Eurodollar University Episode 177, Part 1: Confirming Euro$ Inversion And Its Huge Signal

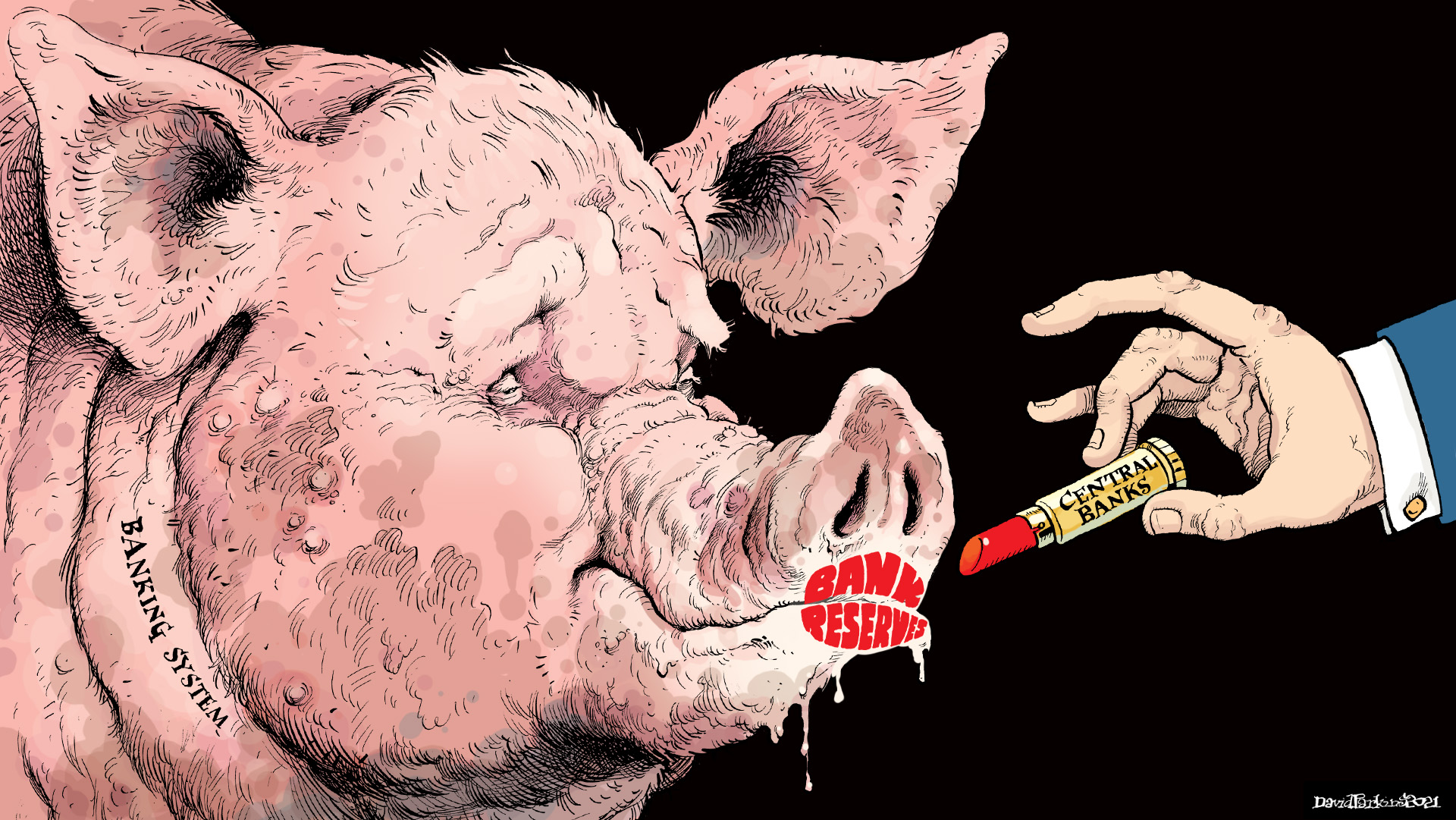

177.1 Eurodollar Warning Confirmed(?) by USA GER JPN & CHN———Ep 177.1 Summary———The Eurodollar futures curve inverted on December 1st - what's happened since? Also, does the American, German and Japanese sovereign bond market corroborate the Eurodollar futures warning? Lastly, does China's lowering of its bank Required Reserve Ratio buttress the E$ warning too? ———Ep 177.1 Topics——— 00:00 INTRO: Updating the [...]

Stay In Touch