Welcome to 2012. While the S&P 500 was essentially flat last year, our clients enjoyed their third year of out-performance, which judging by the results of many of our peers, is saying a lot. We will shortly have our final numbers available to registered users only, so click here to register. Of the markets I track, Feeder Cattle was the best performing in 2011, up 20% and the worst performing was Cotton, down 36%.

Welcome to 2012. While the S&P 500 was essentially flat last year, our clients enjoyed their third year of out-performance, which judging by the results of many of our peers, is saying a lot. We will shortly have our final numbers available to registered users only, so click here to register. Of the markets I track, Feeder Cattle was the best performing in 2011, up 20% and the worst performing was Cotton, down 36%.

The first week of 2012 was a busy one for economic indicators. There were sixteen reports overall, and of these, 10 came in better than expected, five came in weaker than expected, and one came in-line. Our Chief Economist, Dr. John Chapman, has more analysis on the subject.

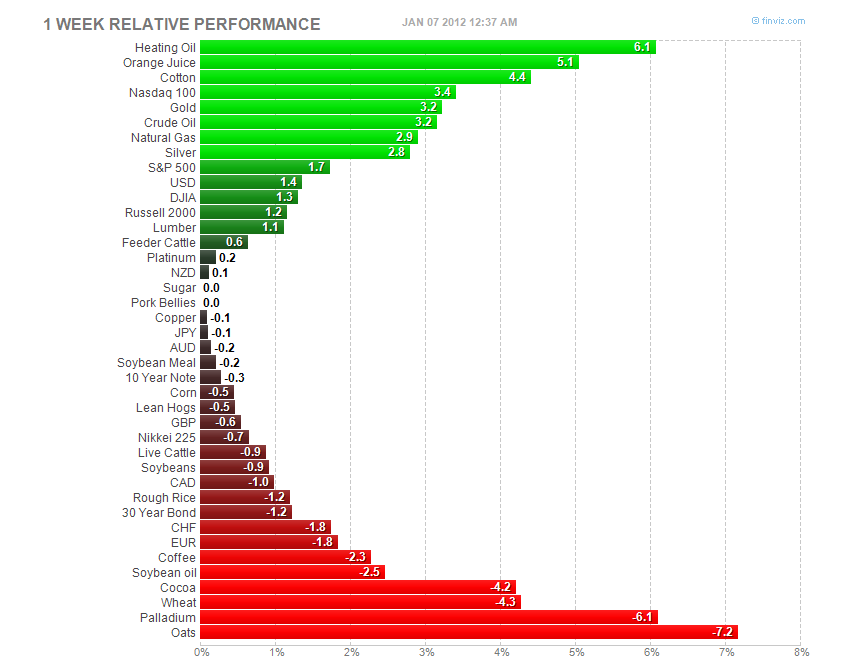

The start of the year has been quite typical. That is, what performed well last year has been the worst performer thus far this year and vice-versa. I happen to be in the defensive camp for now, but I’m willing to change my opinion if things continue to improve. 4th quarter earnings season starts on Monday with Alcoa’s report after the close. One thing that has bulls somewhat worried right now is sentiment. According to the weekly sentiment survey from the American Association of Individual Investors (AAII), bullish sentiment is now at 48.88%, which is the highest level since early February.

Charts of interest last week include the U.S. Dollar, Floating-Rate Bonds and the Chile ETF. Technology continues to be a mixed bag. The year is young and there’s plenty of opportunity to make smart investments. Remain patient and nimble.

Below you’ll find chart trends that stood out last week as well as actual holdings from our model portfolios. I also include an earnings calendar, an economic calendar and key interest rates.

Have a pleasant and productive week.

Earnings Calendar (in order of market capitalization)

| Ticker | Company | Sector | Dividend Yield | Earnings Date |

| JPM | JPMorgan Chase & Co. | Financial | 2.83% | 1/13/12 7:00 |

| MTB | M&T Bank Corp. | Financial | 3.52% | 1/9/12 |

| AA | Alcoa, Inc. | Basic Materials | 1.31% | 1/9/12 16:30 |

| ESS | Essex Property Trust Inc. | Financial | 2.97% | 1/12/12 16:30 |

| MSCI | MSCI Inc. | Technology | 1/9/12 | |

| ILMN | Illumina Inc. | Healthcare | 1/9/12 | |

| LEN | Lennar Corp. | Industrial Goods | 0.78% | 1/11/12 8:30 |

| CLC | CLARCOR Inc. | Industrial Goods | 0.95% | 1/9/12 |

| AYI | Acuity Brands, Inc. | Technology | 1.03% | 1/9/12 8:30 |

| SVU | SUPERVALU Inc. | Services | 4.25% | 1/11/12 8:30 |

| WFSL | Washington Federal Inc. | Financial | 2.19% | 1/12/12 |

| SCHN | Schnitzer Steel Industries Inc. | Basic Materials | 0.16% | 1/9/12 |

| FUL | HB Fuller Co. | Basic Materials | 1.27% | 1/9/12 |

| SNX | SYNNEX Corp. | Services | 1/10/12 16:30 | |

| SDT | SandRidge Mississippian Trust I | Basic Materials | 11.02% | 1/11/12 |

| MG | Mistras Group, Inc. | Services | 1/9/12 | |

| WDFC | WD-40 Company | Basic Materials | 2.91% | 1/9/12 |

| SMSC | Standard Microsystems Corp. | Technology | 1/9/12 16:30 | |

| ZIP | Zipcar, Inc. | Services | 1/13/12 |

Economic Calendar by Econoday.com

Rates by Bloomberg.com

Key Rates

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| Fed Funds Rate | 0.07 | 0.08 | 0.08 | 0.10 | 0.20 |

| Fed Reserve Target Rate | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Prime Rate | 3.25 | 3.25 | 3.25 | 3.25 | 3.25 |

| US Unemployment Rate | 8.50 | 8.70 | 9.00 | 9.10 | 9.40 |

| 1-Month Libor | 0.30 | 0.28 | 0.24 | 0.19 | 0.26 |

| 3-Month Libor | 0.58 | 0.54 | 0.39 | 0.25 | 0.30 |

Mortgage* (National Average)

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| 30-Year Fixed | 3.92 | 3.98 | 4.04 | 4.55 | 4.86 |

| 15-Year Fixed | 3.25 | 3.34 | 3.38 | 3.69 | 4.15 |

| 5/1-Year ARM | 2.86 | 2.92 | 3.02 | 3.13 | 3.62 |

| 1-Year ARM | 2.75 | 2.78 | 2.95 | 3.19 | 3.12 |

| 30-Year Fixed Jumbo | 4.84 | 4.72 | 4.76 | 5.00 | 5.55 |

| 15-Year Fixed Jumbo | 4.15 | 4.01 | 4.14 | 4.37 | 4.93 |

| 5/1-Year ARM Jumbo | 3.45 | 3.15 | 3.17 | 3.44 | 4.06 |

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif)

![[djStar]](https://bloomberg.econoday.com/images/bloomberg-us/djstar.gif)

![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif)

Stay In Touch