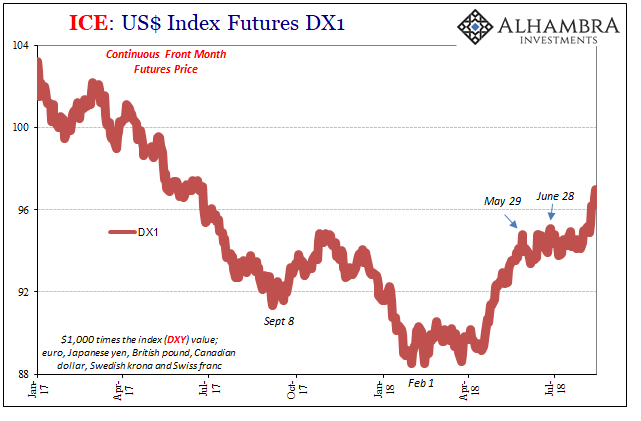

There isn’t really any doubt what happened on May 29. It was a global collateral call. Bonds all over Earth were hugely bid, especially paper in Germany and America – the pristine of the pristine. This is pure liquidity risk, meaning that no matter your feelings on the long-term solvency of the US government (or Germany’s ability to maintain the euro bloc) the debt instruments they issue are liquid under almost any conditions.

For financial institutions with all that has happened over the last decade (including constant reminders central banks haven’t achieved anything of substance in the liquidity department) it doesn’t matter this so-called bond bubble. If you think things are heading the wrong way (again) those long off considerations mean absolutely nothing; what matters is tomorrow when your funding counterparties (JP Morgan) call and demand you put up more of something negotiable.

You need only survive until tomorrow, even if the mad scramble for what little pristine securities may be available at any price.

This is, obviously, not a very good sign about how things are going in the realm of effective global money. Collateral flow requires concerted effort by money dealers, the real monetary substance of the modern eurodollar system. QE’s and their bank reserve byproducts solved nothing on that score.

The Treasury Department’s TIC data for June 2018 almost surely has picked up the aftermath of May 29. Unfortunately, after reviewing all the relevant data it will leave you with more questions than answers – a familiar condition for eurodollar investigations of this kind.

Let’s start with what we already know and expect.

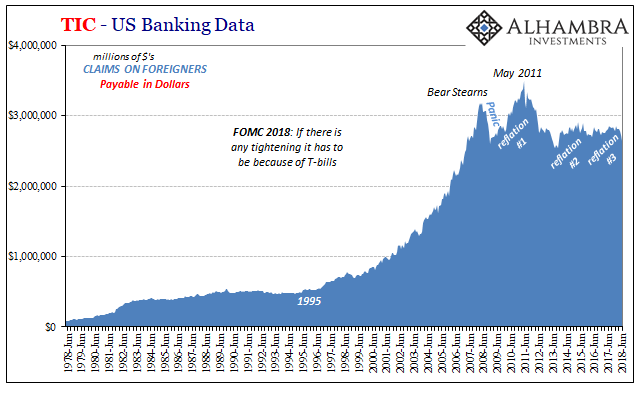

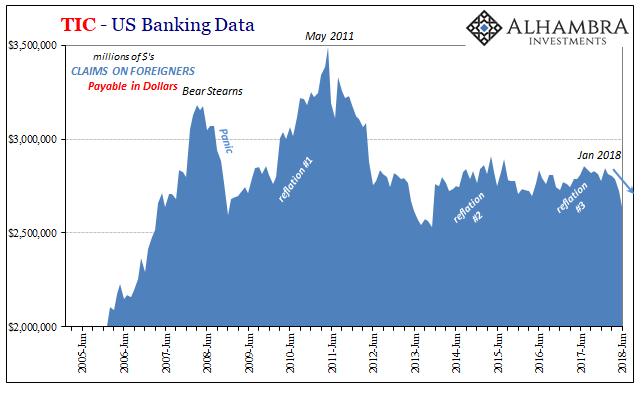

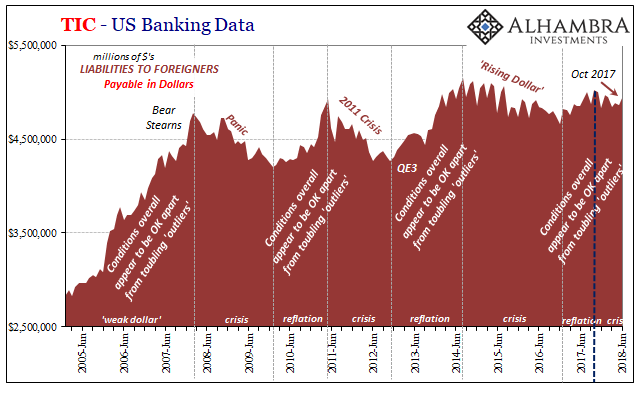

On the “blue” side, various dollar instruments being lent to overseas counterparties by US banks, we unsurprisingly find more evidence Reflation #3 ended. Consistent first with global liquidations in January, there is a clear downward trend (negative eurodollar liquidity or money) starting right after that particular month.

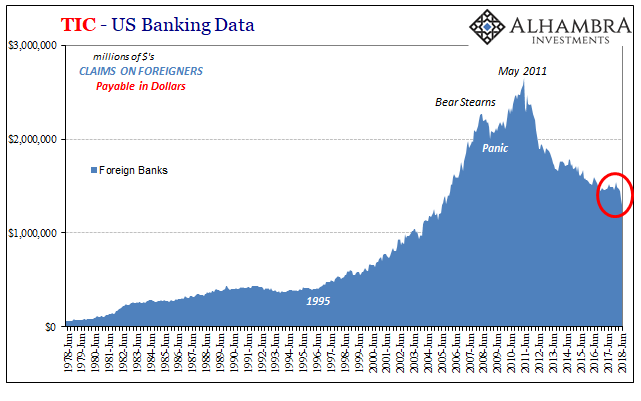

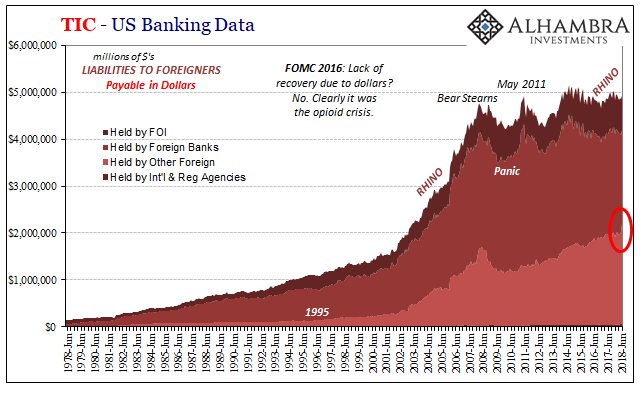

Furthermore, the culprit is the same one (above) as has been the case since Bear Stearns (and really before March 2008; it’s just that Bear’s near demise punctuated building negative pressures in a very visceral way that it shows up perfectly in data like this). Time and again it is the global banks who take to retreat that trigger all these massive worldwide money problems.

It is credit-based system, after all, so the lack of participation by credit institutions in it even if intermittently isn’t ever going to lead anywhere good in either the short run or longer term.

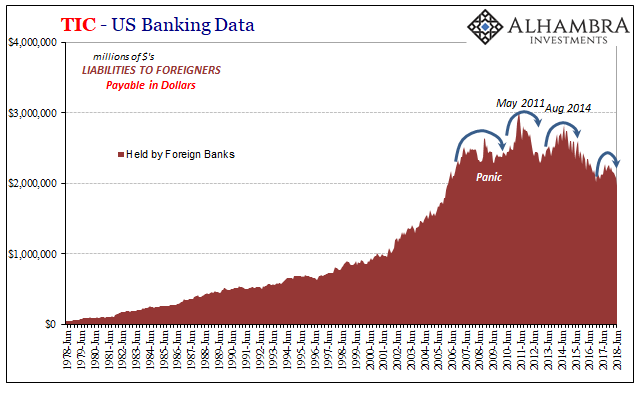

Over on the “red” side, same thing. US banks are borrowing fewer “dollars” and dollar instruments from foreign bank counterparties

Overall, however, contrary to the blue there was a small but noticeable rise in the total inbound TIC balance in June. Disaggregating it by category we find that, as is typical, some unclassified system participants (“Other Foreign”) were responsible for the increase.

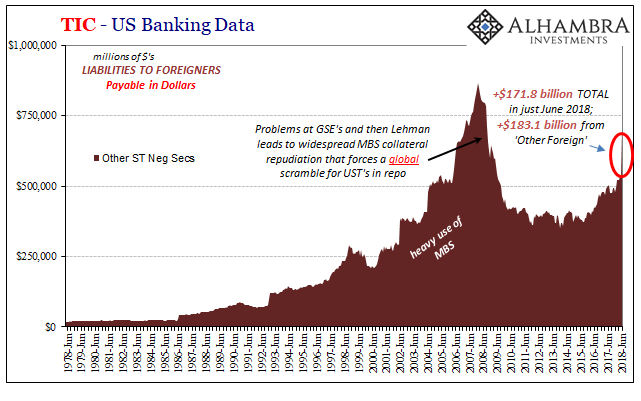

It doesn’t look it on the chart immediately above, but it is actually an enormous jump. The increase is just shy of +$200 billion in only June, but because that’s out of $2 trillion in the one category and ~$5 trillion overall it appears at first small. Still, a more than 10% gain from one class of financial agents, even those counted as “other”, gets your attention.

But what was it?

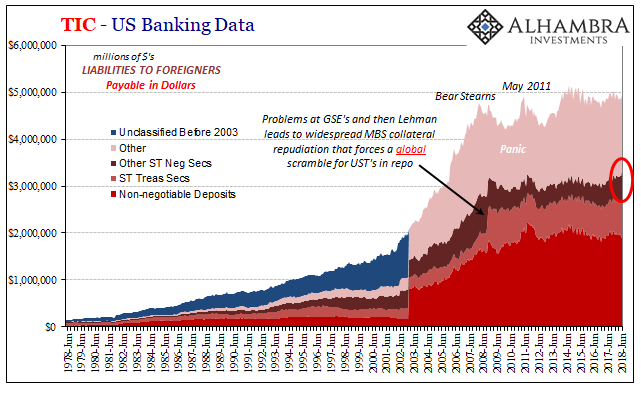

Other short-term negotiable securities. In the past this category has primarily consisted of MBS being used and borrowed for repo. Yes, collateral and securities lending.

But in the past, this group of repo (and FX) collateral had been very much out of favor. Starting with Lehman, practically no one wanted the stuff. In 2008, repudiation of MBS pushed especially foreign entities to the panicked scramble for UST collateral (leading to at the worst times several trillions in UST repo fails).

It leaves us in June in the aftermath of May 29 with two “others”; other foreign institutions apparently lent more than $180 billion in other short-term securities to US banks who in all likelihood really needed some kind of collateral. For what? Who knows, but we can reasonably assume that this was the end result of the collateral problems up to May 29.

Other questions raised by this data are much harder if not impossible to answer. Who was it? The only thing we are relatively certain is that it wasn’t, perhaps surprisingly, foreign central banks (FOI’s), though it could’ve been other entities operating on their behalf. Why did they do it? I have no idea. Where did these things come from? Can’t say. What were these securities, specifically? Again, who knows.

Because it’s a big number and sticks out to such an obvious extent we have to consider first that this is either a statistical anomaly or a possible unannounced reclassification. These things happen, especially in these kinds of esoteric data series.

Right now, though, what it looks like is that in the wake of May 29 and what was happening up to that date (rapidly “rising” dollar, meaning increasingly heavy global shortage squeeze on the global “dollar short”) someone stepped up and supplied a massive amount of paper. It wasn’t banks.

This may account for why up until August things really seemed to calm down. The dollar, especially the euro, went sideways for the next two months as if enough positions had been squared off by May 29. This could answer how, even if, again, it leaves us with more questions than answers.

It will be interesting to see if this potential collateral bump persisted in July (which we would expect given the dollar) and then reversed even if only partially in August (which we would also expect given the dollar’s renewed pressures).

Stay In Touch