It was just over a year ago that the ECB began courting rumors about an ABS addition to its monetary toolkit. With the obvious lack of credit flowing in the real economy flying directly in the face of all monetary convention and expectations, you can understand the desire to dust off the idea.

Just over a week before the ECB’s next policy meeting, where it is predicted to cut interest rates to stoke inflation, central-bank officials and researchers are meeting in Sintra, Portugal, to discuss current monetary thinking. Draghi, who has shown support for measures from negative rates to liquidity injections and large-scale asset purchases, said yesterday that buying packaged loans could reduce the “drag” on the economy.

If I could be permitted to quote at some length my thoughts from last May regarding ABS, it would help, I believe, to understand the process.

By most accounts, this ABS idea closely resembles the Federal Reserve’s TALF program from early 2009. In the US version, the Federal Reserve offered non-recourse funding to “any US company that owns eligible collateral”, provided that company or hedge fund had an account at a primary dealer. The terms of the TALF loans were for three years, and eligible collateral was limited to AAA-rated ABS tranches of consumer loans to US residents.

The keys to making TALF “workable” were a US Treasury pledge to absorb the first 10% of any losses incurred by the Fed and, from the perspective of the borrower, the non-recourse nature of the loans. Without the UST guarantee, it is highly unlikely the Fed would have accepted such credit risk, AAA or not. And borrowers were not likely to sign up if the Fed was able to come after them for losses above whatever collateral was pledged. With a non-recourse clause to the arrangement, borrowers could simply walk away from the collateral and leave the losses on the books of the Fed (and UST).

If the ECB is indeed thinking along these lines, we can already sketch the potential hurdles, most of all the credit risk associated with purchasing crappy ABS. The ECB has already borne significant credit risk in the ABS space through the LTRO’s – eligibility requirements for ABS collateral were loosened all the way down to single A ratings. So the question here is, which government is going to offer a credit loss guarantee? There is really only one country that can with any real credibility, the very country that is most likely to resist (or at least publicly appear to) – Germany.

However, there is another angle here in how this might work in the context of European banking. A new ABS program, apart from the LTRO’s and main refinancing programs, would be the equivalent of a collateral-making machine. By standardizing SME loans and standing by with obvious and available funding, the ECB is encouraging the creation of new security collateral that will already be eligible for low cost funding.

I think that last part is the key here, namely that banks aren’t lending into the real economy because there is no ready leverage available (and loans into the real economy look downright horrendous, which makes the guarantee non-recourse all the more important). That includes both regulatory and funding leverage through “capital” relief and repo/rehypothecation, respectively. It cannot be understated how important this dual leverage set up is in the schematic of 21st century financialism. Banks just won’t go for any additional credit production without a plethora of heaped leverage.

The catch, however, is that in the rush to wind down the LTRO’s in order to cultivate the “everything is fixed” illusion, the artificiality of the whole system began to creep back into the equation. Volatility has returned to Eonia which indicates a drying up of interbank certainty, as well as suggestions of renewed fragmentation.

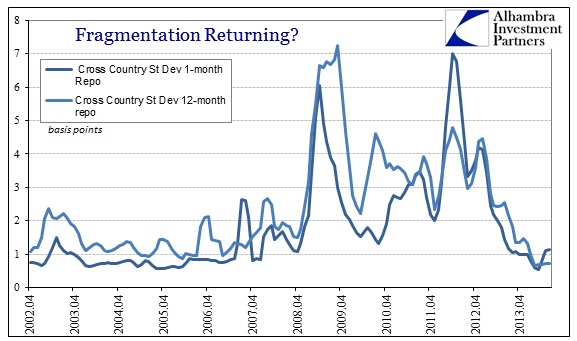

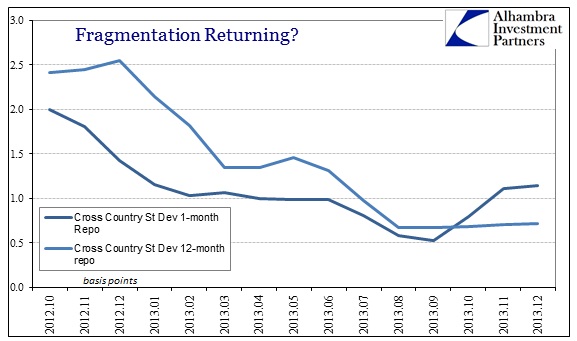

That also seems to be extended to repo itself. The latest ECB survey of cross country mechanisms (through the end of 2013) shows a plain increase in repo volatility across geography.

In the long-term chart above, it looks wholly insignificant, especially compared to the extremes exhibited during the crisis periods. But on closer inspection, it is also very rare to see the 1-month standard deviation rise above the 12-month, as has been evident since last summer (not to mention that it is the first significant reversal of trend since the middle of 2012). Whenever that occurs it indicates more stress in the short-term markets for wholesale funding; here in repo.

That would complement and reinforce the picture being filled out by rising Eonia and volatility there. If that is the correct interpretation, then it might explain the revisit of the ABS idea.

In terms of the bigger picture, anything like a negative deposit rate or the inauguration of ECB ABS carries with it more than a whiff of desperation despite all the careful orchestration to the contrary. Financial and economic fragility remains heightened regardless of mainstream commentary precisely because the major and primary problem has remained unresolved – the euro itself.

A full and sustaining recovery just does not need this tinkering. While it all may seem to be buying time, the fact of the matter is that it is wasting time. Given the nature of compounding, this is all an extremely high opportunity cost as the longer the manipulation continues, the more this all gets dragged out further. And that is the larger point I am trying to convey – it never really gets fixed. No matter the scheme, dysfunction will find its way outward somewhere else at some “inopportune” moment.

We have progressed well beyond “kicking the can” into decay through delay. If the financial system cannot stand on its own after all of this, then that says a lot about both central banking and banking. This continual “need” for hand-holding credit production is itself screaming for something different to be applied. Japan had its zombie banks, and it appears as if Europe wishes to define its own version.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch