Macro: Money Supply

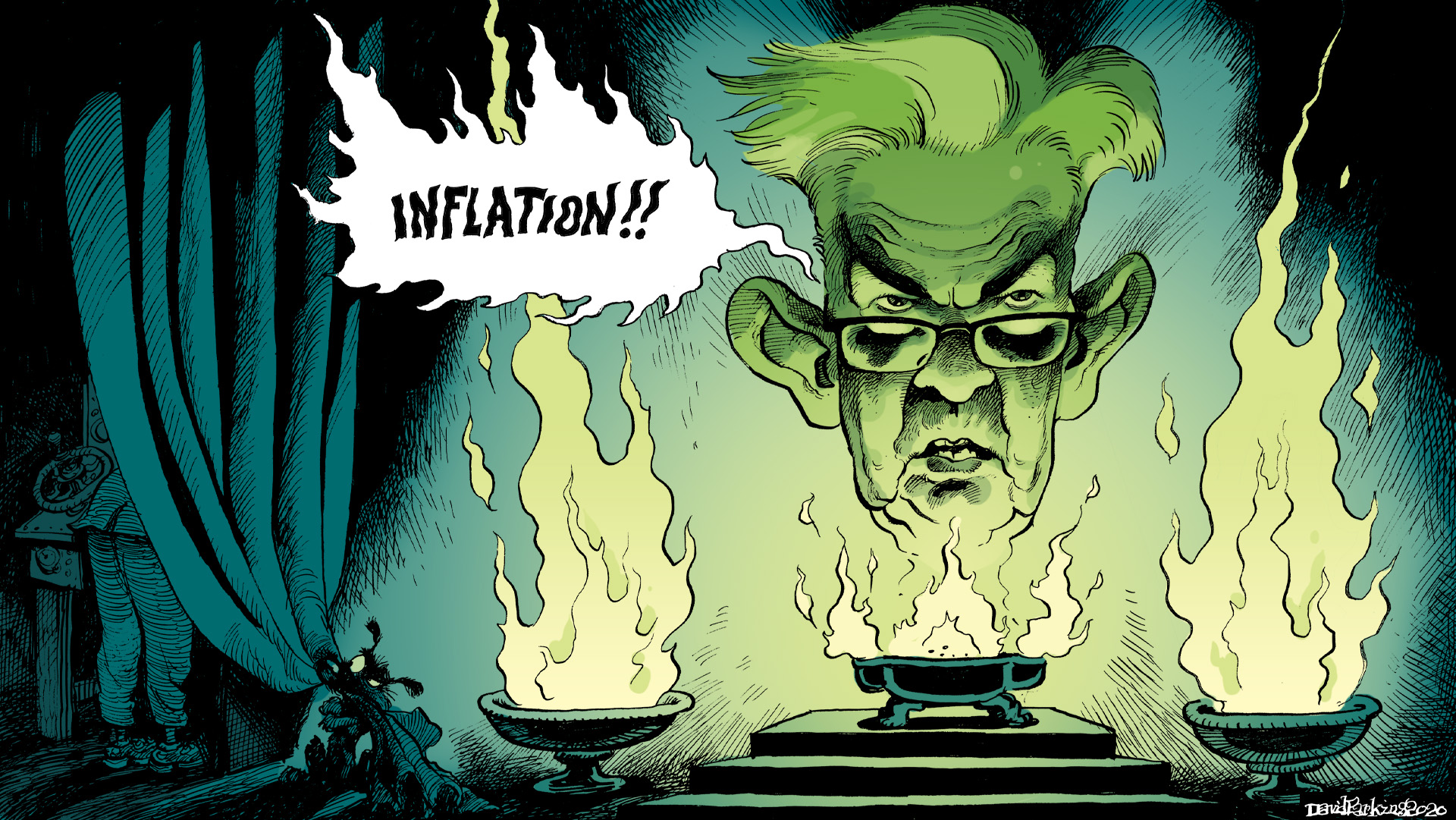

It's a mountainous monetary problem. “Inflation is always and everywhere a monetary phenomenon.” -- Milton Friedman This is a real time case study. Color me skeptical about a "soft landing." At the very least , there's likely to be some bumps. Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or [...]

Stay In Touch