The latest volatility in housing construction figures transferred to the single-family segment, as apartment construction has now entered full-scale languishing. In some respects that is contradictory to 2014’s view of a boom in rental properties, but I wonder if the lack of household formation is finally starting to catch up – rent or not. There is already an immense shadow supply of homes that only partially (and artificially) re-entered the “market” as institutions bought distressed homes in bulk especially in 2012 and early-to-mid 2013.

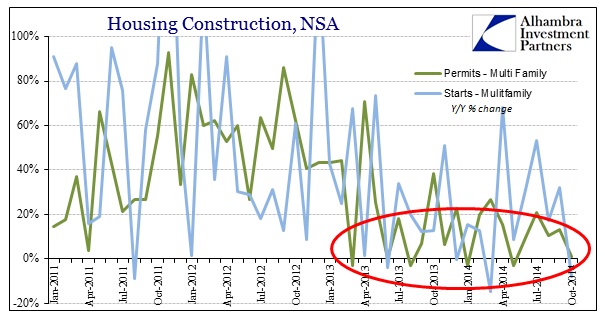

It was right around then that household formation ground to an absolute halt, with that reality clashing sharply with the “narrative” about the recovery. Of course that was followed almost immediately by the taper drama and the collapse in mortgages (mostly refi, but a good deal of disruption in the already-low level of purchase mortgages). But in the multi-family segment in particular, the trend since 2013 seems to be confirming a growing pessimism about this assumed rental “boom.”

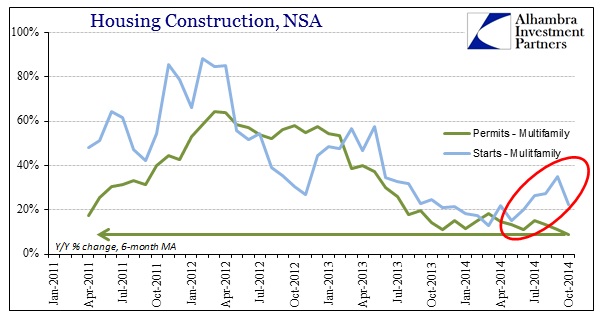

As always, it is rather difficult to see clearly given the inherent month-to-month volatility, but October’s estimates (assuming to further massive revisions, which, given so many other indications, is not a safe supposition) place apartment construction on a clear downswing. That shows up well in the averages:

The rate of growth for new permits in apartment construction is now the lowest since the housing bust itself. It is not unusual to see starts diverge from permits, as was clearly the case in 2011, but permits establish the baseline to which I expect starts to eventually follow (lower).

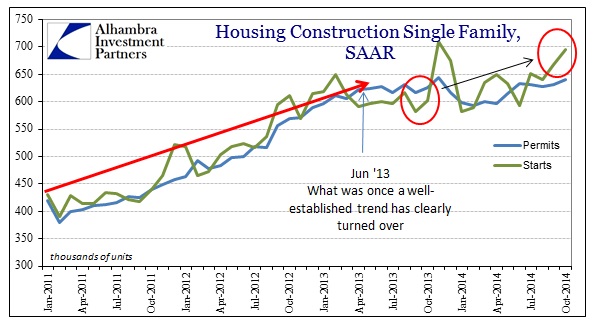

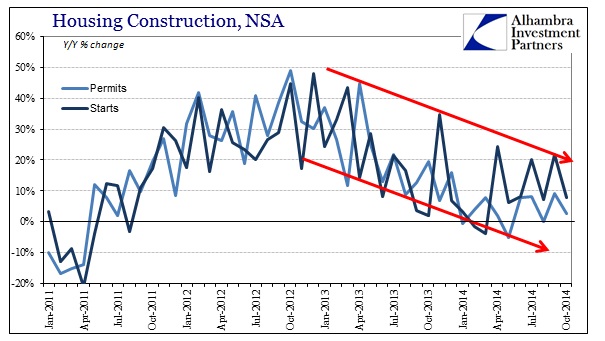

That observation can be transferred to the single family segment as well. There has been a clear divergence between permits and starts, though with the “upswing” in starts that has undoubtedly some trace back to base effects with the downswing in October 2013 (with the government shutdown that affected all manner of these accounts).

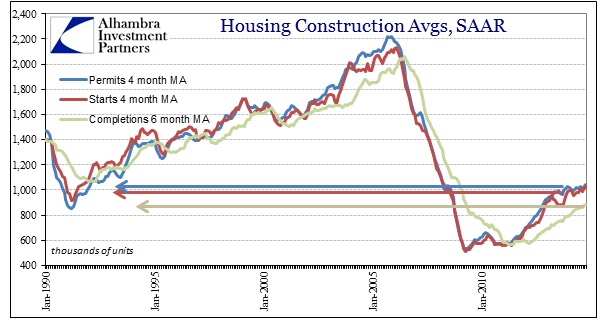

The level of permits continues to flatline in a rather constraining range between 600k and 650k SAAR. As you can plainly see above, ebbs and flows in starts (like the spike in starts in late 2013) largely follow the baseline of permits over time, so there isn’t much to make of the activity in starts on its own apart from, again, typical data noise.

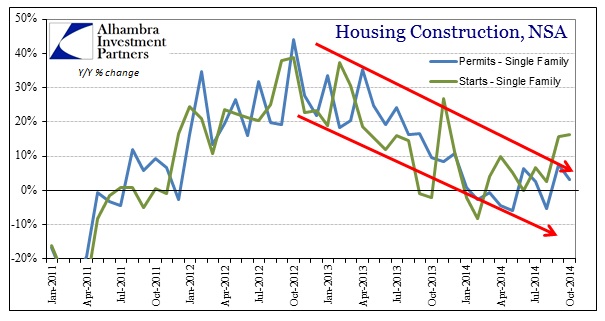

The trends in permits is as it has been for some time as the 2011-13 mini-bubble fades further into history.

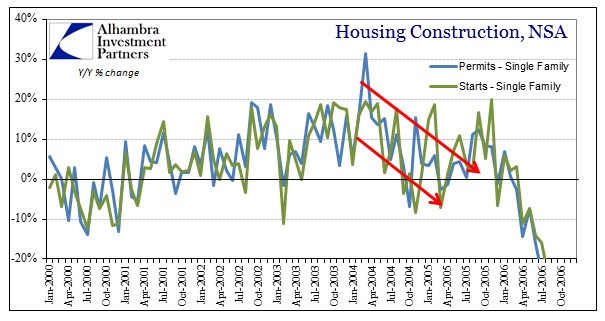

Since the middle of this year, permit activity has flatlined to somewhat negative. While that may suggest a steady period of low and uninspiring growth, the last time there was a similar pattern was the end of the last bubble in 2006 where growth rates suddenly declined, leading to a flattish period the belied growing imbalance and turmoil.

Bubbles themselves are all about momentum, but loss of momentum does not necessarily lead to immediate decline and collapse. Typically there is an extended period of re-assessment as “market” agents are hard-pressed to let go of the bubble paradigm (everyone wants to believe that it is only a pause and that the bubble will go on and on). I don’t necessarily believe that construction right now in single family homes are situated so precariously, but there are signs of imbalance and reticence to recognize it.

Where that goes cannot be determined, but clearly authorities are clearly concerned with this slowing momentum (which is, again, why the GSE’s are seeking quick action on reducing their own financial putback standards for mortgages that flow through them – which is almost all new mortgage finance).

In terms of economic context, housing ceased to be even a minor “tailwind” a few quarters back at that early 2013 inflection. In historical context that leaves home construction still far short of even the worst levels of prior recession and decades past. In other words, without another huge boost to housing there isn’t going to be any boost to the economy anytime soon. Rather, the likely trend is now toward the downside, as real estate activity could very easily become a significant drag once more if the elongated business cycle heads further toward the next stage of slowdown.

Stay In Touch