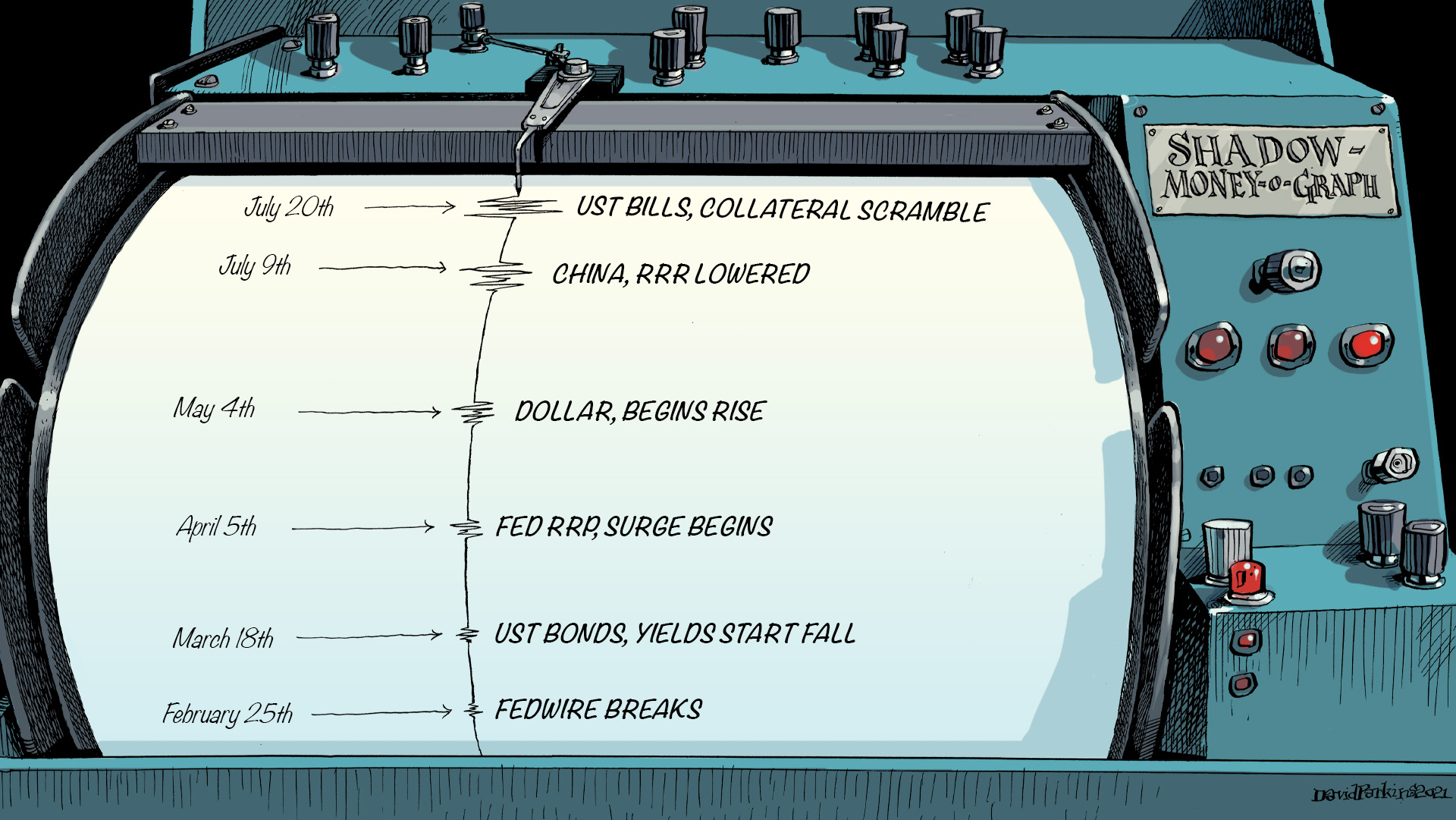

The Biggest Risk, No Surprise, Collateral

It’s not just the 4-week T-bill rate which is defying the Fed’s illusion of control, though that’s where the incidents are most evident. The front bill is nowhere close to the official RRP “floor” which can only mean one thing: collateral shortage, a large and persistent liquidity premium. Therefore, the further under said floor, the more the competition for the [...]

Stay In Touch