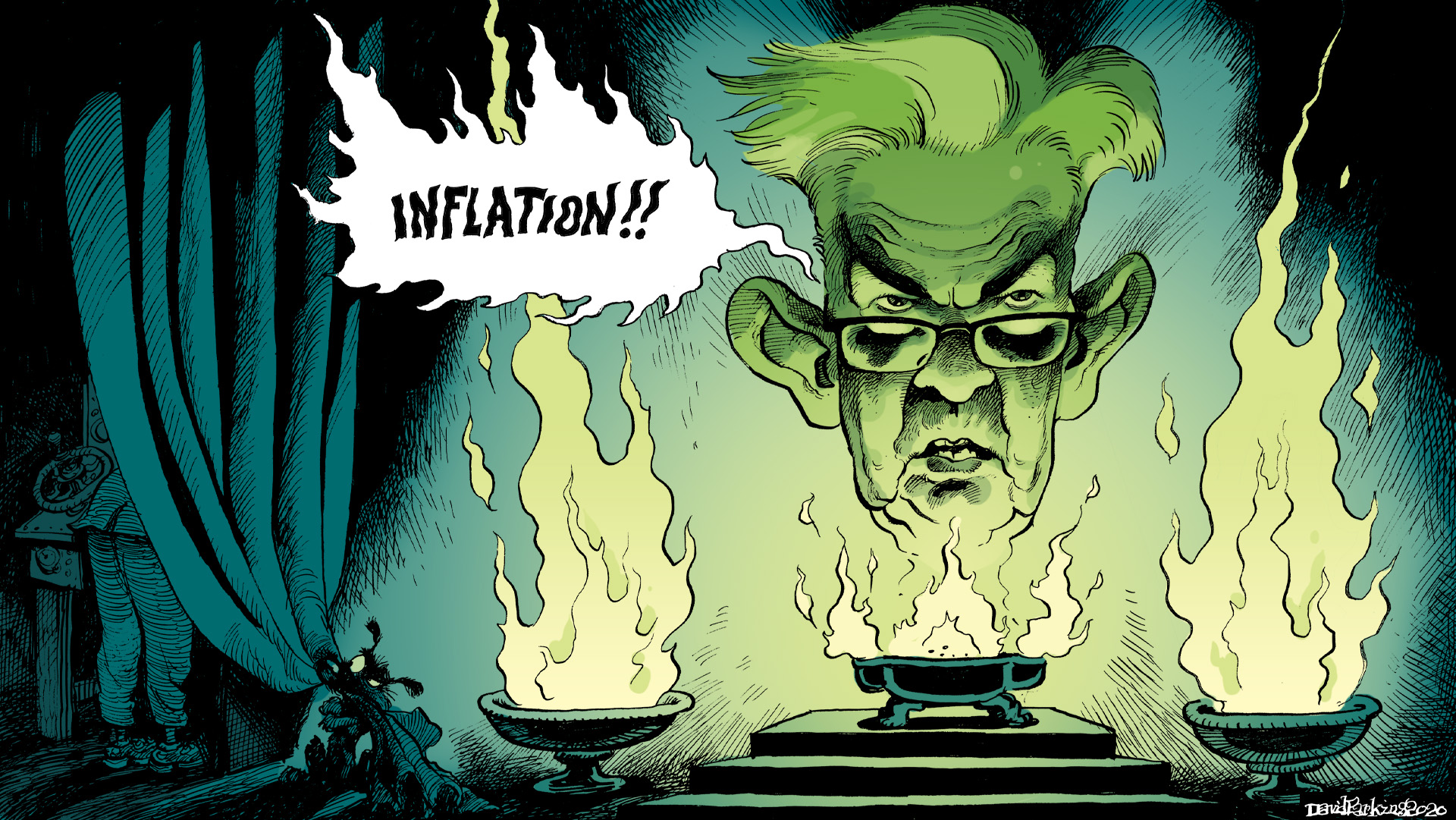

FOMC’s Taper Preview: Inflation Fairy

With the CPI inching closer to 7% and everyone talking about consumer prices, the FOMC meeting which begins tomorrow can’t be anything else other than inflation. Even if there was something else on the economic horizon, say a material “growth scare”, it’s too late for policymakers since they’d already painted themselves into a narrow corner months ago.If they don’t accelerate [...]

Stay In Touch