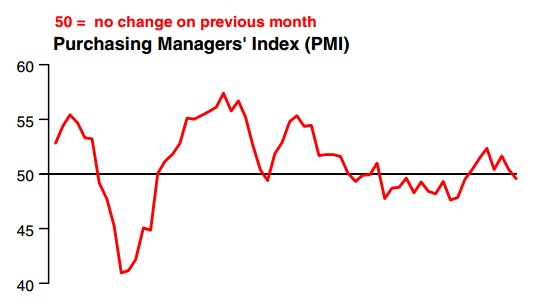

The HSBC/Markit PMI for China fell back below 50 for the first time in seven months. This rebound has been relatively minor, more like an absence of contraction than a surge in manufacturing activity. Nearly every subindex, including all the major components, also fell under 50.

These results correlate with the Australian collapse I noted a few weeks back. That, along with commodity prices, suggest a still-weakening manufacturing sector globally. Indeed, the inventory mini-cycle in the US appears to be waning and, coupled with worsening depression in Europe, shows that there is no real outlet or demand for new production.

Earlier in May, the Chinese government reported a decline in exports to the US (-0.1%) and the EU (-6.4%). That came amid very reasoned speculation that the overall Chinese statistics were unreliable, mostly due to likely phantom accounting through Hong Kong. That places greater emphasis on privately collected data and reports of diminished activities, including the HSBC/Markit PMI.

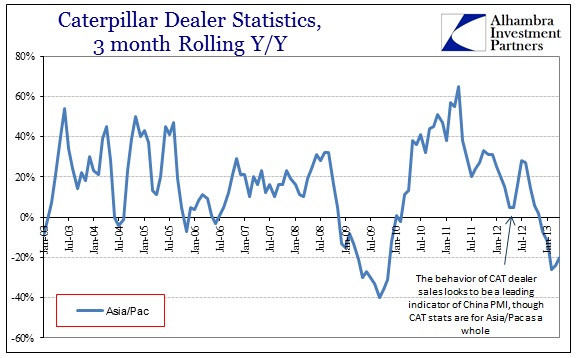

That seems to be the message also transmitted by Caterpillar’s dealer statistics for Asia/Pacific. There is not a one-to-one correlation between CAT and the China PMI, but the corresponding trends are very visible through each. Global manufacturing remains not only depressed but working through a supply chain reversal.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch