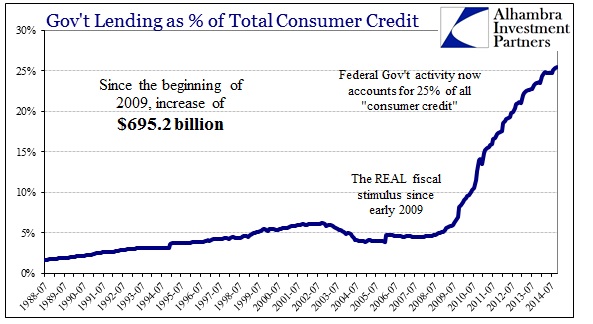

If you don’t have much by way of income growth, then there are other less desirable options for spending sources. There are “entitlements” or transfers and then there is debt. In the current age, the federal government has been responsible for originating and disbursing the vast majority of consumer credit in the form of student loans, in what is really a debilitating trend where college students are existing on that credit that their eventual employment (hopefully) will struggle to even service. This is, of course, another form of arbitrary redistribution guised as “stimulus.”

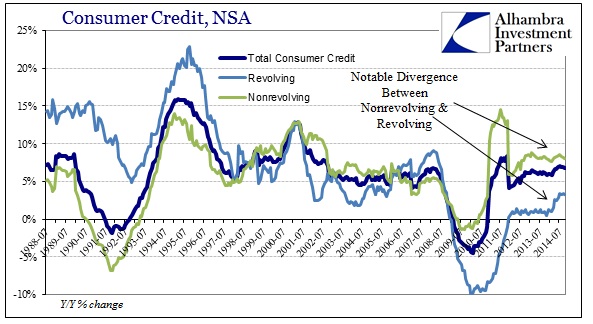

However, earlier in 2014 there was noticeable and rather sudden increase in the use revolving credit which is where consumer discretion supposedly lies. That was taken as the re-awakening of consumer confidence bearing out in a form of risk acceptance.

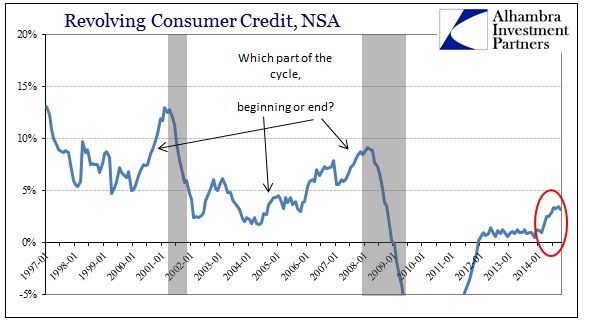

The noticeable increase beginning in February 2014 thus had economists and all the mainstream aflutter about the recovery (this was while Q1 was still thought to be consistent with that). To my own analysis, the small increase was rather nothing to get much excited about nor, more importantly, was its sudden appearance. You have to ask yourself why would people suddenly appeal to credit cards in the winter of 2014 when they had so conspicuously avoided them in the two years prior despite any and all economic changes?

There are enough clues in that framing to more than suggest this uptick in credit cards was not discretionary as is mostly believed. When there is nothing left to maintain even minimal spending levels, credit card debt can and will be a last resort. That would certainly make sense with regard to the economic conditions that were taking place at that time; nothing like an anomaly but rather a very real and biting deficiency.

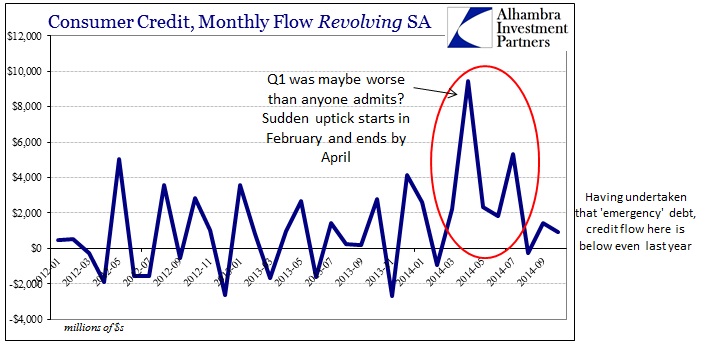

Viewing this in terms of monthly “flow”, even if it is seasonally adjusted, shows pretty much that pattern. There was peak usage during the winter, exhausted by spring and now with bills piling up the rate of accumulation is back down once more right around the time economists are expecting a holiday spending surge. In other words, once again, this is not the behavior of confident consumers and households but rather people already at the margins stretched already too thin only making due and running out of good options. The “best jobs market in decades” was supposed to cure this problem, but we find that again more mythical than anything else.

Stay In Touch