Coincident to the “final” release of quarterly GDP are the updated estimates for corporate profits. While the Q4 headline didn’t much alter from the preliminary version sent out a month ago, there was much in the profit section relevant to both economic cycle and structure. The BEA provides several different breakouts of business profits, but the main emphasis should remain on current production as it relates to linking actual economic activity with the business of capitalistic sustainability.

To that end, there is always going to be a discrepancy between some measure of profits and that of cash flow. But what you find in the figures here is well beyond what I think would pass for reasonable expectations in that regard.

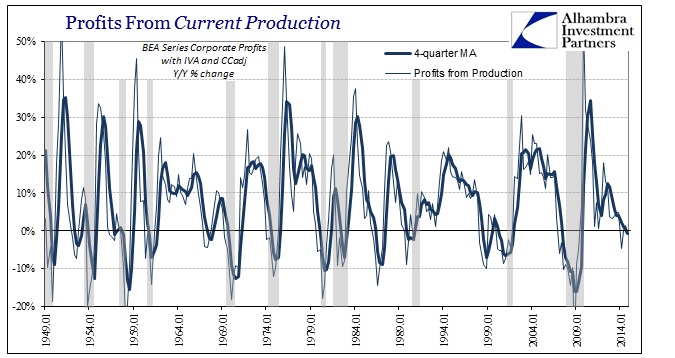

First of all, profit from current production (defined by the BEA series Profits with IVA and CCadj) is looking cyclically worn. The 4-quarter moving average of year-over-year gains is now negative for the first time since 2009. For the year 2014, the four quarterly gains were -4.8%, +0.1%, +1.4% and -0.2%, in that order. That hardly looks anything like the 4% and 5% GDP advances that were used as “proof” of the Yellen version of economic relativity. In fact, that weak profit growth would, by contrast, be very consistent with at least instability if not worse. That should only raise further alarm as we know without much doubt that profits are going to be contracting more severely in Q1 2015 if only on energy alone.

Financials have been a serious lag of late, which is not at all surprising or unexpected given the shape of domestic and international finance since the middle of 2013. But profitability is at least not being offset by strength in other sectors if the economy apart from these is actually performing as is proclaimed. If 2014 was a breakout year for the economy, it isn’t at all apparent anywhere here – instead not just more of the same but continued slide via attrition.

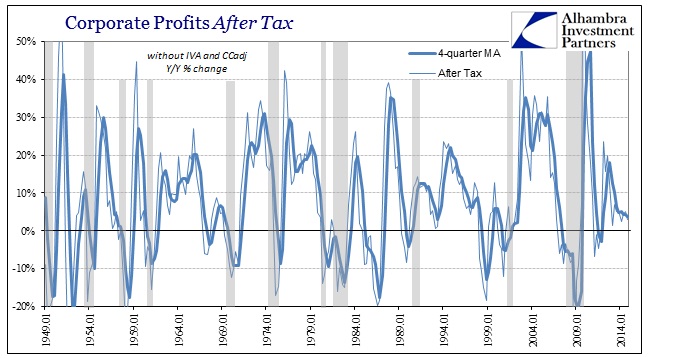

Corporate profits after tax without the IVA and CCadj are not much better, if not yet negative. What matters are the direction and the absolute low level of profitability undisturbed by these purported economic gains. These low profit gains are almost universally association with recession, quite distant from any other period that could fairly be called a “boom.” The only non-recession exceptions were the Asian flu (which I maintain was a part of the elongated cycle), and the near-recessions in 1986 and 1967.

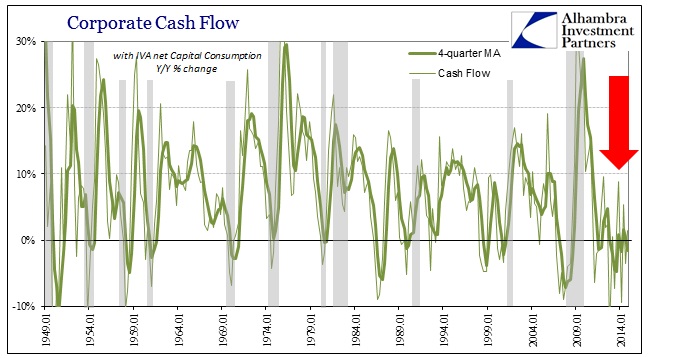

Cyclicality concerns noted, the most important piece here might be cash flow estimates. The BEA calculates a measure of cash flow derived from “undistributed corporate profits with IVA”, includes the capital consumption adjustment and then adds back “consumption of fixed capital less capital transfers paid (net).” Needless to say it is somewhat convoluted, but given the constraints of working backward from GDP accounting that is understandable. In that regard, the cash flow estimate actually makes sense (for once) and probably provides as solid a picture as one might hope (realizing the limitations).

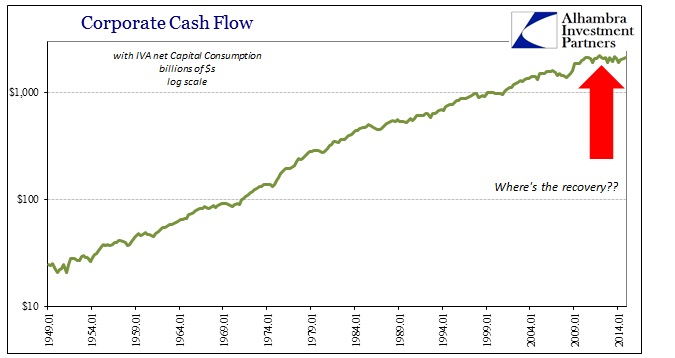

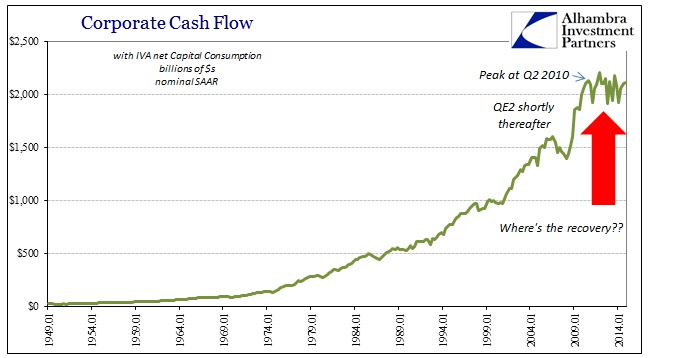

In terms of this view on corporate cash flows, the recovery itself is almost entirely absent – cycles or not. In fact, viewing this nominally the operations of corporate America seemingly find a curious stagnation that has lasted now for years.

On the log scale chart above, there is a clear and steady advance in corporate cash flows throughout the entire history back to the late 1940’s interrupted only temporarily by recession. The much deeper Great Recession is prominent, but so is the initial snapback in cash – which is very much expected as that is entirely the point of the operational end of a recession. Companies are not laying off workers and cutting back on capex in academic exercises to please business models, they are trying to preserve and increase cash flow under heightening revenue constraints and declines. The largest quarterly gain in cash flow for the entire series (even adjusting for “inflation”) was Q1 2009, where the BEA estimates corporate cash flow jumped by $250 billion.

In other words, the millions of workers let go at the trough of the Great Recession were precisely the point to be enough for companies to begin the bottoming process and to restart the economy from a much more efficient place. The recovery process thus begun abruptly ended in Q2 2010!

That was the period of the flash crash and initial eruption of Greece and the euro. It was also a reopening of the “dollar” rift that had just torn apart the global economy only a year and a half prior. So where there is no shortage for coming up with a reason the cash flow indication might have suddenly ceased the recovery, it also makes very good sense with what actually transpired thereafter.

The following year was a continuation of uncertainty in finance once more, which led, of course, to the prominent and underappreciated 2012 global slowdown. If anyone might wonder why businesses have been so reluctant to hire and increase wages, this would be a compelling answer as cash flow stagnation is in no way conducive to a booming let alone growing economy. This is the very nature of economic attrition.

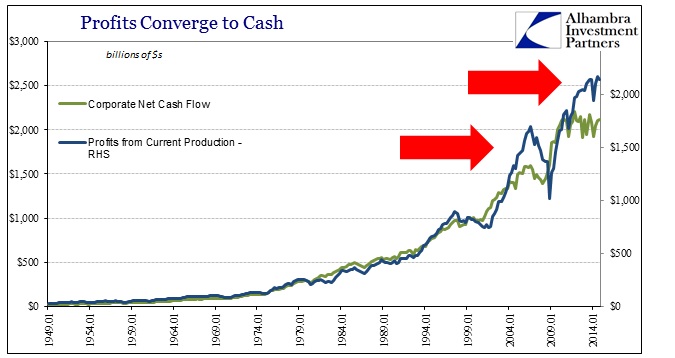

It is entirely confounding, then, that cash flow estimates and profits could diverge so drastically; yet there is no doubt that they have (acknowledging measurement limitations). Worse than that, this is actually the second time profits and cash flows parted so conspicuously. As you might guess, the first was the last big bubble period just prior to the Great Recession.

I haven’t yet studied these figures enough (which may not be possible given the more than hidden aspects of BEA data collection and data series construction) to offer an explanation for this divergence. Even without an explanation, the implications are quite direct. What are stock prices actually reflecting?

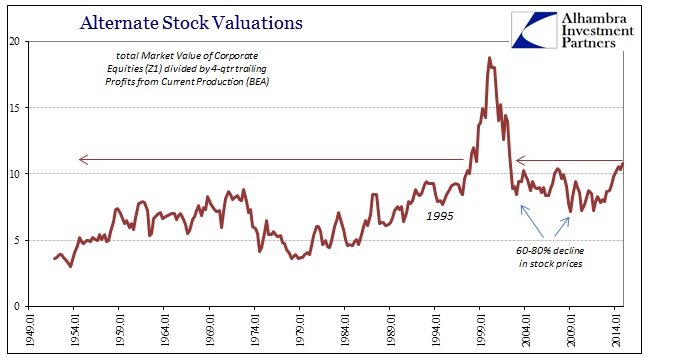

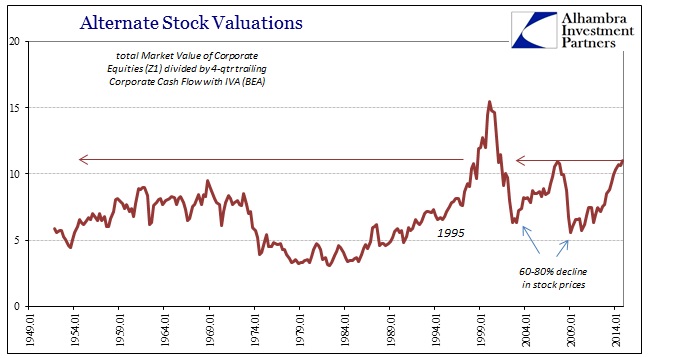

Even measuring the total value of corporate equities (from the Z1 Financial Accounts of the United States) to profits from current production shows pretty much the same huge overvaluation that you find in other measures of the stock bubble. That view is very much sharpened by converting the denominator from profits to cash flows.

Here, the bubbles protrude much more prominently as is their sharp and unsteady rise (in the context of how they ended up). This would explain much more why equity prices could collapse by about 60% (or more) twice in the last decade. And that says a lot about where prices might be going in the future should profits and cash flows again converge as they have in the past. It also speaks to how far economic adjustments might have to reach in order to, like the trough of the Great Recession, restore cash flow “balance.”

Bubbles themselves are already artificial by their very nature, but this all would suggest that even the primary rationale propping them up so far is also artificial even if we don’t fully understand why that may be. It could very well end up that the BEA is way off in its cash flow estimates, and that cash is being generated at a pace more like accounting profits. Observation of the decrepit state of this “recovery”, however, argues against that view quite convincingly – it is instead, in my opinion, a fitting view of an artificial economy.

We are left, yet again, with a potential confluence of scarcity in both the cyclical and structural. On the cyclical side, profits are clearly slowing and may be on the cusp of outright and significant contraction even more consistent with recession. That possibility is amplified by this unsolved divergence with cash flows. On a realistic basis, slowing profits and limited cash flow is the worst case; and if profits have indeed been maintained at an artificially conflicting level then it doesn’t take much imagination to figure out how that will get resolved.

Stay In Touch