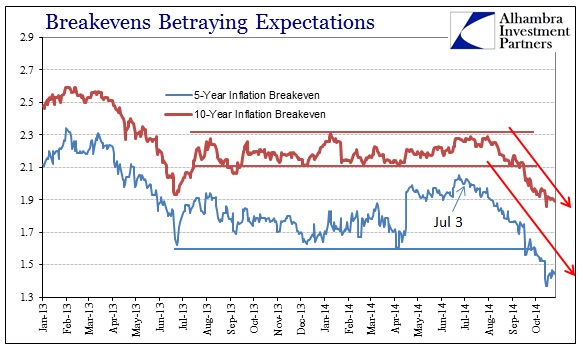

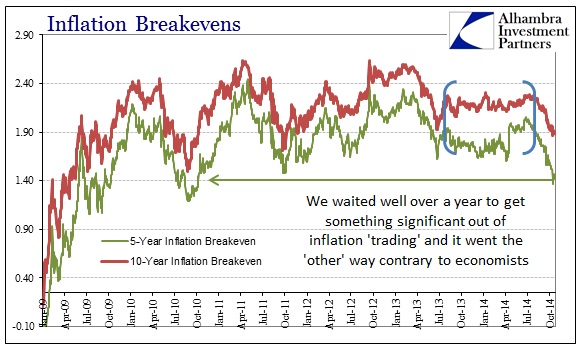

As if it needed further clarification, the FOMC has gone its own way publicly against pretty much everything else because there is no other course that could even possibly end Hollywood-style. The constant reference to “slack” in the labor market is what gives this away. A potential reduction in labor slack would mean emphasis on inflation rather than unemployment. However, there is no “inflation” to be found and “markets” are rather uniform in that interpretation.

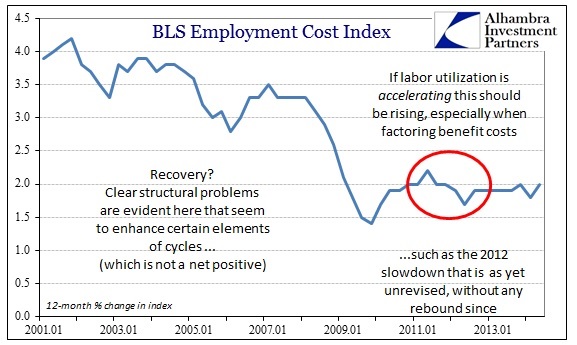

It seems like ages ago when there was much fretting over the BLS’s Employment Cost Index (ECI), as orthodox economists were groping toward anything that might suggest as the FOMC does now; less “slack.” A proper reading of the ECI was actually the opposite, as it clearly shows not just “slack” but historically inept policy action toward alleviating it.

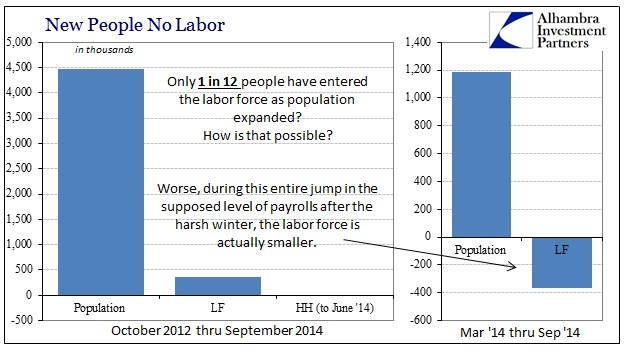

The economy has not even come close to reaching backward toward pre-crisis levels of wages, or what the FOMC would read as “slack” diminishment. In fact, the ECI is far nearer in its appearance to the labor force dropout factor than anything approaching what they claim is happening right now.

It seems very likely that this is what is driving inflation expectations as viewed via TIPS. After talking improvement in labor slack for two years, the “markets” have finally had enough just as the FOMC has had enough of Bernanke-isms. It is, again, no coincidence, I believe, that inflation breakevens finally and quickly moved in the “wrong” direction at the same moment the global dollar short grew so tight. In other words, it isn’t just inflation expectations that are running directly against this FOMC “logic” but rather a good portion of the most important pieces of “dollar” finance.

The unemployment rate provides easy cover to these “slack” references because it was never designed to operate under these conditions. As with almost everything related to the FOMC and monetarism, there is more than a little misdirection taking place here. Noting their current disfavor over “forward guidance” this morning, this afternoon’s statement actually fits very well within that shift. In essence, the FOMC is now totally freed from the shackles of the unemployment rate as Bernanke designed it back in September 2012 (and this gets back to optimal control theory as well).

Now the FOMC can react solely on “inflation”, which includes the opposite direction despite everyone’s assumption that they are now “hawkish.” The point about getting rid of “forward guidance” and the linkage to the unemployment rate is both credibility and flexibility – how can they become “dovish” again if the unemployment rate meets the criteria for “tightening?” In other words, I think they know full well that the unemployment rate is skewed and its continued reduction via the denominator places the Fed in a very precarious position.

That position is exactly where the ECB is right now, desperately troubled about “deflation” and worsening growth (they don’t have the “luxury” to worry about bubbles at the moment). The FOMC members remember well 2012 and the very real fears about linkages to Europe; which means if there grows more darkening trends now in the US they cannot be handcuffed by the mis-measured unemployment rate. Again, focusing solely on inflation means exactly what Riksbank did yesterday “for Sweden” – “loosening” its monetary policy stance still further while the economy is not showing any kinds of actual distress other than “too low” inflation (which they mistakenly see, as Paul Krugman and Keynesians do, as a huge problem).

If we get to that point in the US, and credit markets suggest that is a very real and growing possibility, then the Fed can simply say they want to reduce slack further and boost “inflation” by some means they have not yet whispered about, or at least anything I have seen. From what I can tell I doubt that means more QE, but since I can’t figure what else they might do you can’t rule it out no matter how rotten it has become even to the monetary establishment. However, I do think there is the possibility that a more “loose” position might include, as with other central banks, the introduction of some kind of “targeted” monetarism. That would solve, to their collective minds at least, a couple of problems simultaneously – it would, in orthodox expectations if not in reality, help guard against “too low” “inflation” while not exacerbating the bubble problem of secular stagnation.

So where the convention so far is that the FOMC has turned more “hawkish” I don’t think that at all; instead this is just more cover for the ongoing shift in monetary operations, a trend that is global though not at all appreciated.

Stay In Touch