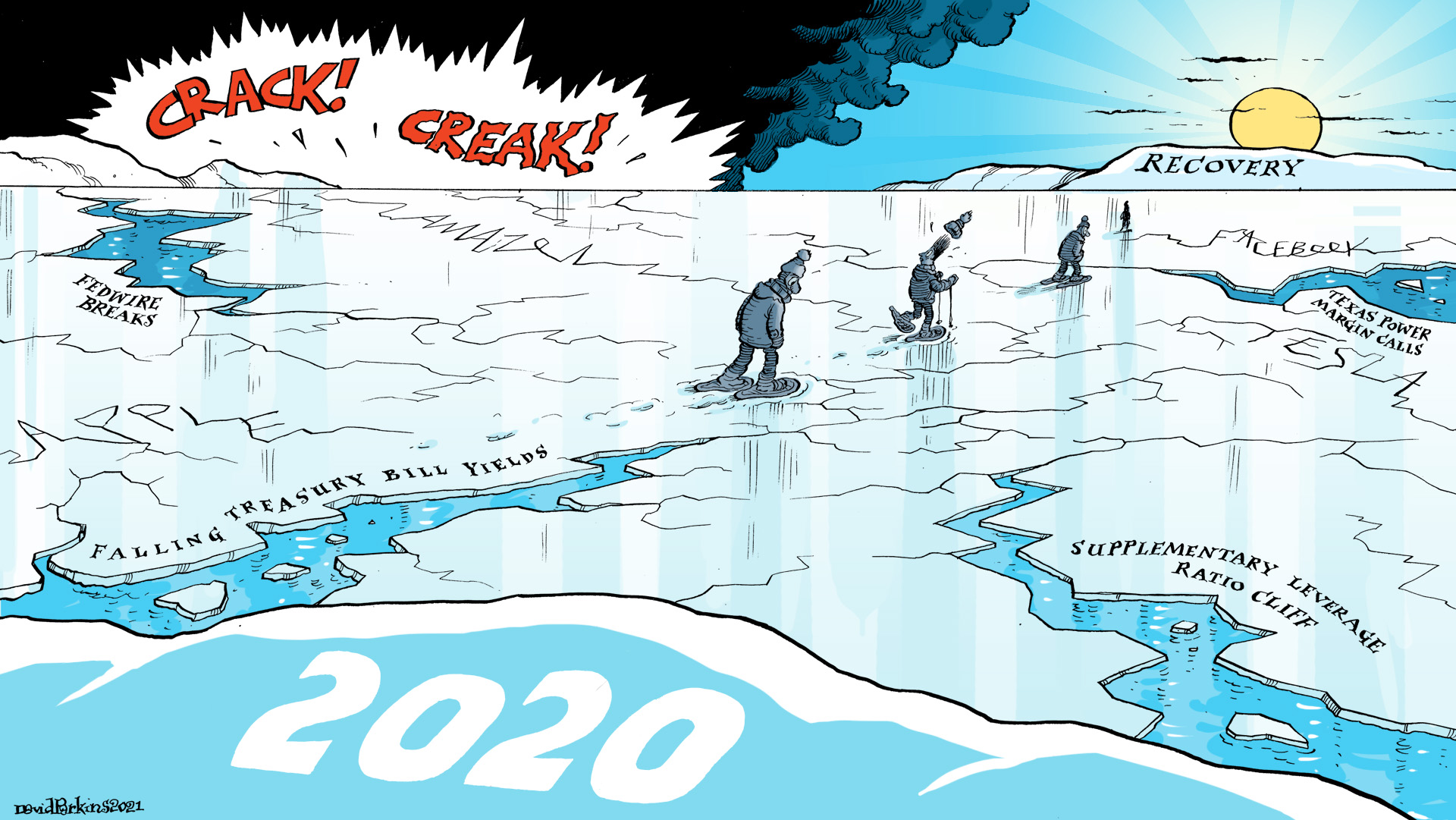

A Year Later, The Fact Fedwire Is Still There Tells Us Why Markets Have Done What They’ve Done

The world seemed to have everything going for it, for once, everything coming up favorable for the first time seemingly in forever. There were vaccines, financial government interventions worldwide just recklessly chucking money at anyone with a pulse, an end to the pandemic even normalcy right in front of us. What could possibly have messed this up?It was around 11:15 [...]

Stay In Touch