The June 2003 FOMC meeting is one of those events that has only taken on increased relevance and significance with time. That gathering marked a major shift in monetary policy as it was, particularly with relation to the fomented housing bubble, as the FOMC was debating the zero lower bound. The discussion centered around the proposed monetary alignment that would take the federal funds target down, finally, to 1% and a historic low, which only brought out questions about what might happen beyond.

The entire discussion is worth reading through, though it amounts to 211 pages of mostly numbing inconsequence to and fro about orthodox concerns, platitudes and unearned sureties about their own pieties. From that point in time, with uncertainty about the “jobless recovery” and any lingering effects of the dot-com bust, policymakers were being forced (by those pieties) to actually come to grips with the ghost of the zero lower bound (ZLB). Though they did not think it likely at that point, or at any point in the future, there was Japan already there and the fact that they were about to vote favorably on 1% meant that several boundaries had already been crossed.

In one sense, there is the funny and weird occurrence that continually repeated whereby a member would suggest an investigation about what might happen at ZLB and beyond, Greenspan would concur, but it is clear that nothing was ever done so. Between June 2003 and June 2008 and certainly into the ZIRP and QE’s, the FOMC keeps asking the same questions without any apparent effort having been expended on anticipation. It’s as if they worried about what might happen down there, and then were too confident to admit the possibility, keeping instead their fingers crossed the US would never trace Japan that far.

One passage in particular comes from Alan Greenspan and says a lot about the conditions that dominate a decade after his speculation:

One is that I don’t think we know enough about how the private financial system works under these conditions. It’s really quite important to make a judgment as to whether, in fact, yield spreads off riskless instruments—which is what we have essentially been talking about—are independent of the level of the riskless rates themselves. The answer, I’m certain, is that they are not independent.

The “these conditions” above are ZLB considerations, and his initial qualification gives away the seriousness as well as tears apart the public mask of surety that typifies expressed statements of confidence in policy and economic framing. We know all-too-well that yield spreads and swap spreads aren’t as dependent (at all) as Greenspan was hoping then; in fact, on more than a few occasions the financial system has exhibited a tendency to be wholly independent of what monetary policy hoped to achieve.

While that says a lot about ultimate impotence and thus well-founded fears about the ZLB, the context of that Greenspan quote is evident even as far as March/April 2015. The discussion was with Federal Reserve Bank of Dallas President Robert McTeer who was mentioning what he thought was a contradiction of policy heading toward “ultra-low” levels and actual bank function:

I’ve been surprised to see the resistance among the bankers on my board to continuing reductions in interest rates. About the middle of 2002, we started getting resistance to further easing moves, primarily from our bankers. I was a little shocked at their inability, apparently, to lower their costs as fast as their income was going down.

To which Greenspan replied:

I think the answer is very simple. If you are an institution that is doing well within the parameters under which you’re used to functioning, you will fight any change without any notion as to whether that change is good or bad. That’s because there’s a very large uncertainty premium associated with the change.

That tendency to dismiss actual market considerations has marked monetary policy since before 2003, but takes on increasing importance in these areas that are not well-defined by historical experience. It is interesting, in the “proof” hindsight (as I will show below), that maybe what they thought of as “easing” might not be so under actual conditions of repression that far and hard. That is certainly a condition of the current operational framework, where narrow spreads and ultra-intrusive monetarism changes the fundamental character of finance, especially liquidity. While the specific manner of those changes might be difficult to anticipate (though I am not so sure) it at least should render considerations of repression far less straightforward.

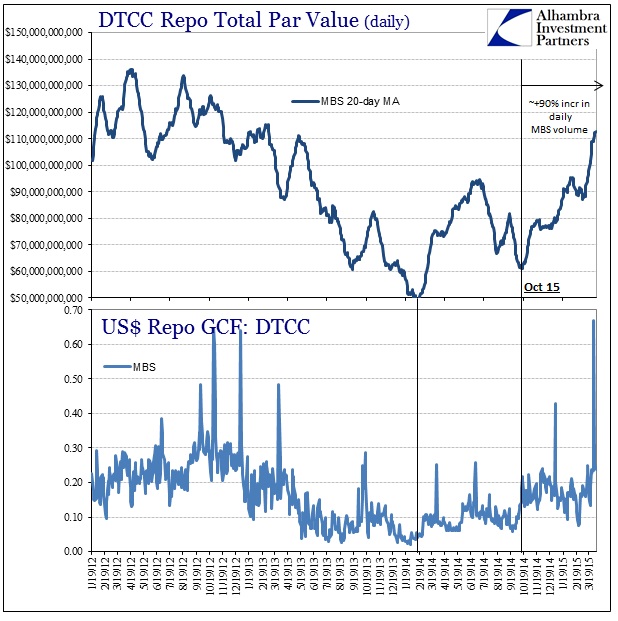

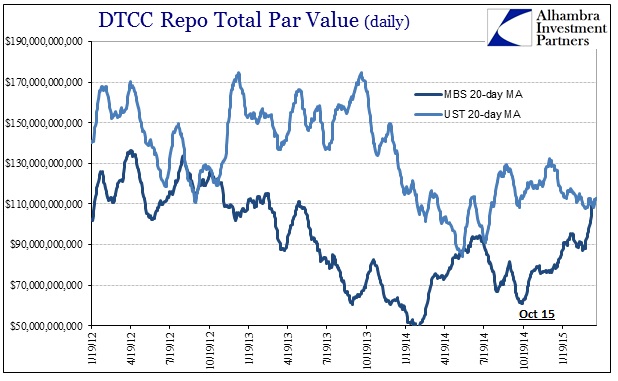

In this specific case, I am talking about repo capacity and the systemic ability to absorb large changes – which is all that liquidity is really about to begin with. Since October 15, that major domestic side of a liquidity event, repo volume in MBS has nearly doubled. That sounds like a positive outcome but since we are talking about what amounts to bedrock liquidity it isn’t at all clear if that is the correct categorization. It may very well be that such a rise in MBS, especially, marks not an increase in capacity but an almost last resort before detaching into a full-blown break.

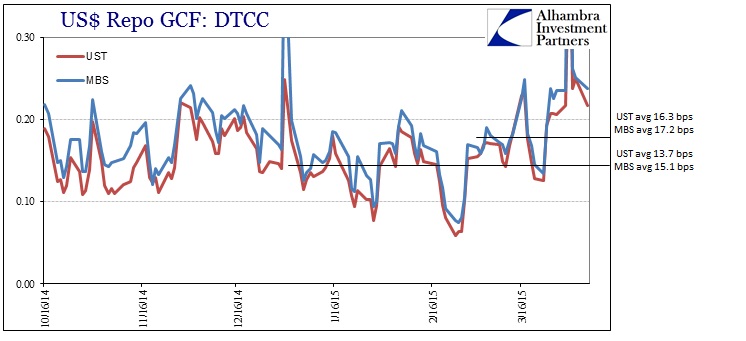

As repo volumes have climbed precipitously, GCF rates in repo have too – far and above anything since 2012. What is particularly noteworthy is that as repo volumes initially started upward around February 2014 (after the MBS issuance devastation of the massive rout the year before) repo rates increased only modestly, remaining very much consistent with GCF rates that dominated post-crash (from July 2013 forward). The dramatic rise post-October 15, however, has been met with a surge in repo rates that has not unwound.

What makes that unusual, insofar as anything might be called unusual under these parameters, is the UST GCF repo rate has been moving equal to MBS without the surge in volume. That would suggest that systemic capacity to forward “cash” into this aspect of the liquidity system is under strain regardless of marginal collateral (which is unsurprising). Given the nature of UST shortages, MBS might be the current path of least resistance or at least the manner/conduit through which any marginal liquidity absorption could take place. The point here is that the system may be taking that path but at a cost that isn’t fully known (or denoted beyond GCF rates).

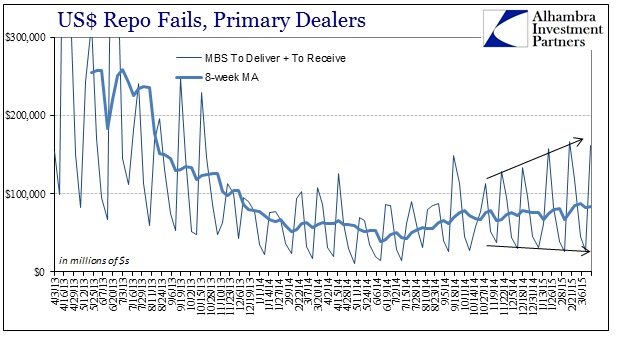

I think that point is further implied by MBS repo fails, which behave in a different manner than UST.

Ever since October, MBS fails have increased in deviation if not in average. That would suggest greater uncertainty, relative to the post-2013 crash existence, more recently about collateral regimes as volumes rise. In other words, it seems another element of strain if only by relative comparison.

That brings us back to Mr. McTeer’s resistance among bankers to lower interest rates. The repo market isn’t so different in actual operation among providers as other elements in finance, namely if a bank cannot take consistent profit from the endeavor they will cease to participate. One of the “unforeseen” problems at the ZLB and “below” via QE is how unprofitable being a liquidity provider has become – with one important exception in the case of QE’s. Warehousing MBS and UST when security prices are rising leads to “prop trading” profits (or FICC since prop trading is “banned”; FICC “revenue” has been decimated generally since Q3 2013) that are really incidental to liquidity-providing activities.

That seems to have been enough to maintain even minimal liquidity standards where dealers were certainly not making enough of minimal spreads on dealer activities alone. Ever since that MBS/credit selloff in 2013, these profit considerations have been altered; and with it dealer capacity and liquidity. Without any “guaranteed” boost via QE affecting fixed income prices, and that includes interest rate swaps, there is not enough profit to maintain sufficiency.

The implications of that are what we see now, where a rise in MBS repo comes at a cost in at least misbehaving GCF repo rates. As of today, GCF rates in MBS, UST and agency remain quite elevated compared to recent experience.

This is highly unusual in that quarter-end surges (to begin with, the latest was the largest, in MBS, since the panic) are always unwound the next day. For repo rates to remain as they are suggests some kind of altered behavior or existence, a fact that is, again, unanchored from Greenspan’s calculus that all rates are derived from the risk-free setting. While he was mostly focused on the longer side of any curves, further out in maturities and tenors, we should not ignore the shortest spaces especially as it is these ultra-short maturities that form the biggest and most asymmetric problems.

Bankers were telling the FOMC all the way back almost twelve years ago that there would be problems; and lo and behold there are, quite serious too. Greenspan dismissed those concerns as resistance to change, but hindsight shows clearly that resistance has been as much a monetary policy position as anything else.

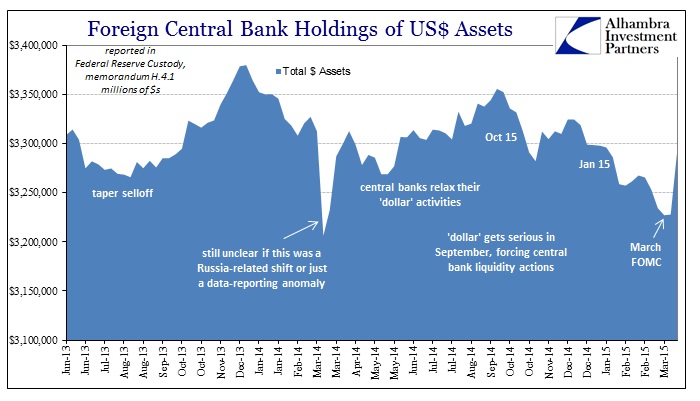

Some of this relates to the potential for an April 15 rerun, but it also has larger implications beyond just repo markets to the “global dollar” position overall. To that end, the Fed’s weekly H.4.1 showed the largest weekly increase in UST custody in the series (going back to 2007). There isn’t any way to determine what or why, but clearly something “interesting” occurred right at quarter end related (probably) to UST as collateral from a foreign source.

It looks very much like a collateral call though we have no idea “from where” and “to where.” Apart from March 2014’s unusual activity (noted on the chart above), the last time there was such a surge was the last week in October 2008 – closing out that quarter in progress of panic.

None of this is to suggest something similar afoot at the moment, only that the FOMC should have heeded their own advice and figured out or at least investigated structural shifts in the integrity of basic and vital financial systems. It is clear that liquidity function is very much “off” and that such a condition is “unthinkably” durable. As with so many other indications, the “rising dollar” is as much about weakness that persists, even if the direct manner of that shift is unclear or even confusing. In that sense, the post-crisis FOMC has been just as much about fingers crossed as that interim after June 2003 – they simply jumped into ZIRP and QE hoping that what was gained economically would be more than enough to offset all these “unknowns.” We are left at the edge of both, namely that not much (if anything) was gained economically but those “unknowns” are starting toward perpetual misdirect and misfire.

Stay In Touch