Future Stimulus Math

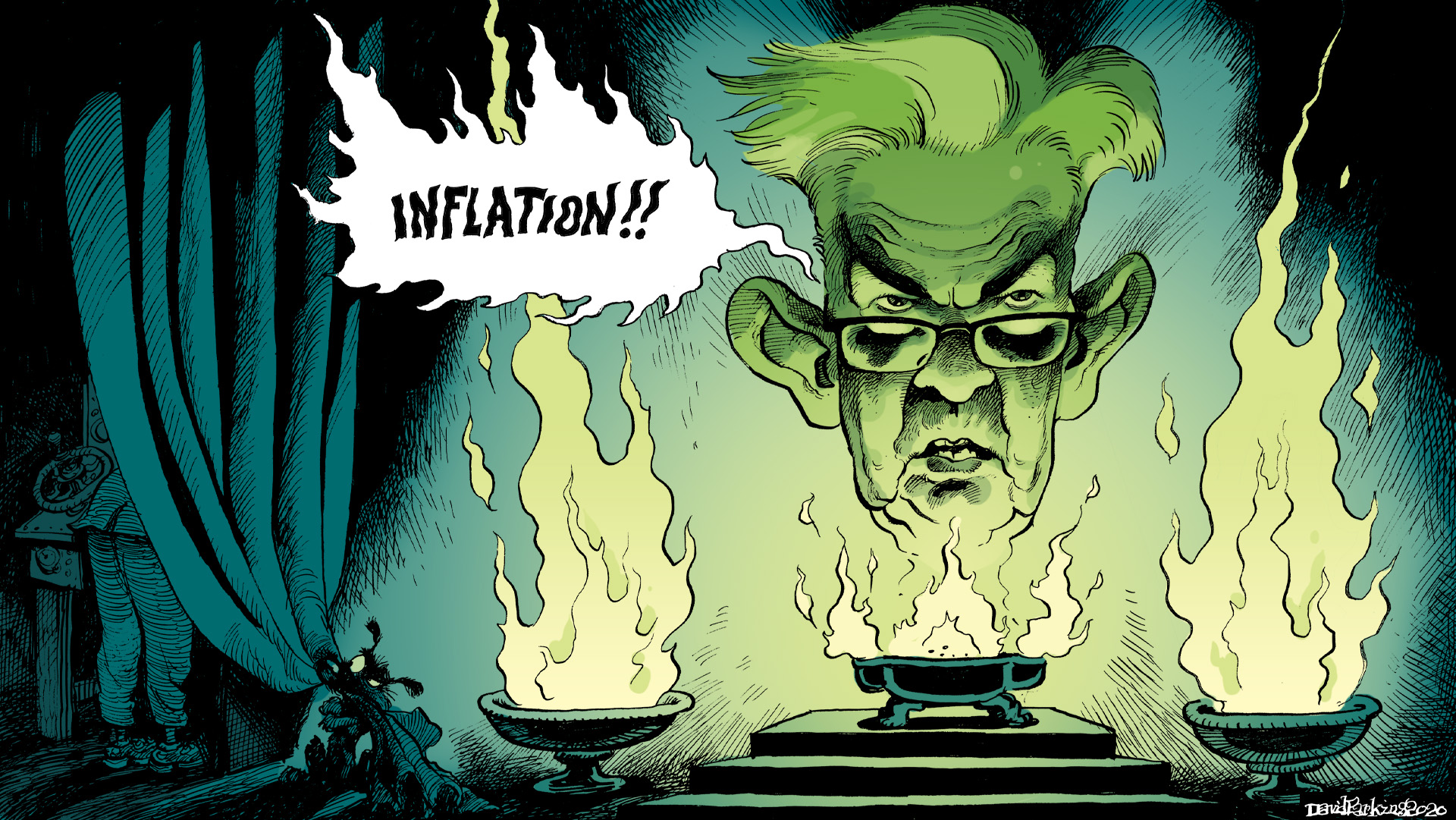

Sticking with Europe, central bankers want and expect higher inflation because that would confirm an economy strong enough – and monetarily sufficed – to sustain success. It’s the sustainability which has been lacking; the global economy since the first global (euro)dollar shortage never able to do more than lurch between downturns and the absence of downturns (reflation).Without enough monetary oxygen [...]

Stay In Touch