One of the most disgusting and least self-aware passages in any of the tens of thousands of published pages of FOMC discussions was in reference to the People’s Bank of China. On September 16, 2008, the US central bank’s operating and policy committee was sharing a laugh at the expense of their Chinese counterparts.

Some solemnity and internal reflection should have been demanded, especially given the setting. September 16, 2008, the day after Lehman was made public, is more infamous not for anything done in China but for what wasn’t done in America. China’s central bank was trying to deal with the tremendous and still then unfolding fallout from what Ben Bernanke’s central bank never did really understand.

NATHAN SHEETS, Staff Economist. Yes. Yesterday the PBOC cut its main policy rate 27 basis points. I guess they felt that 26 would not have been enough and 28 would have been too much. [Laughter] And 27 was just the right number. I’d say a couple of thoughts were there.

RICHARD FISHER. Thank you.

CHAIRMAN BERNANKE. Three is a lucky number in China. Don was going to tell you that 3 cubed is 27. [Laughter].

DONALD KOHN. He was also going to wonder, Mr. Chairman, whether we needed to harness the mystical powers. [Laughter]

CHAIRMAN BERNANKE. I think we have good feng shui here.

MR. SHEETS. The science of monetary policy.

This exchange plays into two stereotypes, only one of which is really valid. The first is the easygoing, carefree US Economists completely detached from reality sitting cozy within their DC bubble while the entire world, the contagion of the dollar, mind you, burns around them. The sheltered laughter should stick in your mind given just how much of a failure it had been to that point, which was nothing compared to what was about to happen and then keep happening. This is the true one.

The other, which isn’t, is of the Chinese as perilously over-precise, the PBOC in particular. There is this misconception that the Communists having given themselves absolute authority attempt to wield it with pseudo-scientific precision. They were, and still are, doing nothing at all meaningfully different than their clueless US counterparts.

That they went about it in slightly different ways says very little, though either side would have you believe otherwise. The PBOC picked exact numbers down to the basis point; the Federal Reserve always moved in round numbers (like the allotment for TAF or dollar swaps or the amounts of QE). Blunt or exact, it has been all the same “monetary science.”

At least on the Chinese side their tendency toward exactness has been confused for a higher layer of competence. Like anything given the gloss of mathematics, it appears to be “quantitative” therefore objective. Nothing could be farther from the truth.

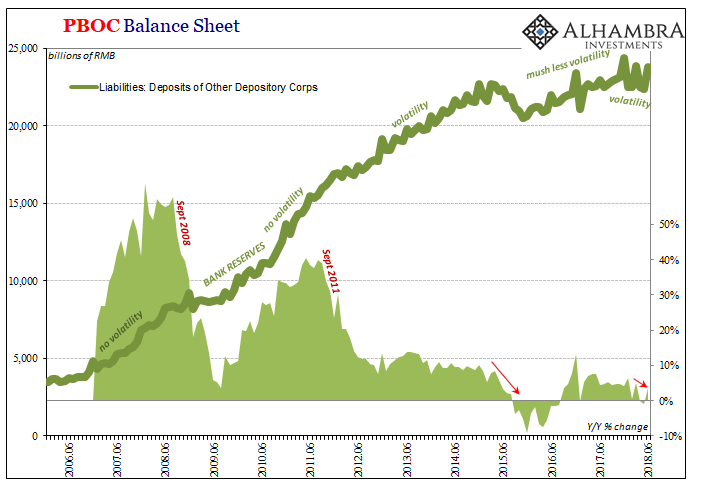

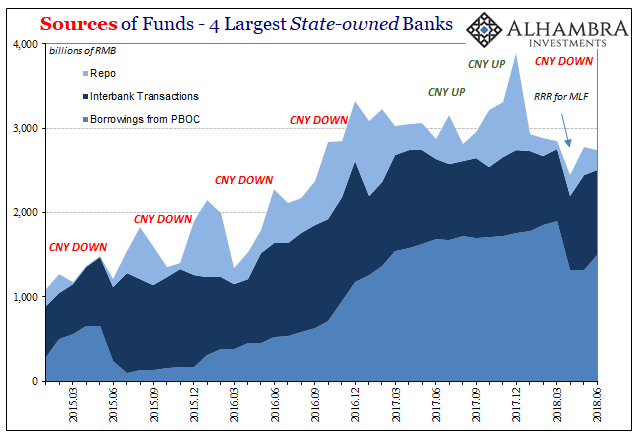

Rather than focus on 27 bps in September 2008 versus 26 or 28, the only thing that mattered was any number presented at all. Look at the chart above. That was Bernanke’s job, though it is captured here in RMB bank reserves. Economists never got the connection, and they still don’t get it now because they can’t – to understand the global nature of eurodollar money would mean an end to econometrics as it is.

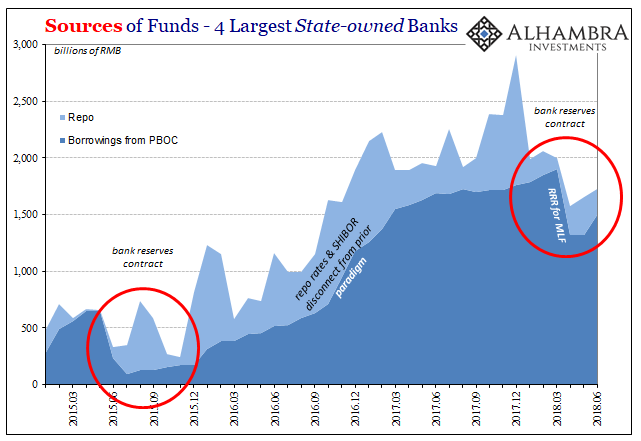

For its part, what you see above isn’t the scientifically determined exact right number of bank reserves added, or taken away, in the exact right month. What should be pretty clear is that the PBOC often is flying blind, just like the comics at the FOMC.

This blindness shows up in the periodic volatility of monthly reserve levels, which is conspicuous when there isn’t much growth in them. Any aviation analogy works in this respect; so long as growth/speed is rapid stability takes care of itself requiring no adjustments from the pilots.

Take away growth/speed and the resulting instability leaves little room for error/crash. When you have low margins, it is human nature to overanalyze and at times overcorrect; to try to be too precise when such a thing is really impossible given the unpredictability of complex systems. When things aren’t going well, you might end up doing too much adjusting.

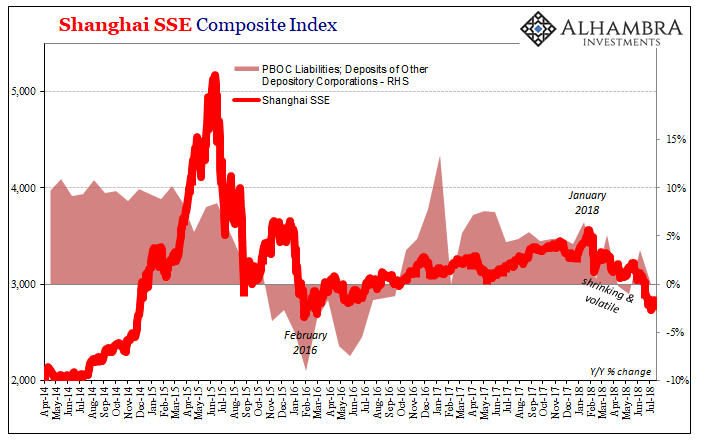

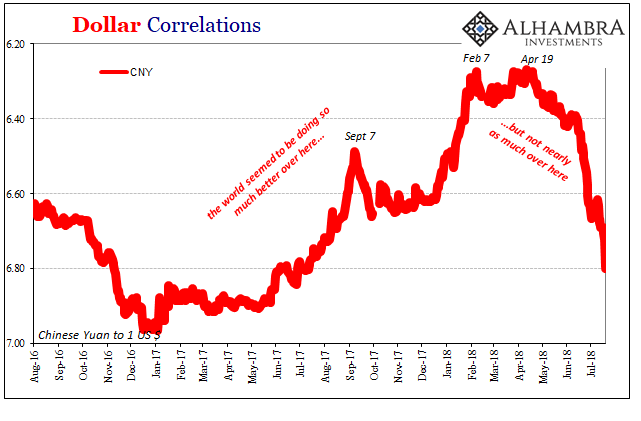

With bank reserves contracting again this year, though not specifically in the month of June 2018 (small increase year-over-year), the latest figures, we see very clearly the return of monetary volatility in Chinese money. It hasn’t yet shown up in RMB money rates but you may have noticed it in markets (and currencies).

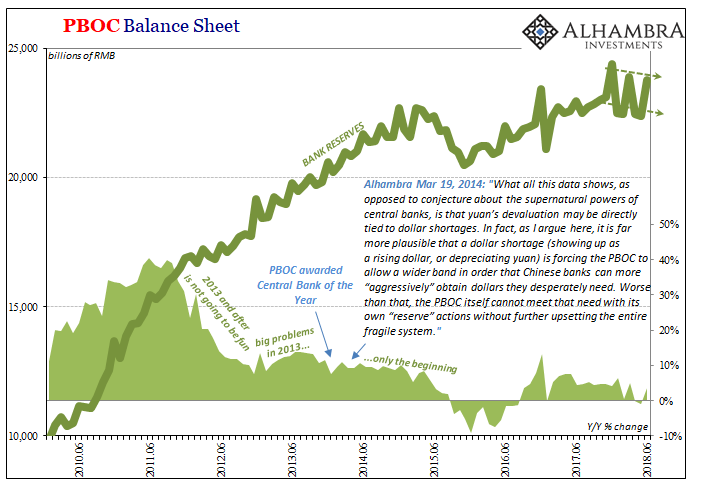

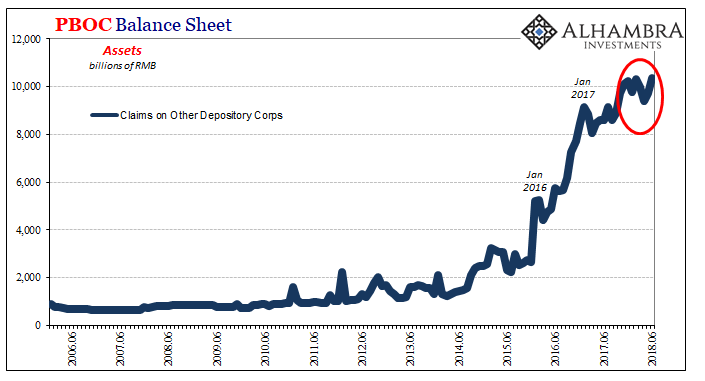

The primary reason for the upswing in bank reserves in June was the MLF. That’s right, after making a huge deal (with offsetting RRR cuts) out of paying down the MLF in April and May, the PBOC and the smaller banks were right back at it in June. From one extreme to another.

One month doesn’t necessarily tell us anything definitive, but I can’t help but wonder if the PBOC imprecisely threw up their hands last month. It would make sense to me, anyway, that if you were doing all this for the sake of stability in CNY and then it dropped precipitously anyway, why bother still doing it? If you’re afraid the MLF will be CNY negative and CNY is hugely negative, MLF up or down won’t really matter.

These June Chinese financial figures, I believe, describe pretty well this concept of overcorrection. It may seem precise on the outside, especially as there was a very good chance PBOC officials had exact numbers in mind for all these shifts, but without the asset side growing (forex, meaning “dollar” inflows) monetary authorities are left to swing wildly from one extreme to another on the whims of short run changes.

You can appreciate, I hope, at the very least why there has been market upset in 2018, and not just in China. The big Chinese banks are depriving themselves of marginal funding, this wholesale stuff that was triggered in the first place so as to avoid repeating 2015. They are repeating it anyway, and for what? CNY crashes again because Bernanke then Yellen now Powell represents an unbroken line of “dollar” incompetence whose direct and drastically negative results span the entire globe – just not in a straight line.

The science of monetary policy, indeed.

Stay In Touch