*The* Monetary Answer: Undoing The Biggest Money Mistake of the Past

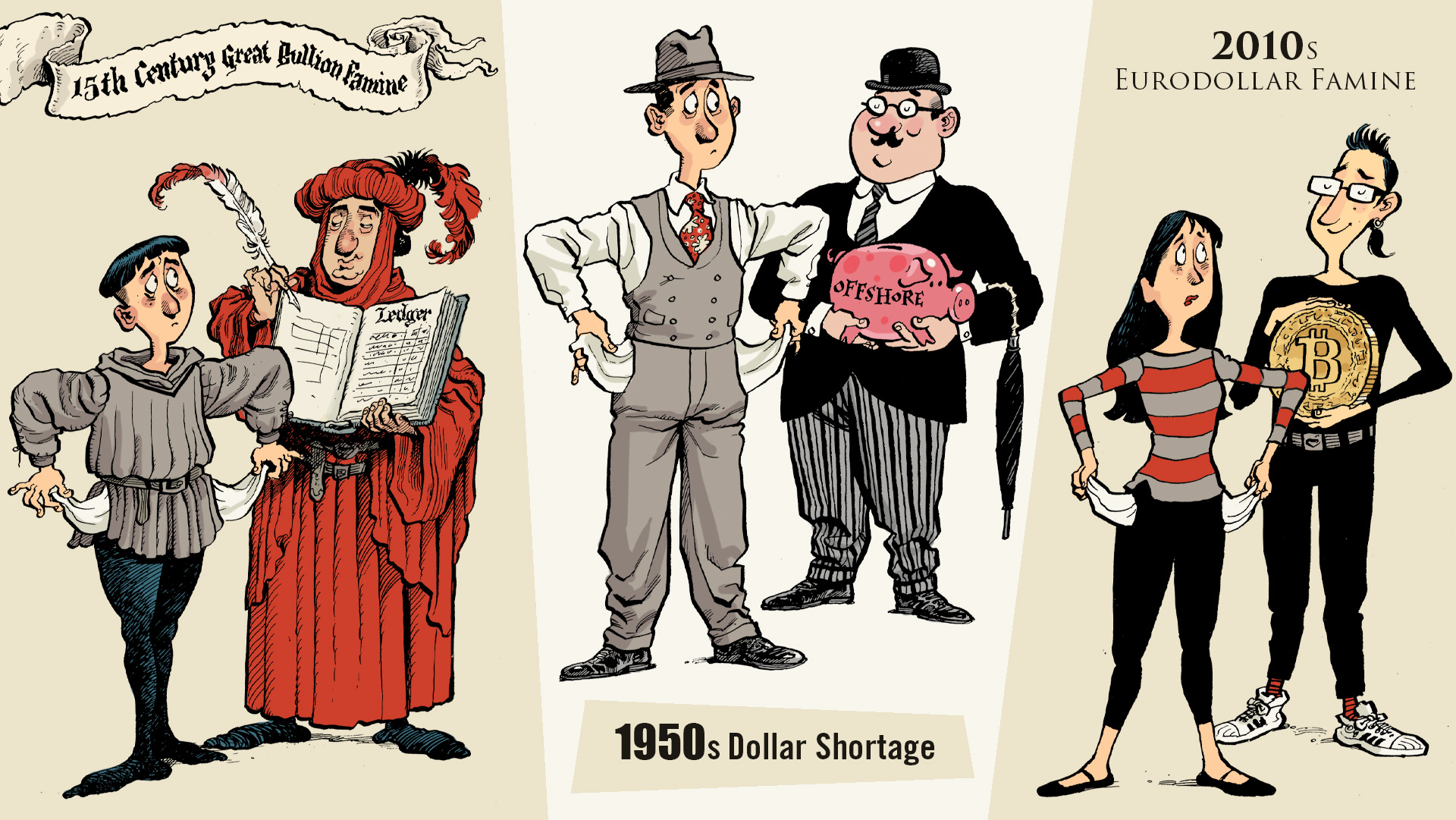

The second most-often question I get asked is, OK, smart guy, since you say the current eurodollar system is irrevocably broken, what do we do about it? [This comes right after the most popular question, um, what is a eurodollar?] I typically avoid answering for two reasons. First, since hardly anyone is ready for the first question, it is somewhat [...]

Stay In Touch