banks) and then in concrete fashion throughout the first half of this year. The ECB’s actions lately are, again, in line with the ongoing review and, since April 18, revision as it relates to global risk/opportunity. This is the renewed “rising dollar”, not projections of interest rate differentials among central bank policy actions that have little grounded basis in anything but their same interpretations that always, always fall short.

What a difference a year does and does not make.

Stay In Touch