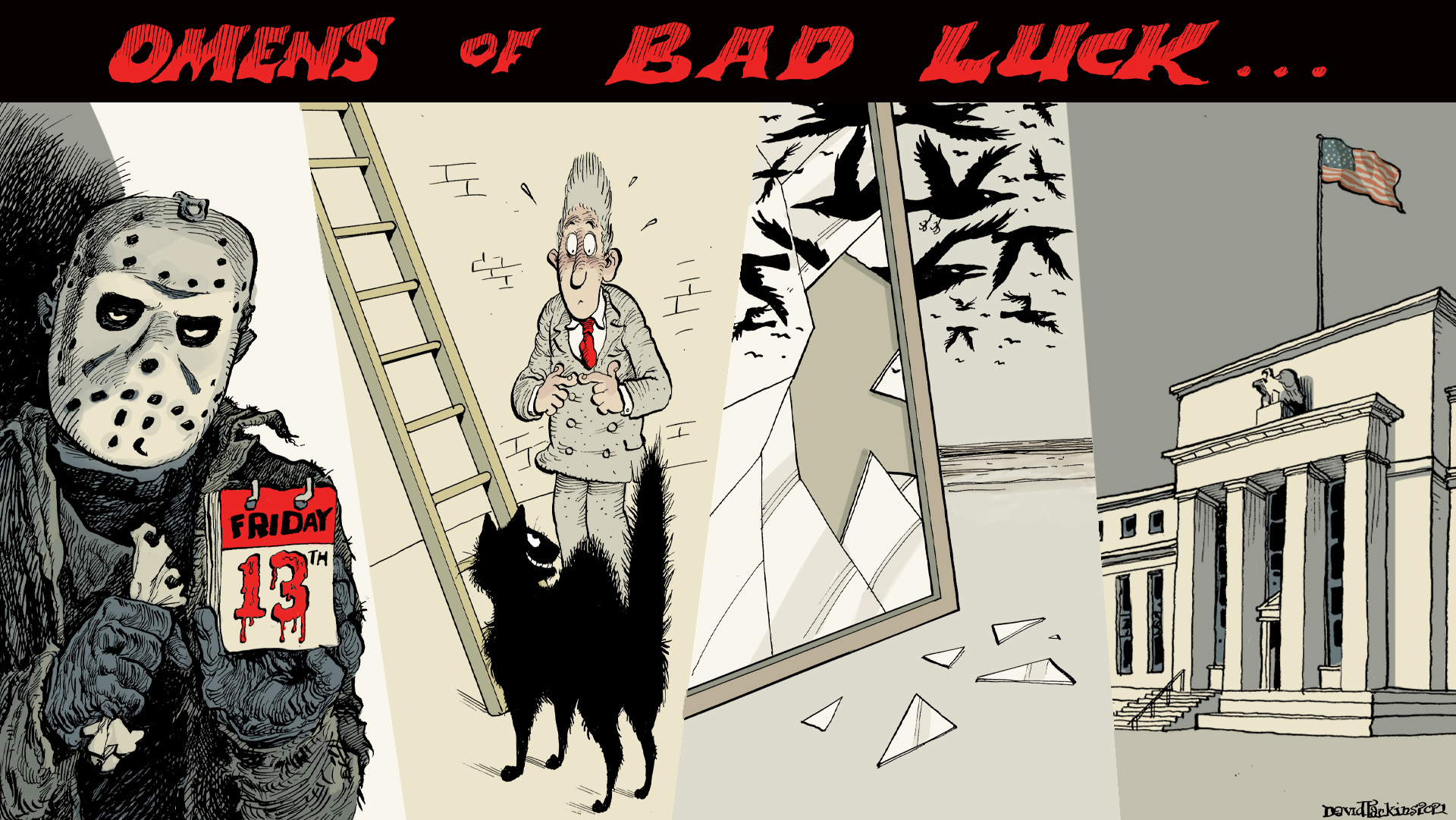

Weekly Market Pulse: The Illusion of Control

Jerome Powell delivered his long-anticipated speech at Jackson Hole last week. Well actually, I have no idea if he was actually in Jackson Hole since the speech was delivered electronically, another victim of the delta variant. The virus itself rated barely a mention in Mr. Powell's remarks and I think that is probably as it should be. There has been [...]

Stay In Touch