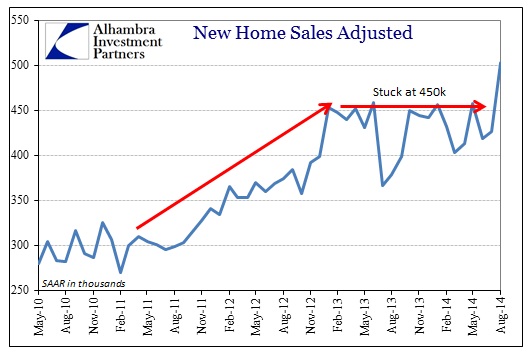

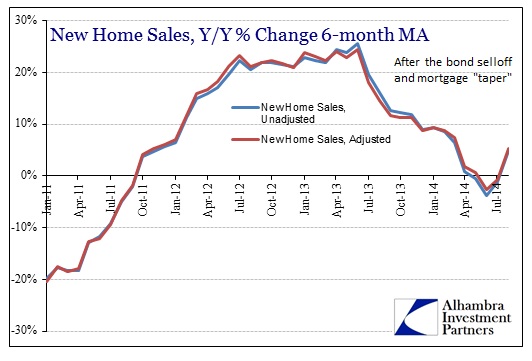

There was a surge in new home sales reported last week, breaking the current flat trend that extended back well beyond last year’s MBS problems. The huge increase in sales, so out of character with other indications recently, suggests possible noisiness in the data. That is particularly true when existing home sales fell in August according to the NAR, and we find out today that pending home sales did so as well.

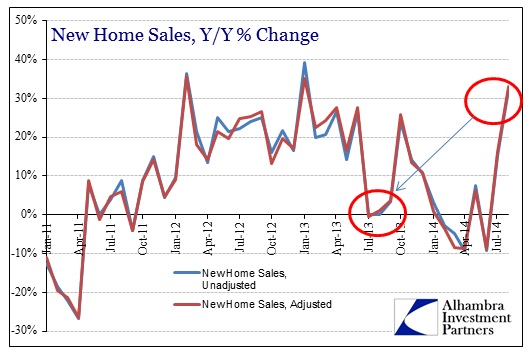

Going all the way back to January 2013, new home sales seemed very much unable to break above that 450k pace – until this latest monthly result which smashed right on up past 500k. The disparity there between this “breakout” and last August leads to a major base effect in the growth rates.

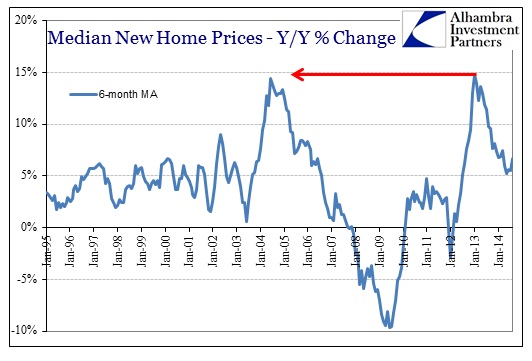

We should not lose sight of the context for home sales, given that 500k is still a fraction of what “normal” experience suggests as healthy and growing, though what are really minor changes in activity and even inventory may account for what is being estimated here (until revisions). The sales figure also is at odds with home construction data, though it is possible that August is making up for depressed activity from earlier in the year (inventory finally being offloaded). That would at least be consistent with the inventory of properties for sale that the NAR continually refers to. However, despite a greater number of properties “on the market” prices still move higher, though clearly more slowly then when sales were growing steadily at this pace.

Again, that is contrary to the assessment provided by pending home sales, though there is a real possibility of diverging data points.

The latest reading pointed to the sector’s headwinds as stretched affordability and fewer investor purchases pinch sales…Monday’s pending-sales report signaled the August softening in existing-home sales could extend into the coming months. Sales of existing homes account for around 90% of all transactions in the market.

The pending sales index was 2.2% below August 2013, which again refers to a similar though inverse divergence in readings among these series even last year. No mention of housing in a mainstream article, though, would be complete without contradictory implications:

Steady job growth, slowing price gains and an increased supply of homes for sale have helped to support the strengthening recovery. Employers added jobs at a monthly clip of 200,000 or more between February and July, the strongest six-month stretch of job creation since 1997.

…

The sector continues to grapple with tight bank-lending standards and worsening affordability caused by rising prices and higher mortgage rates.

Mortgage rates and “worsening affordability” would not be consistent with a truly robust economic period. Instead, an economy with income growth stuck far below even middling levels would very likely be perfectly consistent with a struggling real estate market that “grapples” with any number of negative factors.

While supplies of for-sale homes had been rising through the first half of this year, that trend appears to be turning; listings usually drop off in the fall and winter months, but the number of newly listed homes fell 9.3 percent from July to August, compared with an average drop of 3.2 percent between July and August over the past five years,” according to Redfin, a real estate brokerage.

One factor appears to be the end of the institutional buying craze sparked by the TBA profit subsidy of QE3. With mortgages, including purchase applications, sinking again the confidence of earlier this year seems to be waning. Everyone wants to blame an expectation for “rising interest rates” but there is at least the possibility that organic buyers simply don’t have the wherewithal to keep the market up at even its currently depressed level (in comparison to both 2013 and pre-2008) – even factoring August new home sales.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch