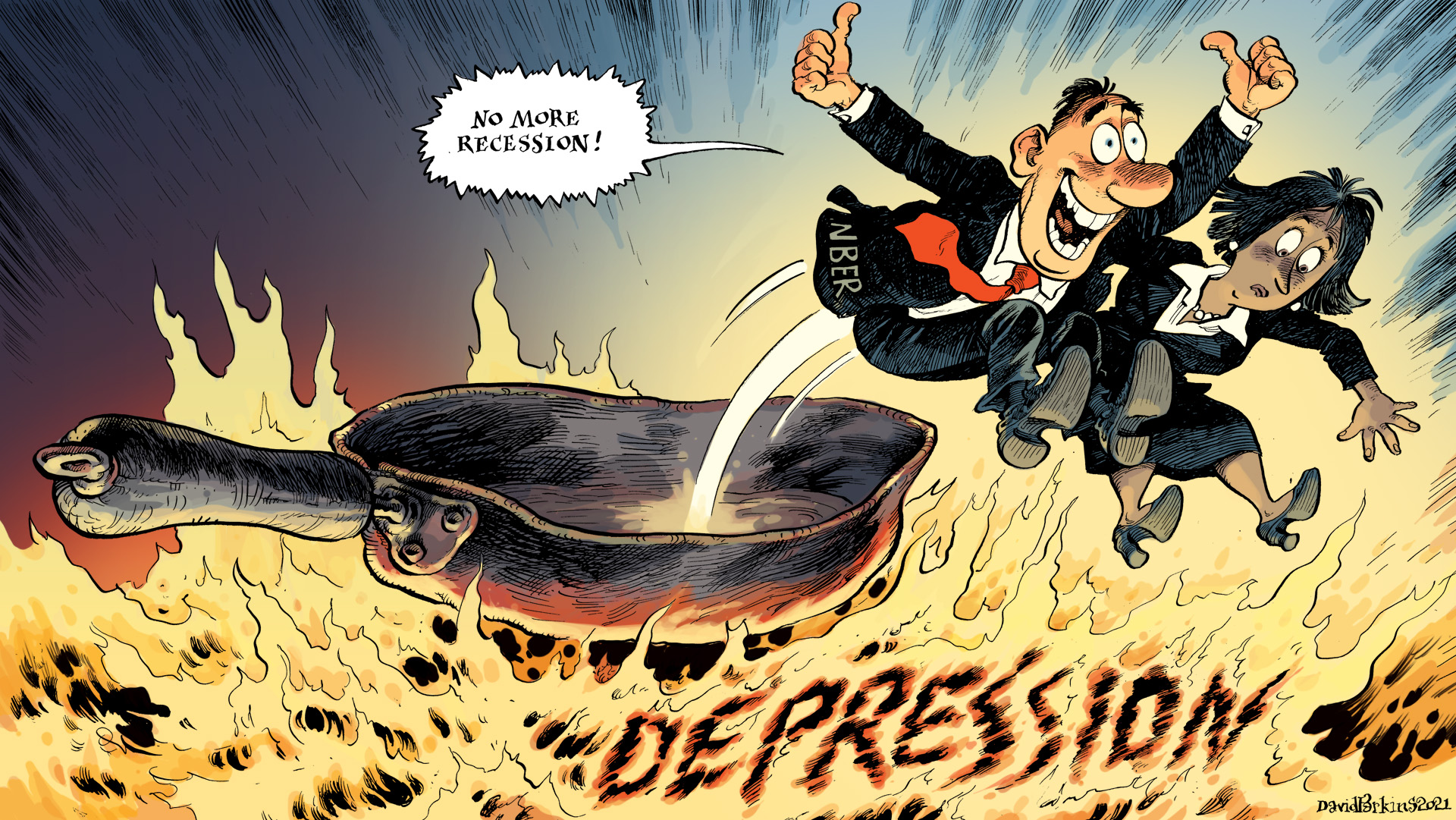

One For Waller’s Taper Table

Score one big one for Governor Waller’s taper checklist. This particular FOMC member had, just a few days ago, speculated on continued large gains in US payrolls. A couple more on top of the last one, that being June, and it was his position the Federal Reserve would have to begin to seriously consider shifting course. He doesn’t mean to [...]

Stay In Touch