The rumors of the ECB rate cut had become rather ubiquitous in the past few weeks. Confidence in the European economy has been indirectly proportionate to those rumors, particularly as Germany seems to be heading south again after a short-lived reprieve. France is just a downright mess.

But the rate cuts that were just announced will have no impact on either Germany or France – both those banking systems are already “suffering” from the opposite problem of too much “liquidity”. The overnight Eonia rate, which indicates unsecured interbank lending among the largest banks, primarily German and French, is still stapled near zero.

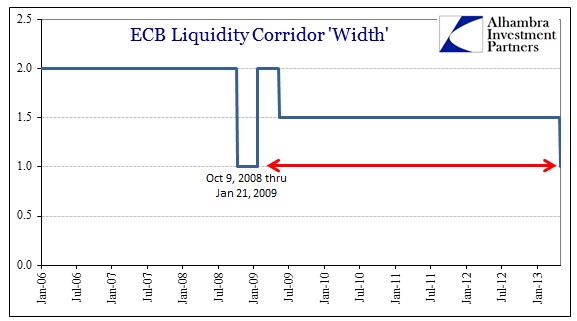

The ECB’s move today is highly unusual in its asymmetry. For anyone unfamiliar with the monetary mechanics in Europe, you can read my previous post on European liquidity for a detailed explanation. In short, monetary mechanics is all about the rate corridor.

What Draghi did this morning is telling in that it indicates the rate cuts are more about periphery than where the economic downturn is accelerating. By cutting the refi rate (MRO) 25 bp and the marginal rate (MLF) by 50 bp, all while keeping the corridor floor (deposit rate) at zero, the central bank has narrowed the corridor by a half percent to a record low last seen at the height of panic.

The implications of a narrow corridor are essentially liquidity management, not economic stimulation. By reducing the spread between the deposit rate (where Eonia has traded since the crisis) and the MRO, the ECB is essentially acknowledging that interbank lending will not be returning to the periphery any time in the near future. Reducing the MLF rate by 50 bp is a signal that the ECB is seeking to harmonize liquidity rates across the continent. What they have done is offered unlimited liquidity (dependent on collateral) to peripheral banks at interest rates closer to where core banks borrow. That reduces significantly the incentive of core banks to lend to peripheral banks, meaning this measure is not aimed at “healing” the financial liquidity divide.

But narrowing the corridor does promise a more homogeneous rate environment for banks in varying stages of liquidity distress, making them more likely to take advantage of ECB facilities (again, collateral dependent). That was the intent at the height of the crisis in 2008-09.

Why now?

We have very little idea of funding stress in peripheral banks right now. The ECB just released March figures on deposit levels in its member countries that seemed to indicate the Cyprus mess had not caused any immediate deposit flight. But that was March, and the Cypriot banks did not actually reopen until right at the end of the month. As I mentioned in that previous post, overall deposits in Greece did not fall in March, but they didn’t rise as they had in the months prior either.

What struck me most was the quote from Bank of Greece Governor Giorgos Provopoulos indicating an expectation for deposit levels to fall in April. According to the ECB’s latest figures, for the week of April 26, 2013, total borrowing at the MRO and LTRO facilities declined by about €51 billion in the month of April. The majority of that was repayment of LTRO borrowings. We don’t know yet where that “improvement” is coming from, at least until the national central banks release their monthly figures.

Since there was a similar decline in ECB liability accounts (about €41.7 billion), we can infer that banks simply repaid the LTRO’s from their accounts already at the ECB – having little impact on the wider system since these banks were only unwinding unneeded funding arrangements.

However, aside that decline in ECB lending through the main operations, the line for “other claims on euro area credit institutions denominated in euros” had risen by €18.8 billion in April. This is where the ELA resides, the emergency funding account where banks have no eligible collateral left to pledge to the ECB. Instead, they pledge lower quality collateral to their own National Central Bank. It is the last recourse of banks on the edge of illiquidity.

The entire Cyprus bailout seemingly had already increased ELA usage before April began, so it is not clear where the incremental €18.8 billion is coming from. It could very well be coming from Greece, as suggested by Provopoulos. We don’t know, but I have no doubt Draghi does.

Now this is all speculation on my part, simply putting pieces together and thinking out loud, but there is some logic to it. This is particular true if it does turn out that April saw a return of deposit outflows from PIIGS. The disclosure of that later this month would likely sour liquidity markets again. We have seen Swiss 2 & 3 year gov’t bonds turn negative once more, with the 2-year falling below -0.10%. It is certainly a possibility, and it would make sense for Draghi, thinking about last summer, to get ahead of such a move.

There is also the issue of the ELA itself, another problem from 2012. If ELA usage is up again above what is realisticly expected directly from Cyprus, it may also have a wider impact.

It could all very well be the usual central bank maneuver – rate cuts and talk of negative deposit rates to “talk down” the euro and kickstart Germany’s export machine. It could also be an honest, but misguided, attempt at reducing funding costs for peripheral banks (particularly Italian) that seem hopelessly stuck at the ECB window. Neither of those two possibilities fully explain the need to drastically narrow the rate corridor, and, given what happened to gold and that we don’t yet fully know what happened in April, we should at least be open to consider all possibilities.

Stay In Touch