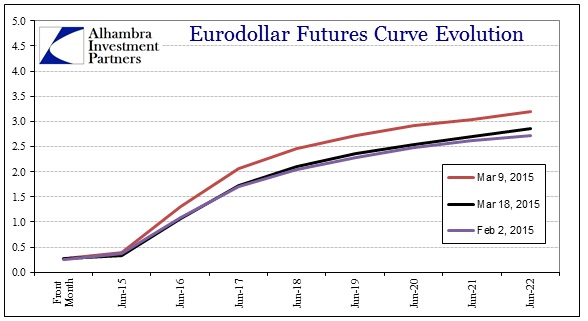

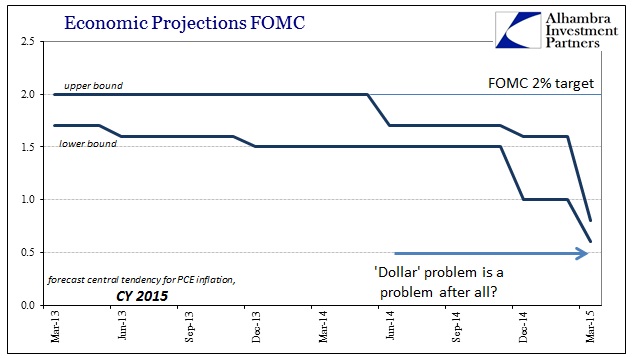

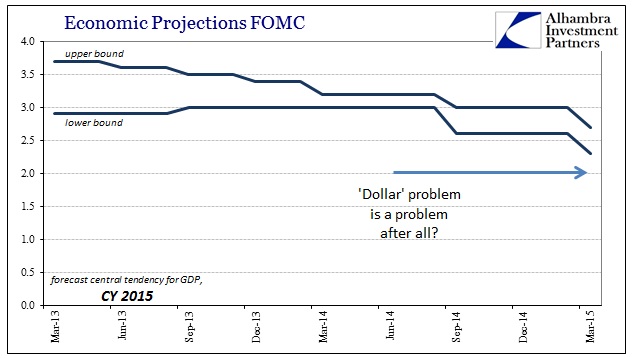

So far the heavy buying after yesterday’s FOMC admission has held on the eurodollar curve. Most of the contracts along the curve have only given back a few bps after the 15-25 bps moves everywhere yesterday afternoon. The salient interpretation of trading along these lines is one of deep and abiding concerns over “dollar” liquidity and the economy. With the eurodollar curve back closer to the bottom of the last event, it would be fair to say that economic strength, as policymakers are attempting to call it, is totally absent from trading.

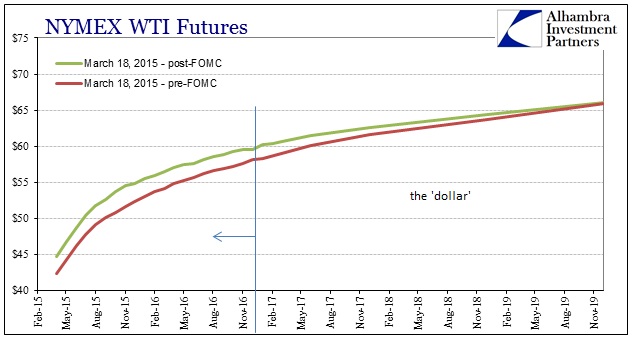

That creates a very interesting contrast to the behavior in crude oil prices. The WTI curve had been pummeled the past week or so as the “rising dollar” prominently returned to alter the prior bounce back in the $50’s. However, the FOMC’s announcement instead of furthering such pessimism immediately reversed it!

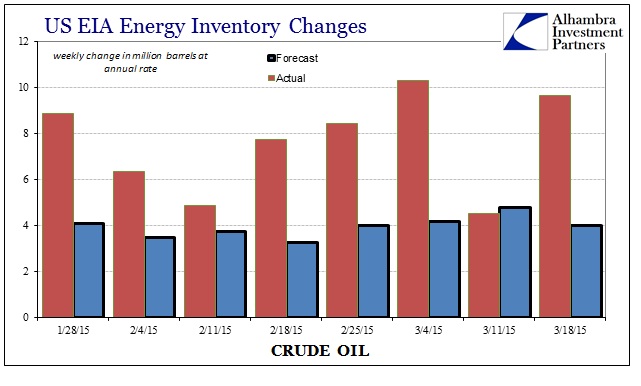

The April contract which had been down almost $2 on the day to a new low of just above $42 suddenly found a huge bid to pull up nearly to $45, bringing the entire curve out to 2018 with it. There was nothing of recent data to suggest anything like this sudden and sustained bid, as the latest figures on inventory and production again suggest continued difficulty clearing the still massive, fundamental imbalance.

That weekly inventory estimate, also released yesterday, saw a huge increase well-above expectations and thus continuing the depressive pattern of late. This was likely the reason oil prices were down so much in early trading to begin with.

That leaves only the “dollar” and its massive slide to produce such a large intraday swing in WTI and crude in general. The “dollar” sold off hard on the FOMC announcement as apparently speculators that see interest rate differentials as a primary factor looked upon the lower probability of the FOMC ending ZIRP with disfavor. Of course, neither interest rate reality in the US vs. abroad nor comparative economic outlooks (real and imagined) have much to do with the longer trend in the “dollar” but in the short run the speculative nature of any market can be altered by almost anything – especially when liquidity is less than robust.

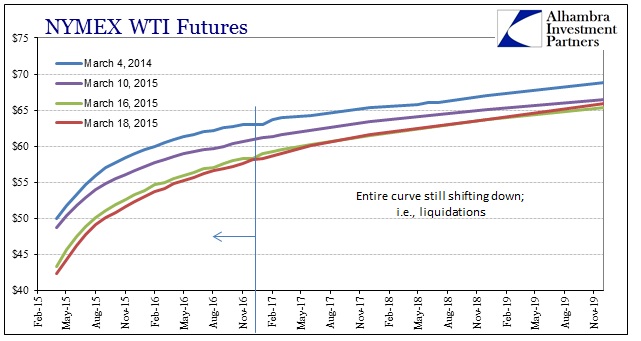

So it was interesting that oil traded with the short-term “dollar” move, and that has already “corrected” this morning back into the longer-term, fundamental trend of “tightening” globally.

In other words, apart from these short outbursts of mainstream convention, the “dollar” is and has been a very tight proxy for “demand.” The trade of oil in tandem, even in the short run, only strengthens that relationship as forced liquidation of leveraged oil positions is only the method by which lower demand expectations become price effective. From that view, yesterday aside, the past two weeks or so have seen another increase in effective “demand” concerns which impact not just oil.

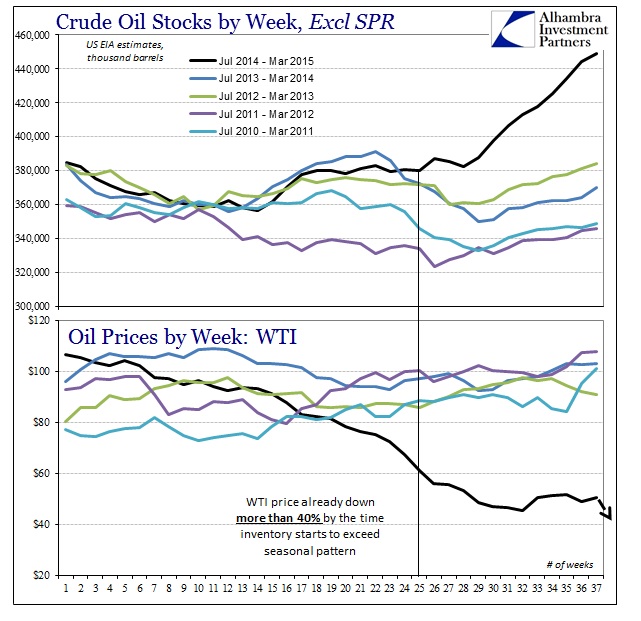

That is the only way in which to read this oil price collapse from its very inception, especially as it dates right to the point at which the “dollar” first turned in late June/early July. As far as oil stocks in the US, there was absolutely nothing to suggest at that moment there was, or was going to be, a great and sustained imbalance.

It wouldn’t be until the week of December 12 that domestic non-SPR crude stocks started to outpace the seasonal trends of the past two years. Yet, by that time oil prices had already fallen by 40%! That would strongly suggest oil trading via the “dollar” trend which was anticipating not supply but the falloff in demand that has absolutely occurred; to which the FOMC is only now, belatedly, starting to admit.

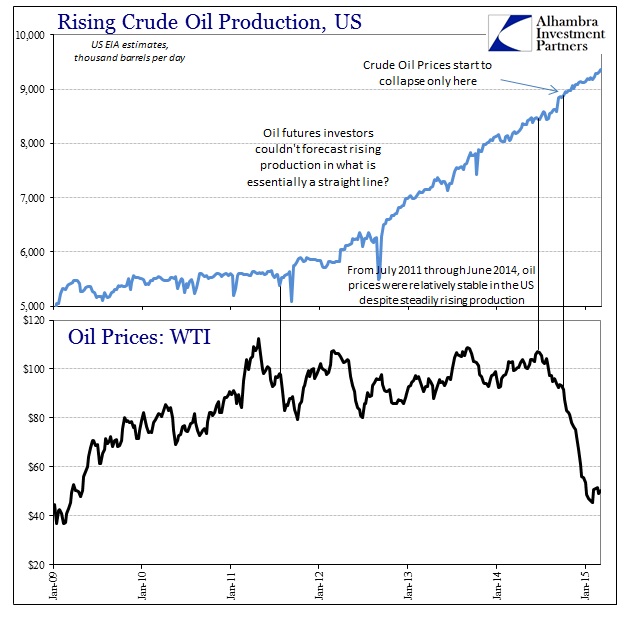

As to oil supply, there remains nothing unpredictable about the trajectory as it has been both well-established and very well-defined for just about four years now.

The entire time economists and mainstream observers were so sure about that 4% and 5% GDP (as Q2 and Q3 estimates were released in these months) the “dollar” and oil prices ignored all of that and began to anticipate a dramatic economic change untold by those extrapolations. Only now, after the “dollar” and oil prices went over the cliff are those same economists starting to soften their stance on just how great “demand” may be, and may be becoming.

In March 2007, Ben Bernanke did much the same as he told a Congressional Joint Committee that, “at this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.” On January 8, 2008, in a speech delivered in Washington with the Great Recession already begun, he said, “The Federal Reserve is not currently forecasting a recession.” Even with that forecast he promised to be aggressive in slashing interest rates and the stock market responded by jumping 117.78 points on the DJIA despite terrible conditions in, what else, “dollar” liquidity. On June 10, 2008, Bernanke reiterated the growing belief that they had seen the worst and that the FOMC had done enough, telling a bankers conference in Chatham, MA, that, “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.”

Following FOMC advice on finance and the economy has been dangerous as they take you right over the cliff. You can make the argument that “not fighting the Fed” in the past five and a half years has been the “right” decision, making any amount of “easy money” you desire; but so what? What good is it, on paper, to have rising portfolio values if you don’t get to keep it? If this is another asset bubble, it collapses as expected and you don’t get out the Fed will not have “made money” for you they will have cost you, for the third time, a huge chunk of time – and that is vastly more important to investing.

I remarked about this problem back in September just as “everything” was kicking into gear, entitled “Being Wrong.”

Investments are about two facets, as Doug Terry is fond of reminding: returns which are all very apparent right now, and risk. Risk is defined as keeping those positive returns for more than just numbers on a long ago discarded custodial statement. You can generate all the positive return you want on the upside, but you better have a solid handle on risk of a downside that buries the returns wherever and whenever it may show up. An economy that never lives up to the hype set against rapidly rising prices is simply a highly increased probability of that.

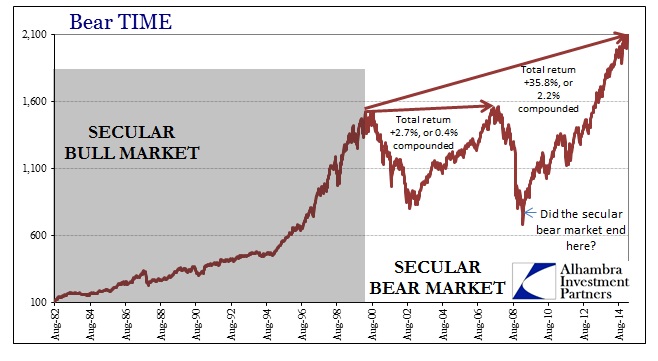

In other words, looking at the oil and “dollar” cliffs and assessing that in the context of stock prices is not just an academic exercise in econometric modeling toward redefining equations and correlations. The S&P 500 would only have to decline to about 1500 to erase all gains this century (not counting dividends, but also not counting inflation). The problem of bubbles is not just the huge drawdowns, but the amount of time wasted over the complete cycle that gets you exactly nowhere for all your trouble (usually worse than nowhere).

My point in “being wrong” was that looking at the economy realistically (through oil and “dollars” but also broader contexts on economic accounts) meant separating a true and secular bull market from the third in the serial bubble manifestations of monetarism running out of options. Can anyone really afford 15 years of going nowhere; or much worse?

Stay In Touch