Eurodollar University’s Making Sense; Episode 89, Part 1: T-bill Scarcity So Obvious Jay Powell Tells Congress About It

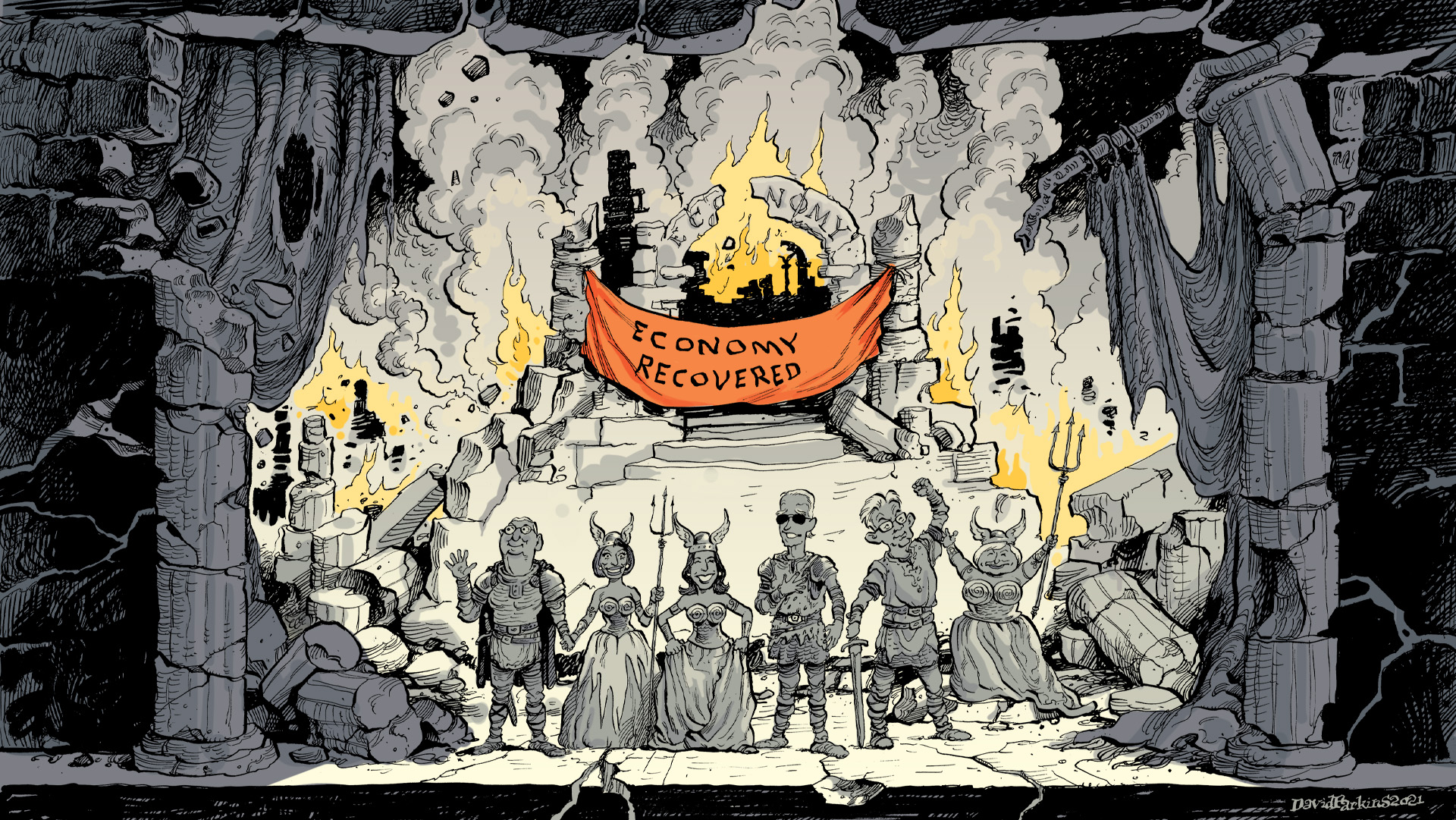

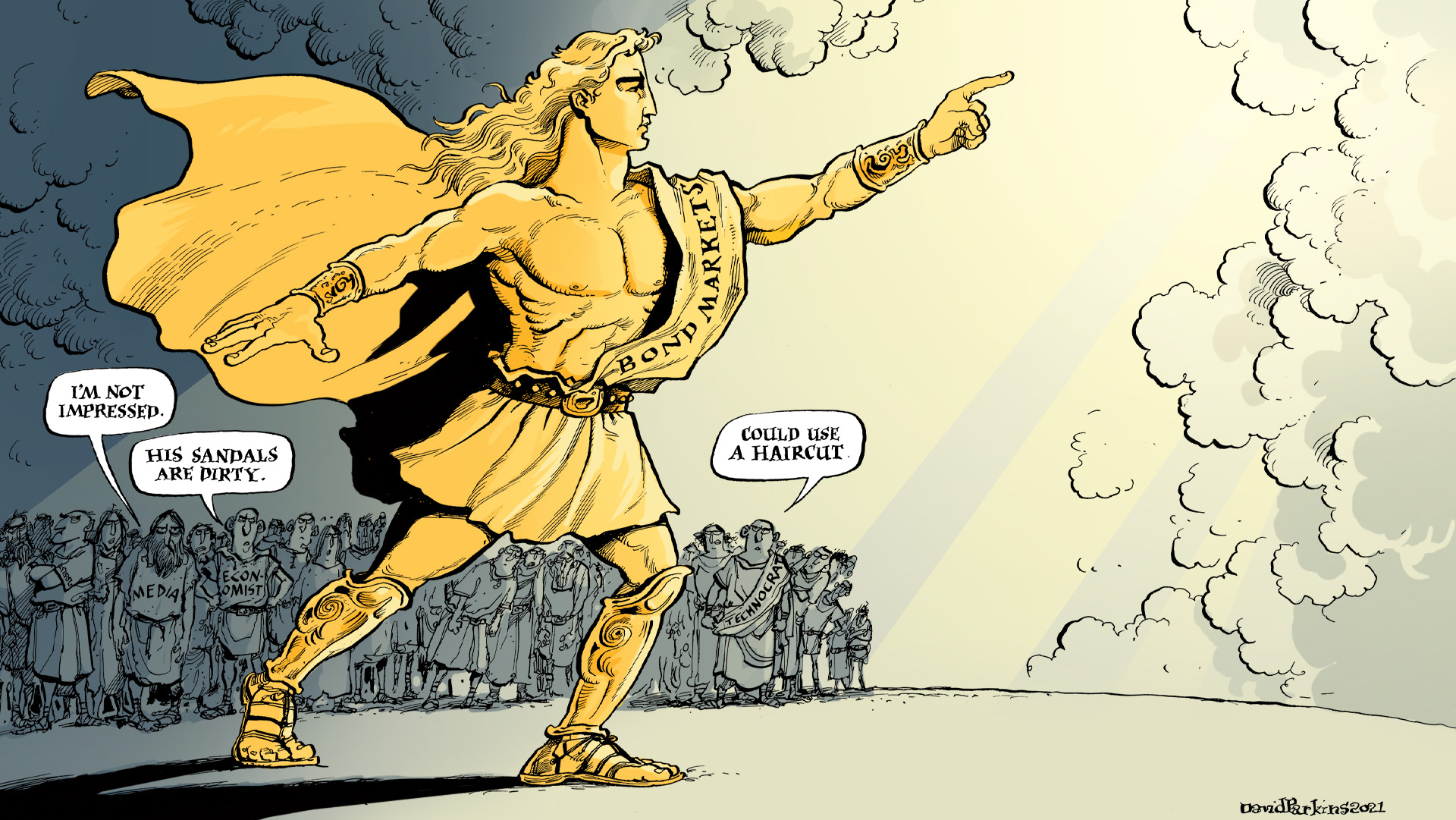

89.1 Jay Powell Sees Safe-Asset Demand Surge; Why?———Ep 89.1 Summary———Jay Powell has confirmed a surging Fed program (RRP) is partly the result of safe-asset demand. But he plays it off as a monetary technicality, mere arcana. Nope! Safe-asset scarcity is step one along a well-trod path towards a malfunctioning economy. Here's what happens next. ———See It——— Twitter: https://twitter.com/JeffSnider_AIPTwitter: https://twitter.com/EmilKalinowskiAlhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisLArt: https://davidparkins.com/ ———Hear [...]

Stay In Touch