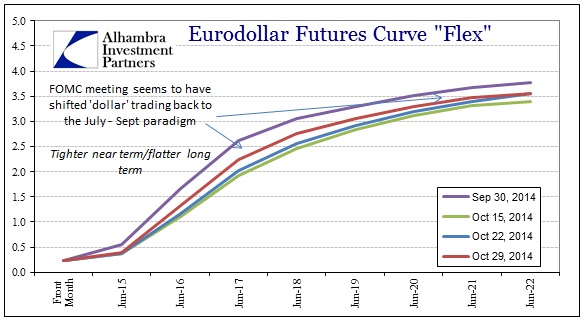

It began more than a week before the FOMC meeting, as eurodollars again anticipated what the mood would be surrounding whatever the FOMC might say. “Dollar” conditions had run down significantly where the entire curve shifted lower (looser) for the first two weeks of October as doubts grew about the economy in the US and pretty much everywhere else. Right around October 14 or 15, the eurodollar curve shifted back up into the same conditions as had dominated trading in that July-September “tightening” period: tighter in the shorter months, flatter thereafter.

Downstream impacts are about what we have come to expect, roiling any kind of “market” that is attached to the global dollar short. The proxy I have been using, the Brazilian real, has seen both domestic issues (especially the election) and the dollar problem combine to push the real to another new low in devaluation.

Also downstream, I think this accounts for a good deal as to why gold has been pummeled in the past week (especially the past few days since the actual FOMC minutes were released). As with the eurodollar curve, the “tightening” bias picked up scale more recently.

The last time gold was near $1,350 was July 10, just as the “dollar” began to “rise” (tighten). If the “dollar” market has again found itself in the vise of FOMC machinations and interjections, then that likely won’t mean much good for either gold or anyone else attached to the gold standard’s bastardized and financialized replacement. That would seem to suggest the October “calm” is over and the renewed “tightening” (and flattening) will be the focus once more, destabilizing markets all over the world (except maybe developed world stocks that are somehow captured by stimulus that doesn’t stimulate).

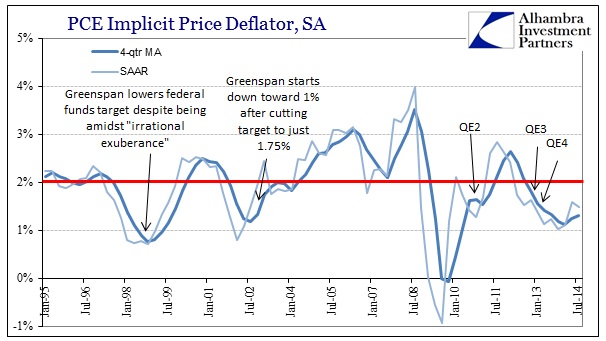

I wonder if it might be too late to undo the damage, or to intervene before it goes too far. In the end, it may not make a difference to the “dollar” bias but I still think there is a good chance that the FOMC is not at all “hawkish” and is instead seeking nothing more than to remove Bernanke’s shackles. Along with GDP yesterday, the Fed’s preferred inflation measure, the PCE deflator, ticked lower from Q2 (1.6% down to 1.5%). The 4-quarter average is still just 1.3%, which, as you might guess from all the distress over “low inflation” in Europe and elsewhere, is a huge problem for orthodox central bankers (though, curiously, not for anyone in the real economy).

Historically, the Fed doesn’t sit still whilst its favorite measure of inflation remains “stuck” below its target for extended periods; especially as those periods are typically correlated with recessions or far less than ideal economic conditions (and curiously not recoveries). Again, while I doubt anything the FOMC might do to “combat” this condition will have its intended effect, you do have to wonder if any damage being done by this “dollar” bias toward malformed “hawkishness” could actually be avoided.

Then again, it may not matter at all to the global dollar short anything less than another QE. I seriously doubt the FOMC is going to raise the interest rate (let alone can they without huge and massive disruption all over the financial plumbing), though ZIRP isn’t likely to be enough to “satisfy” trading positions as they are transitioning now. I think that shows just how gripped the FOMC is by the trap they have sprung upon themselves, as they cannot just simply come out, as the ECB, BoJ and even Riksbank have all done this week, and say they are dissatisfied with the inflation level. They have to play this misdirection game which causes real damage; monetary policy is not neutral.

I doubt there is much sympathy in Washington and NYC for gold, which they hate openly (Greenspan’s recent return to its “favor” in trying to reshape his legacy notwithstanding), but they will not long be able to ignore Brazil or China if it gets that far (and Hong Kong regains honesty toward imports once more). There are more fireworks ahead, and more chess pieces to be moved.

Stay In Touch