With both the final revision (for now, benchmarks still to be re-estimated numerous times) for last quarter’s GDP estimate and the news that jobless claims “unexpectedly” fell, the idea of recovery is making rounds again particularly in the context of spring (the season). BusinessWeek sums it up best:

Applications for U.S. unemployment benefits unexpectedly declined last week to an almost four-month low, a sign companies are confident in the outlook for demand…

“It seems to be genuinely good news for the labor market,” said Guy Berger, a U.S. economist at RBS Securities Inc. in Stamford, Connecticut, who projected a decline in claims. “In all likelihood, employment growth in March is going to be stronger than what we’ve seen in the last three months, and this claims data is consistent with that.”

The obligatory quote from the credentialed “economist” tells us absolutely nothing useful. If March is stronger than the last three months, how does that compare with some contextual relative measure? How about some absolute measures? The same holds true for these attempts to provide only disjointed and discrete analysis for GDP. This strikes at the very heart of the notion of recovery itself, and thus what it is businesses might actually be responding to (and why).

A recovery is not just a positive number in some economic account. If GDP falls by 10% one year and rises by 1% the next, that is not a recovery. Even if GDP continues to gain by 1% per year for five years, it is still not a recovery. That would indicate, without ambiguity, an economic rut whereby residual and base factors are driving marginal gains rather than productivity and innovation, the truest forms of economic progress.

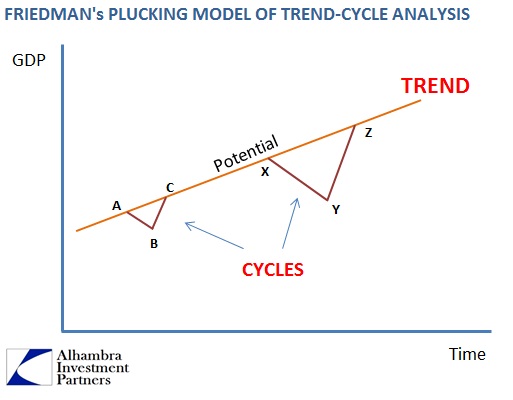

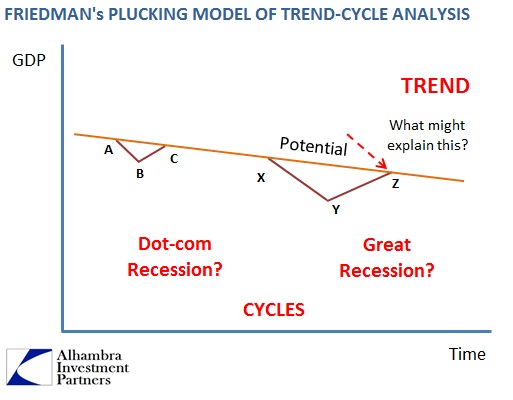

While the numbers I use above are admittedly extreme to the point of seeming absurdity, a careful analysis of recent history renders them far less so. The place to start is the plucking model. There is much to admire in the plucking model, particularly the intuitive sense that we all have about the recession/recovery cycle.

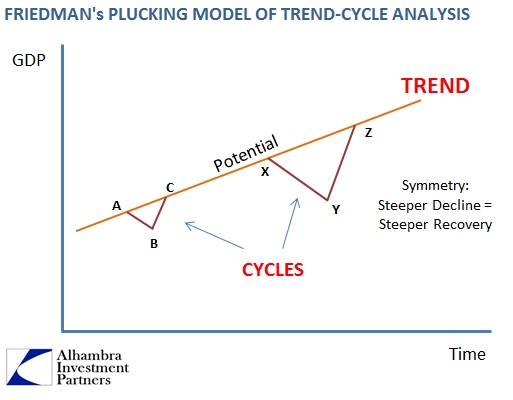

Economic progress through innovation and the applications of it in true productivity (as opposed to statistical creations and representations of false narratives) determines the overall trend, while cyclical recessions temporarily interrupt that progress. Yet, in almost every case, recoveries regain their previous trend level in near perfect symmetry.

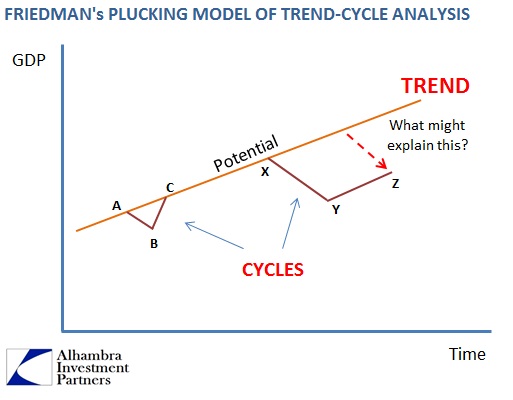

Setting aside any tangential discussion of what causes cycles themselves (usually policy intrusions of one form or another), the obvious lack of symmetry after the Great Recession has created a number of distortions not only in the real economy (asset bubbles growing out of credit with little real economic opportunities; again policy) but also in the economic accounting. GDP and labor accounting are now somewhat at odds with each other, having moved apart early in this century. Yet for all of that, there is no effort at explaining this conspicuous divergence from orthodoxy.

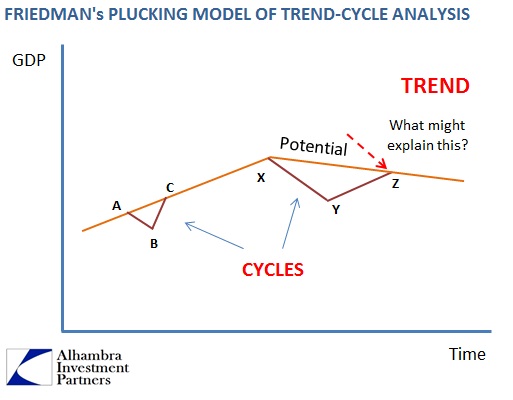

To preserve even the idea of the plucking model (which I think is needed) requires an adjustment to the terms. The only way this can continue to hold consistency is if we revise our view of the overall trend.

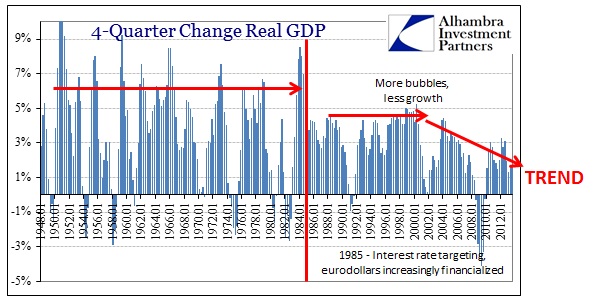

Going back into recent historical data series causes this revision to extend beyond just the last cycle. In fact, if we read these patterns correctly, this narrative format for the 21st century economy can be redrawn as below.

If that is a suitable theoretical notion of economic behavior, then we should be able to see this downward “stair step” pattern empirically. And we don’t have to search very far – we can start right in the labor market.

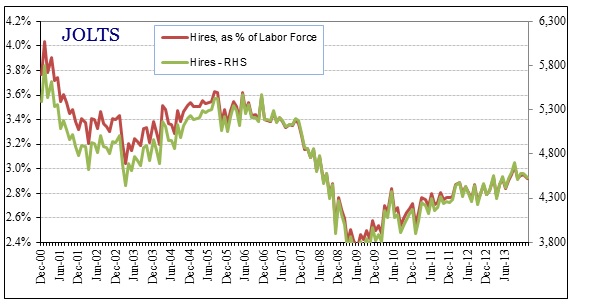

The relationship between unemployment and employment changes run through the JOLTS series. Here the BLS has broken apart several factors within the labor market, with estimations for rates of hiring, job openings and separations. If employers are “confident in the outlook for demand” we should see it here.

Even if there is a relative pickup in hires in March, it won’t make much difference in this context. In fact, even a larger increase would be meaningless unless it portended a true change in trend and trajectory. A relative change in March as compared to the past few months holds no explanatory power as to the overall economic condition, even the “outlook for demand.”

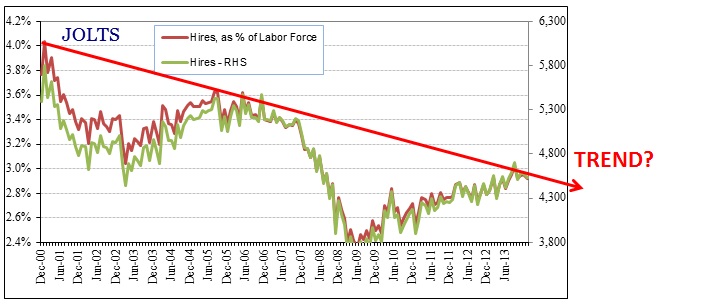

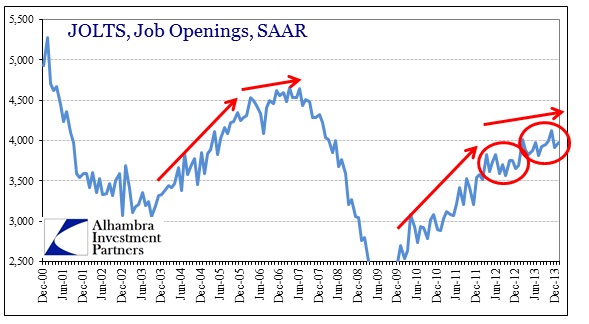

The reason for that is that this data seems to explicitly bear out the down-trend plucking model.

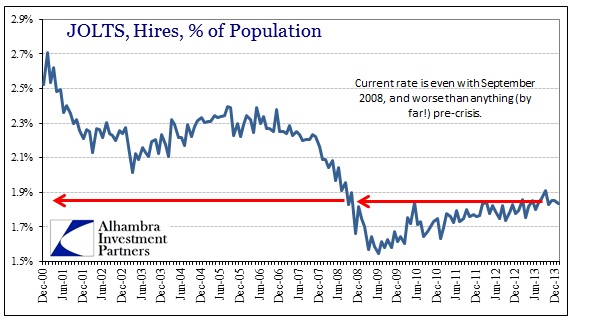

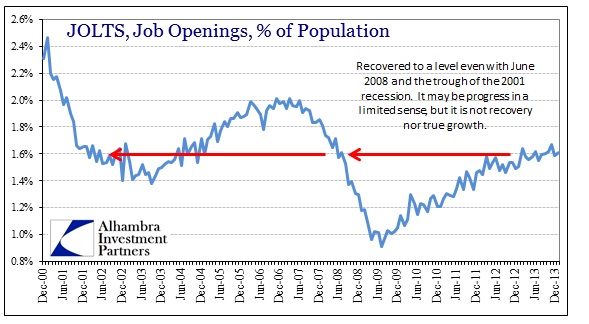

And even that projection might be overstating the current cycle. Since the most basic economic transformation reverts all the way back to demographics, the population growth has to be taken into account in some fashion. If we normalize these labor statistics by population, the overall trend is potentially even worse.

There are two points to make of the chart immediately above. First, it suggests a severely depressed trend which should be very concerning. Second, it also suggests that the cycle portion of the upward move is reaching a delineation or potential inflection.

The change in cyclicality is more evident in the series for job openings, the most robust of the three measures contained within JOLTS.

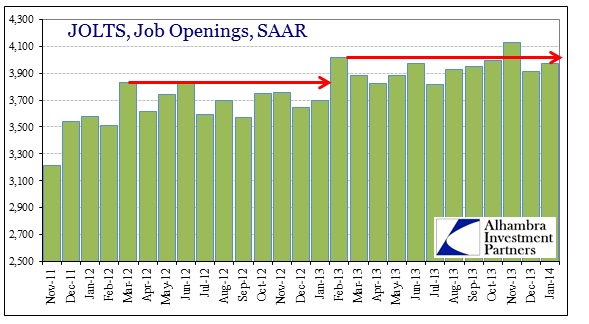

Again, we see the downward trend evident, but also that most recently the cyclical expansion has become disjointed. Going back to early 2012, nearly all the improvement in growth rates is traced back to only one month – February 2013.

Given the economic framing of February 2013 it is somewhat anomalous, raising the question of statistical veracity (since these monthly measures are chained together). Beyond that, these evident and elongated periods with little outward improvement conform to the idea of a cyclical inflection.

If the above analysis is anywhere near correct, that would mean any minute changes in the “outlook for demand” in March are, in fact, meaningless. In the wider context, it would call into question the validity of interpretations of everything from unemployment claims to GDP (an issue I have raised before). An economy is not some number of a dollar value assigned to the theoretical trade goods and services, but rather a system of redistribution aligned toward enhanced labor specialization. We don’t grow our own food or make our own clothes, allowing us to be far more productive as a society. These basic economic accounts are supposed to measure that, and up until the Great “Moderation” these accounts featured relative robust correlations to that trend.

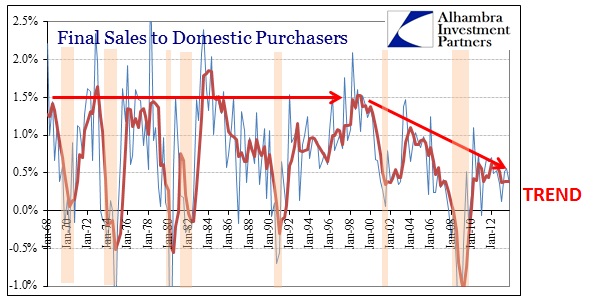

The emphasis now should be on arresting and correcting this downward economic trend that is palpably durable. It is not just labor statistics that this downward “stair step” appears, it is also evident in GDP and some of the specific components of that calculation.

Since the time periods here align closely with the ascent of the bubble economy, I don’t think it is much of a leap to suggest that as a potential cause for this major downward inflection. We also don’t need to look very far in terms of the accumulation of financial factors that spilled out into this overriding of true economic productivity and innovation.

While the appearance is evident in the statistics, the actual link between financialization and the reduction in productive economic trend may be less clear. But it only takes a few moments of review to see that established in common sense. The more financialism takes over, the greater the resources devoted to not only “take advantage” of that monetarism (in terms of both character and rent seeking) meaning less dedication to true productive advances including innvotion (non-financial).

The great internet and computer revolutions had their basis in the 1950’s and 1960’s, yet there has been nothing close to that magnitude to follow it forward. If you look at what companies were doing, at the margins, in the 1970’s and 1980’s you can tease out exactly this transformation. If big businesses weren’t becoming financial concerns themselves, they were increasingly zealous (distracted, really) about M&A and other financial “investment” opportunities.

There had been numerous challenges to Regulation Y over the years, and some succeeded in narrowing the definition of “commercial loans.” However, it was First Associates, then part of Gulf and Western, in 1980 that would unleash the fury of one pillar of financialization. The company proposed, without petition to the Federal Reserve, to buy Fidelity National Bank of Concord, California. The idea was to take advantage of the wording in the Bank Holding Company Act regulations under Regulation Y by using the literal definition of a bank. That meant, under the statute, a bank had to do both, take in deposits and make commercial loans (the word “and”). Associates First reasoned that if they divested the commercial loan part of Fidelity National, it would fall outside the definition of a bank.

However, since Associates First was interested in the bank’s retail branch system it was obliged to notify the Comptroller of the Currency, C. Todd Conover, under the Change in Bank Control Act. In August 1980, Conover notified Associates First and Gulf and Western that he would not object to the merger under the same legal interpretation of the word “and.” The nonbank bank was born and accepted into legal precedence.

While Gulf Western, an industrial company, was unleashing the nonbank concept, Sears, the retailer, attempted to become the largest consumer finance company in the world. The entire corporate cohort became totally enthralled with finance. The inevitable reductionism of that impulse was exactly what we saw in the 2000’s – the tsunami of share repurchasing at the obvious expense of productive investment. The hidden side of that change in corporate preference is the decreasing devotion and incidences of innovation (outside of finance) required to maintain the upward slope of potential economic expansion.

So now we have two concurrent problems. The financialization trend that has shifted economic potential toward repeated disaster, and the recent cycle’s apparent and growing exhaustion. Thus the dawn of spring means only the removal of weather as a fanciful factor.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch