The purpose of this exercise of examination of global funding mechanisms is to put together means for inference about the state of dollar funding as it relates to the systemic short (Part 1 here; Part 2 here). There is no direct path for observation; that is why nobody can figure out how big it is or how it has really changed since 2007. All we know for certain is that it has, and that the paradigm shift is still under way.

This last piece pulls in the dollar itself, though even this view is suspect given this rather crude construction. There simply is no such thing as a monolithic, universally representative “price of the dollar.” The reason for that is obvious in this context, as there is no conclusive or even widespread understanding of what a “dollar” actually is, let alone the supply of them. The closest we can get to something like that is when the weight of “action” moves the relative price against so many other currencies in the same direction at the same time as to preclude the intrusion of minor factors.

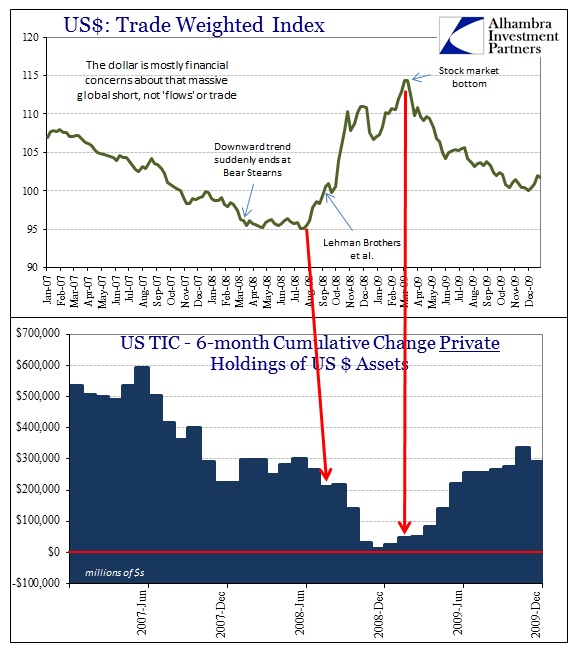

A good example is, I think, what occurred in 2008. I don’t find it coincidental that the dollar (represented here by the trade-weighted index which overstates some currencies, and understates others, but, again, there is no perfect measure of price) stopped its downward trend right at the moment Bear Stearns failed. That tells me that dollar liquidity which had been strained to that point entered a new phase of heightened problems. And that was confirmed by the steady erosion of TIC flows up until Bear.

The major rise in the “dollar price” occurred when TIC was at its lowest, more than suggesting the problem of funding the massive dollar short and the responsibility of that toward asset price panic downstream. The dollar’s trade weighted price stopped rising the very same week the S&P 500, Dow and every other major US stock index recorded their ultimate bottom. This was a coordinated selloff directed by funding issues that were far too widespread to be “contained”; all of which went back more than a year before ultimately finding this catastrophic disposition.

Again, that view is confirmed by TIC flows, registered here as a lower level of “inflow” which was in some months actually an “outflow.” If you view the dollar as simply those kinds of flows, its rising “price” during the period makes no sense; however, if you think about the short position and how the availability of dollar funding affects what amounts to a short-squeeze, the price of the dollar and the behavior of TIC flows is perfectly consistent.

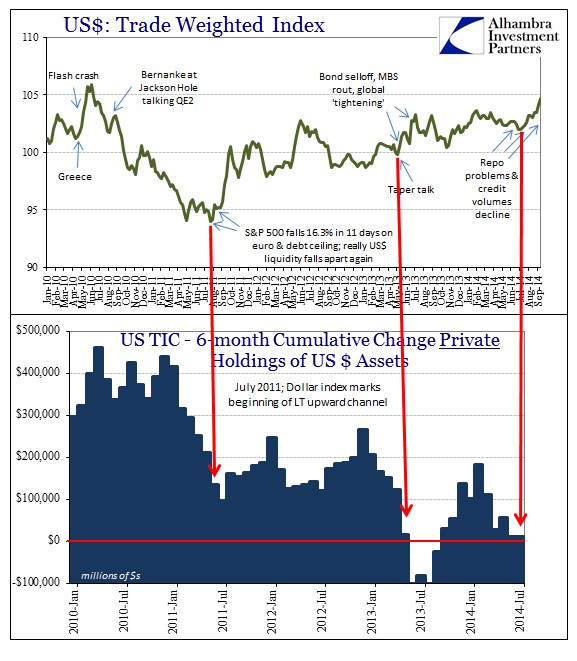

The chronology of changes thereafter follows the same guidelines. As the dollar short looked toward a rebuilding position in 2009 and into 2010, the eruption of the euro crisis interrupted it in both TIC and the resumed downward channel in the QE2 regime. Ever since dollar funding collapsed in late July and early August 2011, which forced, among other actions, the SNB to peg the franc to the euro and the Fed to reopen dollar swaps, both in September 2011, the trade weighted index has opened what appears to be a very durable upward channel. That would seem to explain the relatively steady price of oil since that time and other factors that demand greater attention in the official inflation estimates.

The upward channel of the dollar seems to have been given a boost or push on May 8, 2013, when the first published version of “taper” was given. The selloff and global “tightening” that followed resulted in a short but sharp dollar rise, again consistent with the idea of the dollar short and its funding problems.

What is relevant to this moment in time is the renewed dysfunction in repo which seems to indicate dollar stress once more. The particulars of that problem can be found here. As it relates to the wider dollar issue in global finance, it seems that the trade weighted index price of the dollar’s steady rise since August may indicate, alongside both repo and TIC flows (prior through July), renewed funding pressure on a global basis.

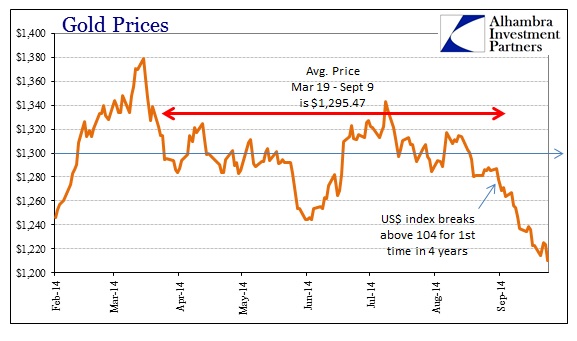

As the dollar has risen to a level not seen since the first outbreak of the euro problem in mid-2010, it would seem as if the level of dollar stress might be somewhat heightened, though it is impossible to know exactly if that is the case and to what degree. It looks as if the breakout of gold prices below the range that had been so stable since early in the year would add evidence to that theory. Gold prices under these conditions will act inversely, as funding pressures where gold is used as a substitute collateral are depressive. That would further suggest, if correct, that central banks may be back into supplying gold where they were likely absent only a few months ago.

Whether that represents an escalation or not really depends on what changed and why. As to the larger issue at hand, the dollar system as it clearly shifts along the axis established all the way back on August 9, 2007, continues to be somewhat disruptive to orderly function. What is interesting in that regard is how QE2 clearly had an impact (seemingly acting as a funding assurance) whereas QE3 & QE4 did not (outside of a short-lived decline in the dollar index that ended exactly when QE3 was officially announced). That would seem to advise that global dollar participants have learned and become aware that QE’s tend to be disruptive to conditions and that they do not necessarily represent a positive change in either economic or funding conditions, and certainly not directly.

The direction of the dollar now, if the trade weighted price is a valid avatar, at a 4-year high would suggest that the eurodollar system continues to erode toward whatever end awaits the global exchange schematic. Reduced dollar participation means fewer bids, and thus liquidity, when the bell finally tolls. The accumulation of flows and finance I gather here are relatively solid toward that inference.

Perchance he for whom this bell tolls may be so ill, as that he knows not it tolls for him; and perchance I may think myself so much better than I am, as that they who are about me, and see my state, may have caused it to toll for me, and I know not that.

John Donne, Deviations Upon Emergent Occasions, 1624. Describing asset bubbles and their inevitable end?

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch