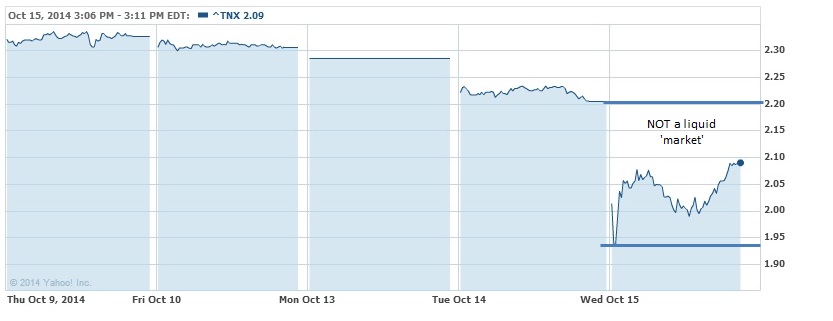

An unbelievable morning of credit market trading has at least seen some semblance of “market” forces return by the afternoon. One aspect is certain, that the open was about as illiquid as the treasury market has seen in a long, long time. We should not make the mistake of illiquidity being only associated with selling, particularly since today’s volatility was due to “panic” buying in UST. The 10-year at one point was off about 26 bps, which would have marked one of the biggest moves since 2009.

Even still, considering the eventual restoration toward the close of less overall impact, the intraday volatility was enormous. That points to one factor which many have been making for some time, that there is a whole lot less liquidity now than there maybe “should” be.

In a lot of ways there is a colossal struggle about the direction of this QE-less enterprise. There are those that assume the bond market will be listed upward (rates) without the persistent “buying” of FRBNY’s Open Market Desk. The problem with that view has been the entire history of taper – almost from the moment it was actually implemented interest rates have been moving lower. That represents the other side, in that without the gloss of QE actual economic conditions and “tail risks” will be revealed by less artificial “surety.”

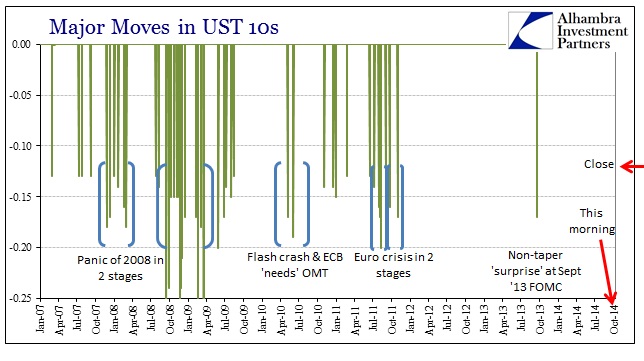

Indeed, just a cursory review of such volatility in the 10-year UST shows such days clustered around major (negative) events – with the exception of last September’s “fool me” FOMC. I think the chart above shows very well that artificial calm induced by QE3 and QE4, about a final push toward an assurance that the tendency toward crisis was finally put into the past and that there was nothing but clear skies ahead.

That is the biggest blow of the disruption in Japan and Europe (and in the US, once the unemployment rate finally recedes from its unearned pedestal), that what looked like such durable placidity was nothing of the sort – I say again there has been no actual recovery anywhere, only the temporary absence of contraction. So in that respect central bank “magic” worked as all magicians practice.

This may all turn out to be overblown and unrelated to any larger fundamental extrapolations, but history suggests at least some needed objective examination. As I noted yesterday, there are two facets here to be most concerned regarding bubbles, namely sentiment shifting against a seriously diminished system of liquidity. Treasury market trading today just may have demonstrated both together. Time will tell, especially as global correlations are again at the forefront.

Stay In Touch