A Few More For Potential ‘Days’ Of Deflation

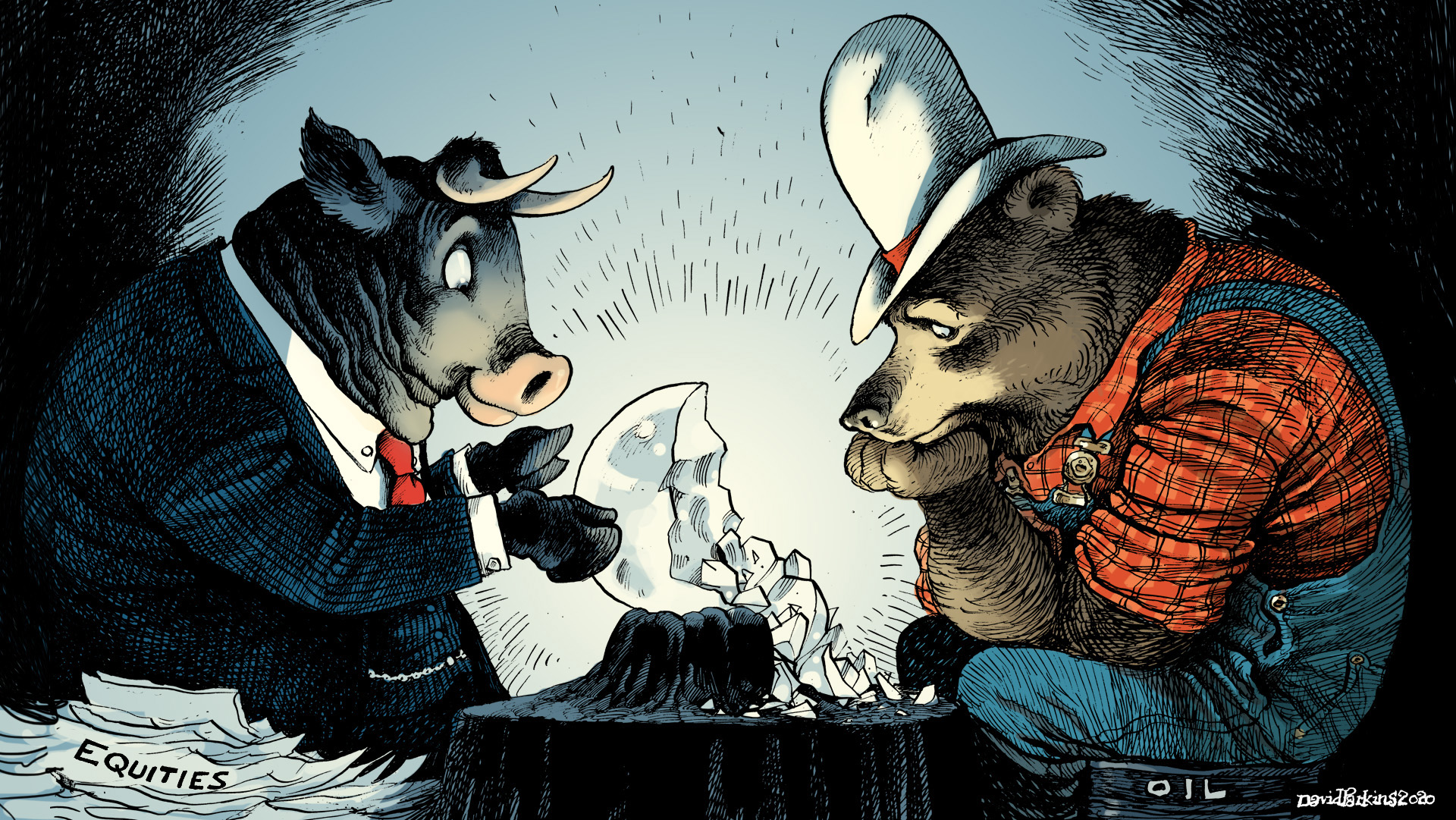

I’m not much for writing, so I’m sure nothing of a song-writer. While that may be the case, what I do know is that two of the missing lines in our Twelve Warnings of Deflation carol would belong to JGB’s and oil. How to fit them in, someone else would have to do so; the number we’d associate for JGB [...]

Stay In Touch