There are several misconceptions about the US$ as the world’s reserve currency, including the use of the hegemony qualifier. Part of that stems from a very persistent lack of understanding about what actually took the place of the gold exchange standard after Bretton Woods (which itself is misunderstood as it replaced other forms of exchange control). You hear the term “petrodollar” thrown about but that is nowhere near comprehensively descriptive to fully appreciate the change that manifested in what we see today. What replaced gold exchange (not a full gold standard, as gold coins were outlawed by FDR inside the US; an appropriation of property that opened the door to all of this) was eurodollars in all their very forms and essences.

Likewise, the assumed “benefits” of a US$ standard, whether eurodollar or actual currency as takes place in some “undeveloped” or “emerging” locales, are usually noted as cheaper goods, especially oil and energy; thus the emphasis on “petro.” But that only assumes part of the systemic evolution as there are equally significant financial factors to consider. This goes well beyond simply tying foreign trade directly to US government bonds, as this is far more than just an interest rate or debt cost consideration.

When the euro was first designed, as it happens, the impetus for doing so was largely political but also in parallel to a rising “concern” in the financial sphere. Consider that going all the way back to 1985 and the Plaza Accord European domiciled banks had begun to develop what is now known as “hub and spoke.” Under such a framework, European banks gather deposits through local branch systems in local currency and then, using the “miracle” of the exponential growth in futures and IR swaps, convert them to US $’s in order to lend and purchase assets denominated there instead.

In that circumstance, which came to dominate in the 1990’s, especially at the margins, it must have been more than galling to be the government in Germany or Spain and watch your citizens’ marks and pesetas “flow” to the US in the form of growing financialism. Given the predilection globally for debt as a tool in economic control and central planning, that created a huge incentive for the European combined economies to create a “reserve” currency to rival the dollar just to keep more financial resources at home – European banks lending to Europeans rather than Americans; “defeating the business cycle” in Europe rather than keeping to just Greenspan’s “genius.”

It never quite worked that way, especially in the earlier days of the euro. European banks remained dollar steady, opening up a short dollar position of biblical proportions (that we still have little idea of how large it was), and were the largest source of credit production for the mania portion of the housing bubble. From Spain and Germany to the UK and Switzerland, global banks were financializing the US through eurodollar “liquidity.” The visible benefits (in the orthodox view) may have been lower interest rates and greater flow of credit, but there has to be at least some appreciation for the liquidity aspect of it all.

The favoritism of the US dollar in eurodollars had as much to do with perceived stability as with anything else. The flow of global resources in to US dollar mechanisms was, as it turned out, quite ill-suited for what was expected of it. As with most things about liquidity, its appearance is usually a misdirection; as what looks great one day can disappear for great lengths the next. In other words, what was regarded as a huge financial positive in the decades leading up to the Great Financial Crisis was actually a massive weakness since it created a fragmentation that was fully hidden (especially to regulators and central bankers) from view – until August 9, 2007.

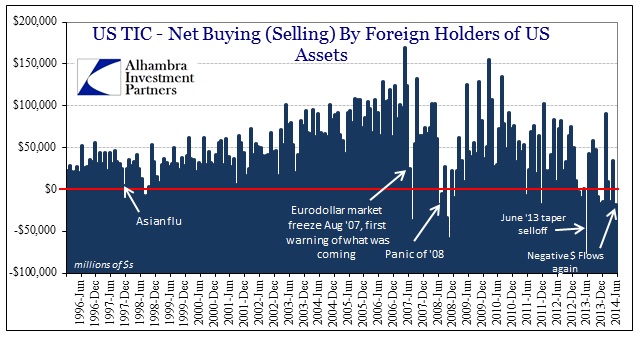

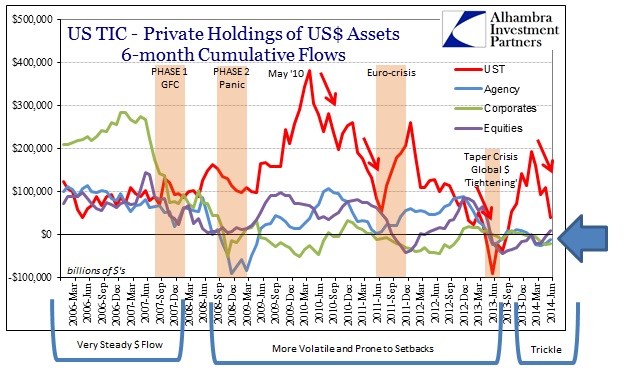

As we know now, the US$ standard has been durably altered by the events of that day and everything that has come afterward. Foreign dollar flow has become far more volatile, which threatens US$ liquidity in domestic markets (not just eurodollars). That observation applies not just to the formerly-immense dollar “suppliers” in Europe, but Japanese (Japanese banks have been consistently the second largest dollar “short” in the world; dollar swaps between the Fed and other central banks usually place Japan second in usage) and otherwise domiciled financial firms.

The events in May 2010 with the first eruption of the euro currency crisis, born through immediate concerns about the tiny Greek financial economy, opened a second hole in the dollar flow system largely because so many of those European banks were also dollar asset holders and users of eurodollar liquidity. It was a dramatic link between what transpired in Europe and asset market fragility inside the US (driving to what I still believe was a very near panic on December 9, 2011). Dollar liquidity and thus asset prices were imperiled as the European dollar “bid” (or short) was threatened by very European problems, an incongruity that still seems to elude most observers under cover of central bank-inspired rationalizations.

That harrowed narrowing of the exits is usually a private affair, with central banks stepping in long after the carnage has been assumed. Most people, including probably every single casual observer, notice such dysfunction and disorder solely by proxy of stock prices. But in the middle of 2013, dollar chaos manifested in ways and manners far more remote than that slender focus.

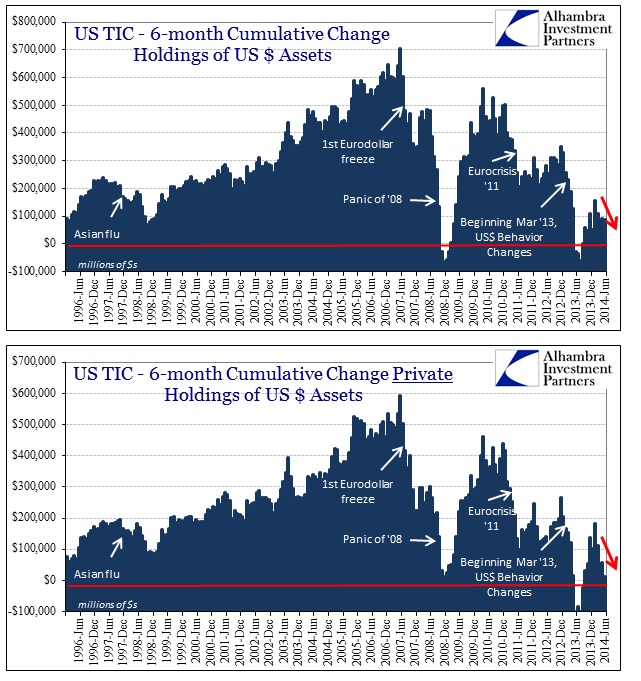

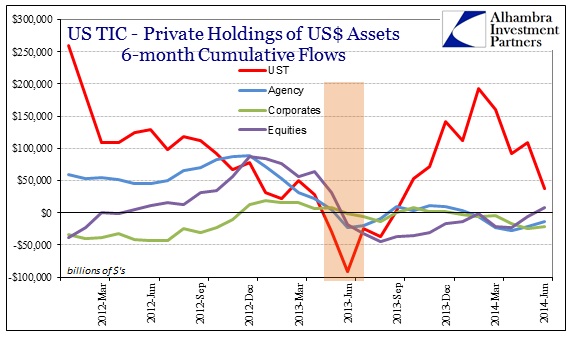

If you observe the cumulative action of the private financial system, you can see just how much of a mess these four instances (2 phases of the GFC, euro crisis, and taper selloff) have created in US$ flow. The reduction in holding of US$ assets takes place because of liquidity problems, and thus the congregation of them into singular waves is the visible aftermath of exactly that disorder. However, where stock prices were noticeably impacted in 2007, 2008 and even 2011, there was little notice of the grand disruption in 2013 – unless you paid attention to eurodollars, MBS (in particular) and foreign currencies (pretty much the rest of the world).

The two charts above look nearly identical, but the first (top) is actually total dollar holdings while the second (bottom) is just private dollar holdings. As you can see from the stark similarity, changes in US$ behavior are driven by private considerations; as I said above, central banks are entirely reactive in the purview of liquidity.

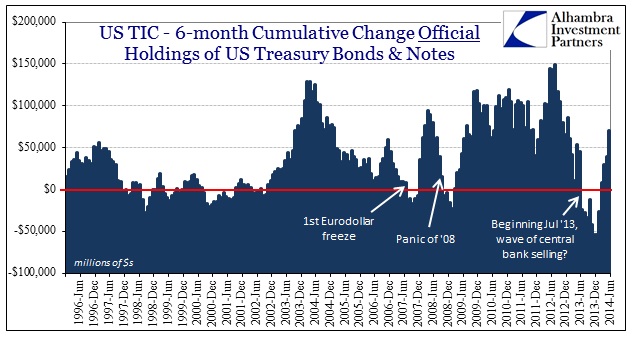

More recently, “official” holdings of US$ assets have again resumed nearly their prior pace. That suggests that foreign central banks have become more confident in the ability of local institutions to procure US$’s on the eurodollar market (or wherever else they can find them). Private dollar holdings, however, suggest the exact opposite.

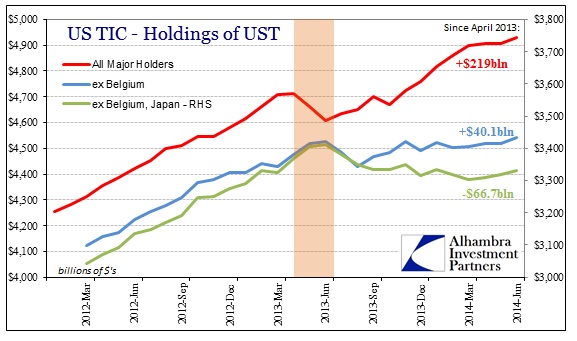

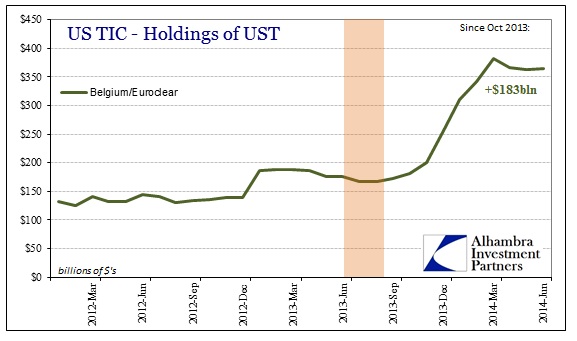

Some of this is bogged down by what is surely an almost unrelated matter, as private movements of UST to Belgium now appears to be confirmed as nothing more than a one-time shift of operations from those domestically-based in the US to Euroclear. That is as much about regulatory changes and capital costs associated with derivative books as any penchant for increasing US$ exposure (or, in our case here, confidence in US$ availability).

Away from Belgium, the US$ market looks at least unsteady. In terms of trying gauge future exit availability, liquidity, the taper-driven dollar selloff may have been far more damaging than it appears with a close gaze.

The flow into US$ assets was clearly interrupted during that event, and only UST’s look to have somewhat “normalized.” But, as the Belgian/Euroclear figures show, even the rebound in UST was likely artificial.

Whatever the case there, a longer-term view shows just how diminished the US$ bid (perpetual short) has become after repeated dollar episodes – all dating back to August 9, 2007.

This interrupted dollar stream is the financial equivalent of narrowing the exits. This is in addition to internal systemic pressures I tried to describe of the repo markets. You have internal systems that are far less robust than they were even in 2008, and now on top of that there is a much smaller external financial bid as financial confidence in the US$ wanes dramatically – as much about instability as even politics. The internal problems in repo and dealer “shock absorption” capabilities were surely severe enough to be heavily scaled in the MBS problems last year, though I don’t think you can discount the lack of or shrinking participation from the global dollar short. The asymmetry of cause (Bernanke taper threats) and effects (dollar disruptions raged across the globe, spreading chaos and disorder, though remaining outside the blissful ignorance of the stock observer) are directly related to the narrowing of these exit points.

The problem of liquidity is as much about systems and placement as it is any economist notion of “money supply.” There have been dramatic shifts taking place under the surface that are not appreciated well enough to appreciate the potential ramifications when inevitably conditions transform out of benign complacency. The rift in the global eurodollar exchange system that opened in 2007 is not closing, rather it remains in a state of paradigm shift that can only strain further a liquidity system that has actually lost robustness from even its weakened state just prior to near-collapse. We may yet at some point very much regret the loss of that one “benefit”, the foreign bid creating at least the appearance of liquidity, of the US$ as reserve currency.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch