The taper-folks at the FOMC might be somewhat indifferent to the latest employment report. While the headline bean-count of the number of jobs looked decent enough (for the lowered standards of this age), the stubbornness of the “official” unemployment rate will counter that.

The problem of the labor force participation and what actually constitutes the labor force was fully evident in June, as was the downswing in quality vs. quantity. The media and economists have maintained focus solely on the number of jobs estimated without regard to income. But so far in 2013, even that focus has been muddied by a huge disagreement between even the two bean-counting measures.

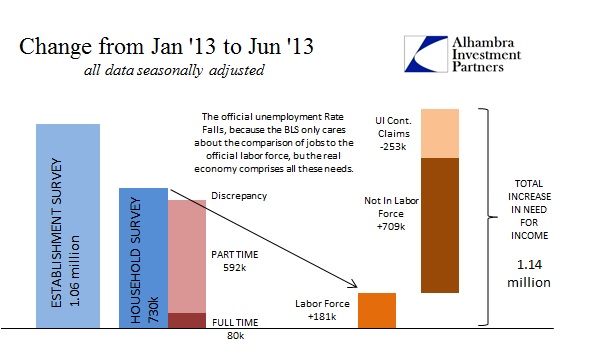

So now we don’t really have any agreement or uniformity on even how many jobs have actually appeared recently; on top of data that suggests far lower income quality regardless of the headline numbers. Since January 2013, the Establishment Survey (which receives the bulk of attention) has shown 1.06 million new jobs. That has been well-received as evidence of both economic and monetary progress despite the fact that such a pace is well-below what should be expected of a recovery (accompanied by so much monetary influence, such that it exists).

However, the Household Survey pegs total job growth at only 730,000. That’s not a small discrepancy, but more importantly, only 80,000 of those jobs were indicated as full-time.

So the topline, narrow approach to jobs shows at least 730,000 new jobs against an increase in the “official” labor force of only 181,000. That means the “official” unemployment rate falls, slightly, and can seemingly support this “taper” talk and all the assumed economic improvement that has come with it.

A much fuller and broader analysis, however, would see problems in this massive divergence between surveys as well as the qualitative aspect of whatever jobs have actually been created by the private sector. In reality, there are 709,000 new people that simply don’t count in the labor force for whatever reason, added to the 253,000 that are no longer receiving unemployment insurance.

In this broader context then, there are an estimated and potential 1.4 million people that should reasonably need some form of income against only 80,000 full-time jobs. That is not “improvement” by any standard; it isn’t even keeping pace.

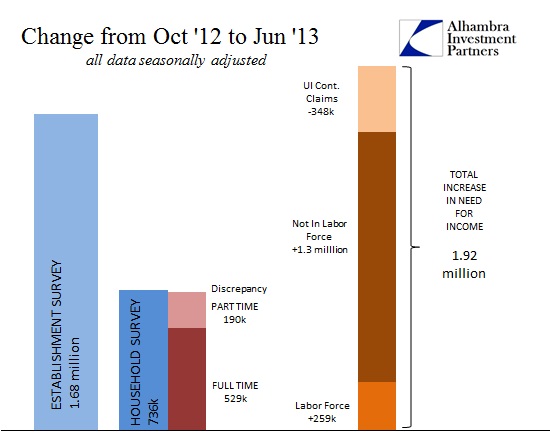

As bad as this dichotomy between surveys has been in the past few months, it is actually much, much wider extending back to last autumn.

Where the Establishment Survey showed 1.68 million new jobs since October 2012 (again, not a relatively robust pace in its own right), the Household Survey is stuck at 736,000. Again, the balance of new jobs is not anywhere near (by either survey) to closing the breach between the population that potentially needs jobs and those that actually attained them. If the Household Survey is correct, then there is a gap of somewhere around 1.2 million without income (and likely falling onto SNAP and “disability” through the Social Security Administration).

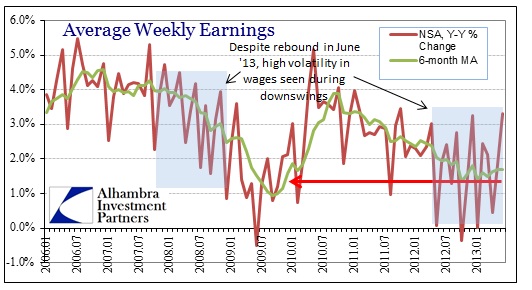

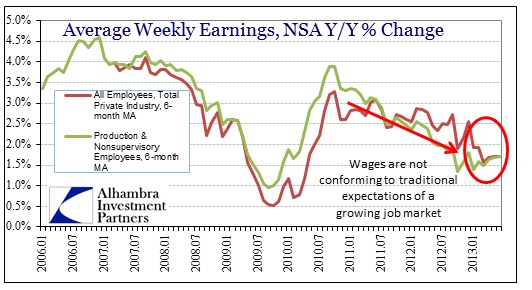

The combined lack of quality coupled with uncertain quantity shows up as both weakening income growth as well as volatility in that data.

No matter which way they are counted, income growth is not showing a robust jobs market, and thus does not confirm taper by any meaningful standard.

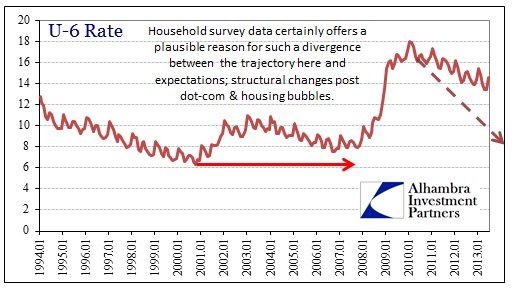

The unemployment rate, because of all these statistical problems, is not a good target or representation for economic improvement in this type of economic climate. In fact, using the U-6 measure of unemployment we see the structural problems that are apparent in nearly every single economic data measure available. The inability of the economy to transition even minor improvement into national and wage income is the defining characteristic of this “recovery”; saying much about the artificial nature of economic growth that preceded the Great Recession.

If the Fed wants to base its monetary pace on the official unemployment rate, then it should be considered as a poor proxy for the real economy (as shown here). Therefore, it is entirely consistent that the Fed can scale back “stimulus” at the same time the economy either fails to actually improve or, as incomes (lack of) show, retrenches.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch