None of the following is unexpected given the “unexpected” nature of retail sales contradicting everything that was expected. Consumers are not acting like they “should” as the unemployment rate describes its version of the economy. From Bloomberg:

Purchases unexpectedly dropped 0.6 percent, a third consecutive decline, Commerce Department figures showed Thursday in Washington. The median forecast of 86 economists surveyed by Bloomberg called for a 0.3 percent gain. The decrease was broad-based, with 9 of 13 major categories retreating.

For the third consecutive year, winter will be blamed for the lack of actual recovery.

Frigid temperatures and snow probably contributed to slumping demand at auto dealers, building-material merchants and department stores, opening the possibility for a rebound this month. Still, sluggish wage increases may also be playing a role by prompting Americans to use the windfall from cheaper gasoline to build up savings or pay down debt.

“It looks like a big weather effect here,” said Carl Riccadonna, Bloomberg Intelligence chief U.S. economist, noting the declines in weather-sensitive categories including apparel, restaurants, building materials and vehicles. “A lot of February data is going to look muddy. This is just a blip. The consumer is just fine.”

Growth in retail sales, no matter which subcategory you include or exclude, was on the same level as October 2008 when the world was in a state of panic. It might be time to acknowledge that there is more than a little consumer “blip.” That would at least start with the idea of “the windfall from cheaper gasoline” which, to all evidence so far, just doesn’t exist. Once again, it appears as if the collapse in oil prices is indicative of an overarching trend that doesn’t spell anything good about the economy; oil prices don’t trade in a vacuum, which consumers are acknowledging rather severely.

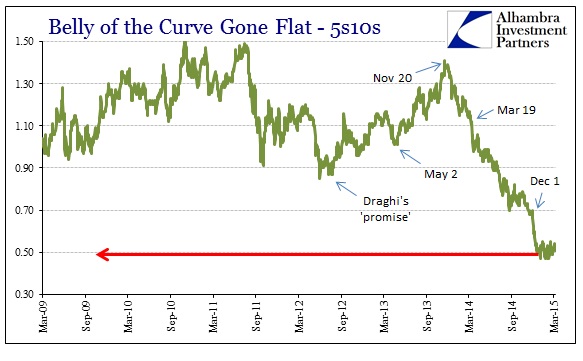

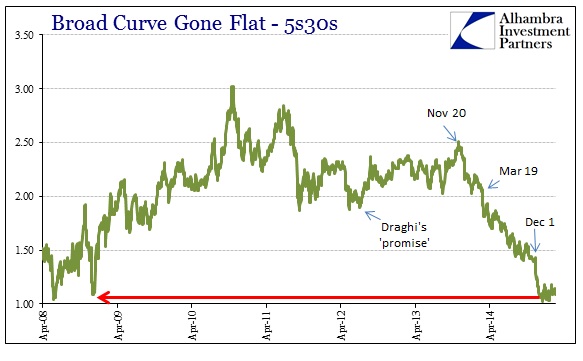

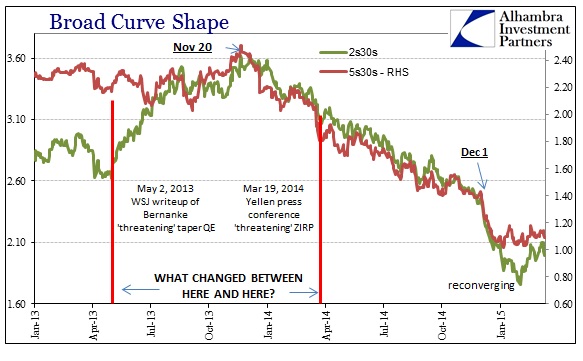

That is also what credit markets have been saying since November 2013. That included two major liquidity events that, because they didn’t turn out to be wholly disastrous, are completely ignored in favor of snowfall. Since the second ended in mid-January, credit markets have staged a “pause” or retracement to varying degrees. This week seems to have seen, to this point so far, an end to that “pause” and re-attainment of more worrying notification. Retail sales of a non-winter, more wholesome context would certainly help to further anchor this rediscovered bearishness.

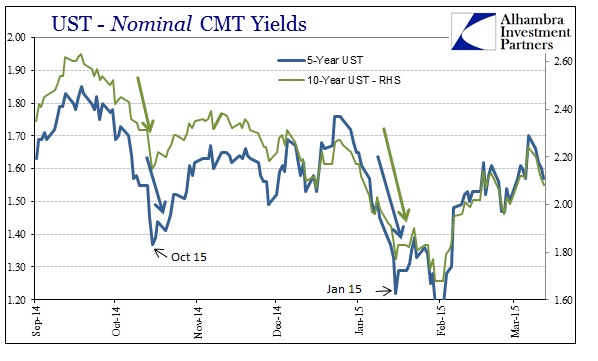

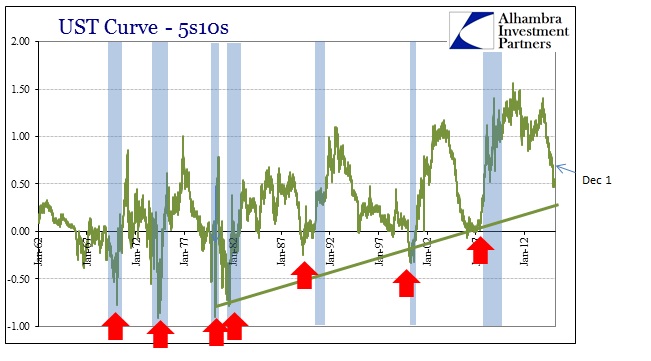

UST’s that sold off so badly on Friday are increasingly placing suspicion, as I put it Monday, on systemic illiquidity amplifying any move but especially last week’s massive corporate issuance. It is increasingly looking as if that dealer distraction simply meant an inability to curb even a modest pickup in marginal UST selling since their resources were highly committed to price stability around those corporates. Since peaking at 2.24% Friday, the 10-year is already back to 2.07% as of this morning. And, as has been the case throughout this “pause”, the yield curve itself remains almost totally unaltered in its high degrees of flattened trading.

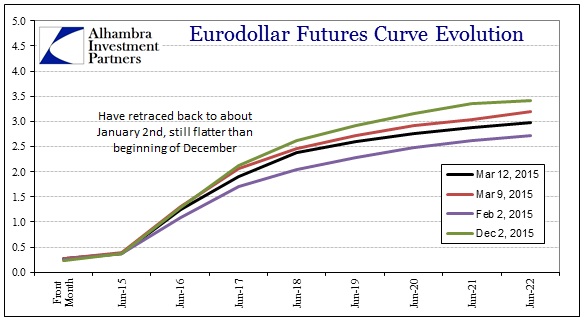

Despite the UST curve remaining curiously stable in that regard, the eurodollar futures curve seems to have ended its retracement. In the past few days, the curve has flattened noticeably away from the December curve and back toward the presentation of the last illiquidity event in January.

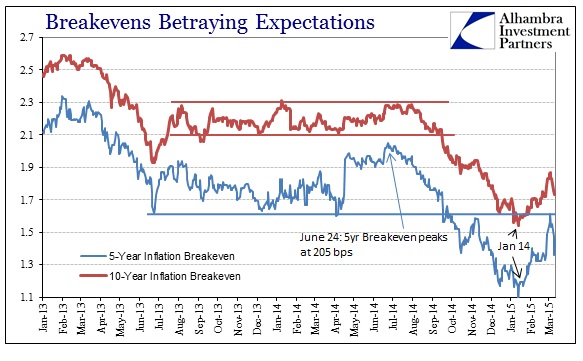

In addition, it should also be noted that inflation breakevens, especially the 5-year, have been highly volatile in this period. Rising rather quickly off the mid-January lows, only to have seriously declined recently – the 5-year breakeven had moved down 25 bps in just a week.

As I said a few days ago, the “dollar” continues to signal “tightening” which amounts to expectations of greater volatility, including that derived from economic conditions. Retail sales and all the rest outside of the Establishment Survey are contributing to that view. In that sense, the history of the flattening yield curve remains perhaps the guiding hand in interpretation here, as the reality in credit markets (post-interest rate targeting, which has certainly pushed up the yield curve “steepness” if only artificially over the decades) would ignore the perpetual winter analysis.

Stay In Touch