A few brief comments on the market this week. Yesterday, the S&P gained 1.6% after being up 2.3% in the morning. The price spike on the open was a decisive move above the 200 day moving average we penned about last week. The move was accompanied by better global manufacturing numbers and optimism about the US housing market. I also believe there was some big new money being put in the market for the start of year. Strength was seen in basic materials and commodities, a sign of hope for increasing economic activity. Weakness was observed in defensive sectors like utilities and some non-cyclical areas such as tobacco.

A few brief comments on the market this week. Yesterday, the S&P gained 1.6% after being up 2.3% in the morning. The price spike on the open was a decisive move above the 200 day moving average we penned about last week. The move was accompanied by better global manufacturing numbers and optimism about the US housing market. I also believe there was some big new money being put in the market for the start of year. Strength was seen in basic materials and commodities, a sign of hope for increasing economic activity. Weakness was observed in defensive sectors like utilities and some non-cyclical areas such as tobacco.

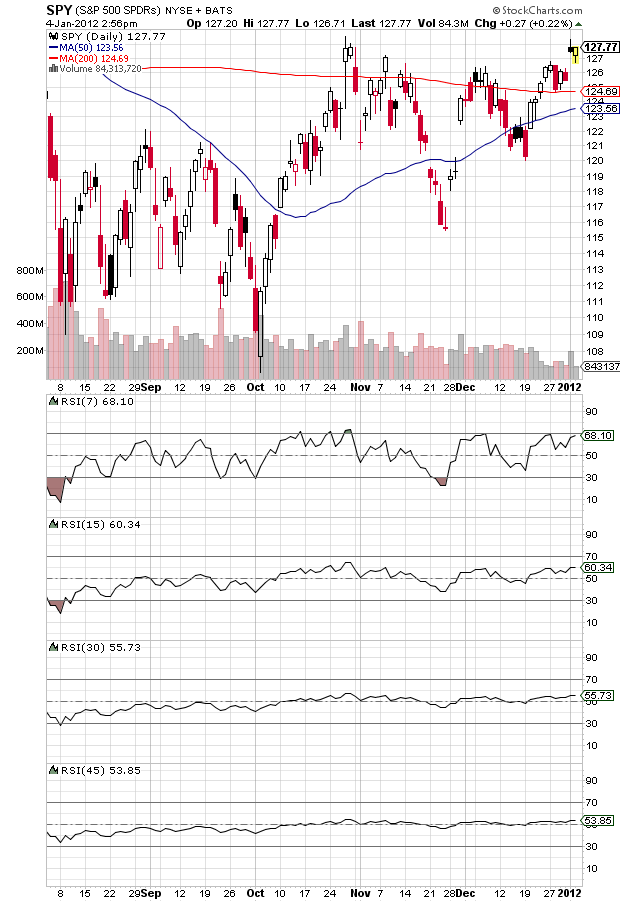

Today, markets are remembering that global risk factors have not changed from 2011 and the market opened the session slightly lower. But, let’s not forget that momentum can be a strong factor in short term market movements. The pessimism during the final 5 months of 2011 surely has some investors short to neutral. Short term momentum indicators are very positive, medium term indicators are slightly positive and longer term are very neutral. The price action has been very interesting today. The market opened lower but has been slowly clawing its way up and has just turned positive. We will be watching some favorite short term momentum indicators for signs of follow through, RSI is one I became accustomed to from my days at the CBOT. additionally, the 200 day moving average for the S&P is transitioning to a positive slope. Technicians will next be watching for the 50 day moving average to move above the 200 day moving average, indications of a longer term positive trend.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch