The Consequences of What You Don’t See

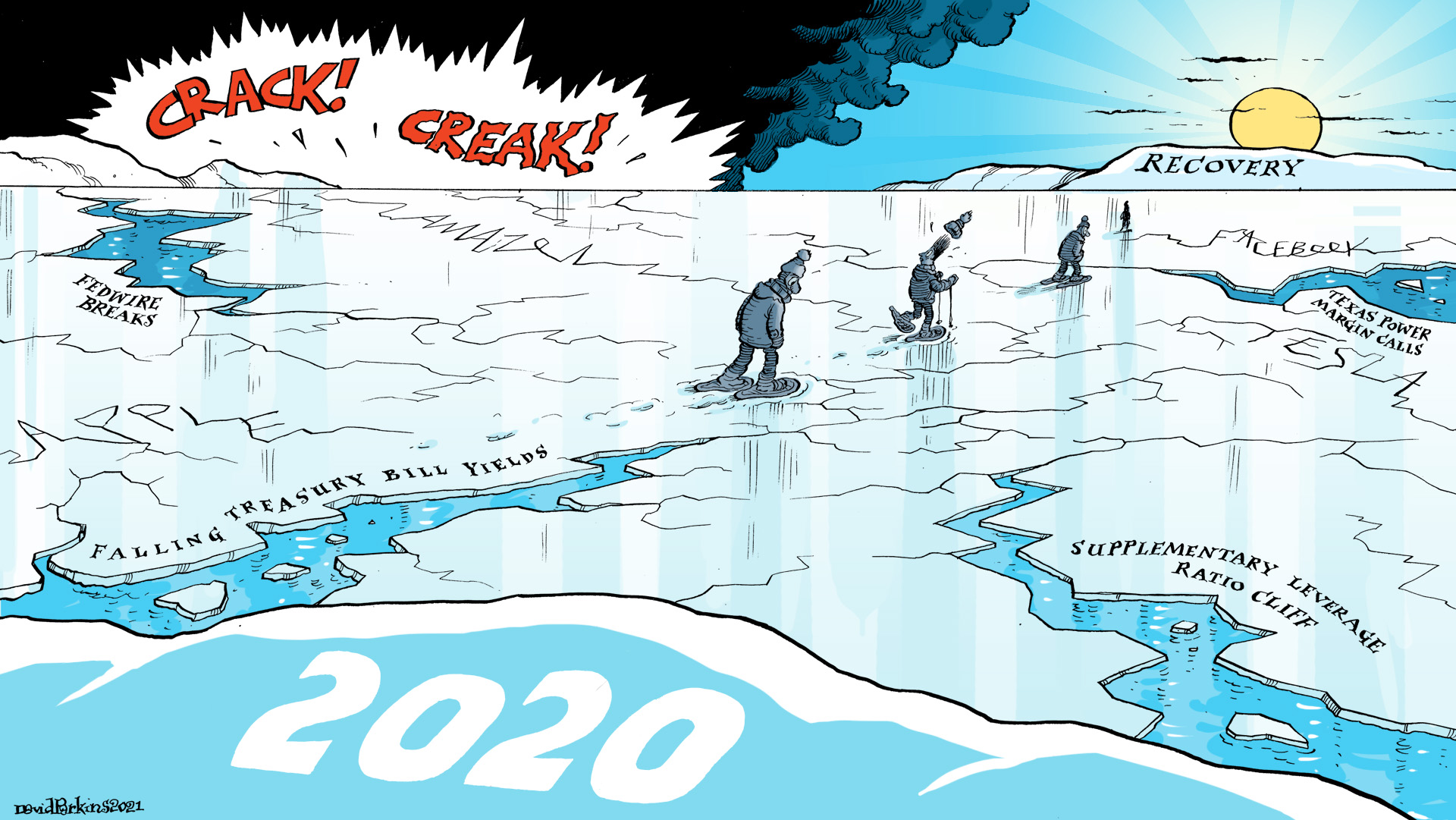

Because it’s what you don’t see that ultimately matters, the public is left entirely in the dark unable to join what really should be easy dots to connect. Something is wrong, and pretty much everyone acknowledges this if in their own way. We can see the social and political disintegration before our very eyes, the anger, the “revolution”, even the [...]

Stay In Touch