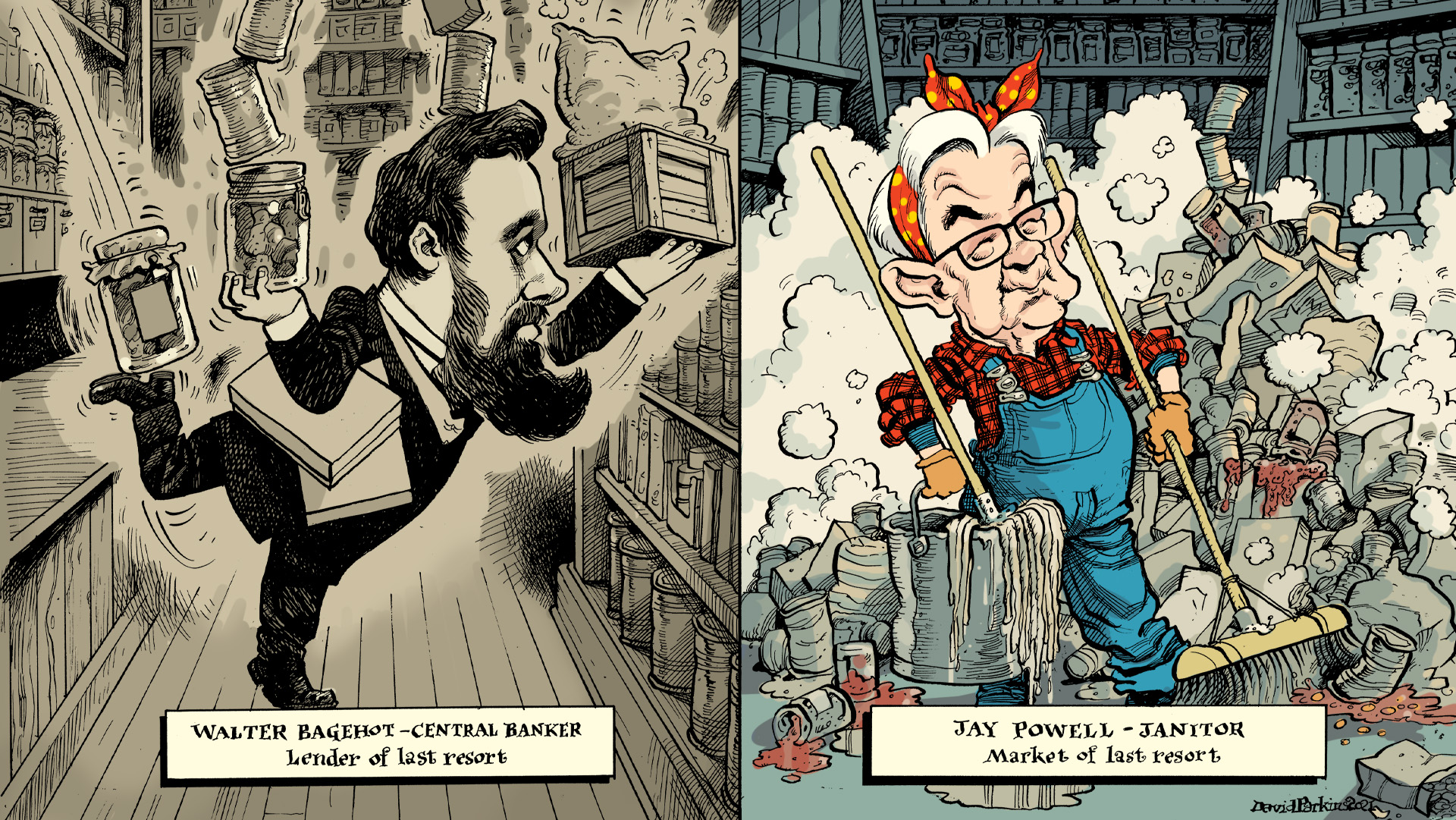

Eurodollar University’s Making Sense; Episode 82, Part 2: How Last March Proved Beyond Any Doubt The Federal Reserve Is Not a Central Bank

82.2 The Federal Reserve is NOT a Central Bank Pt. 2 ———Ep 82.2 Summary——— In March 2020 long-term US Treasury yields shot higher - why? Aren't these safe assets? Did the 'Treasury market break'? No. Yields shot higher due to illiquidity. And liquidity is JOB #1 of a central bank. So... here's looking at you Federal Reserve. ———See It———– Twitter: https://twitter.com/JeffSnider_AIPTwitter: https://twitter.com/EmilKalinowskiAlhambra [...]

Stay In Touch