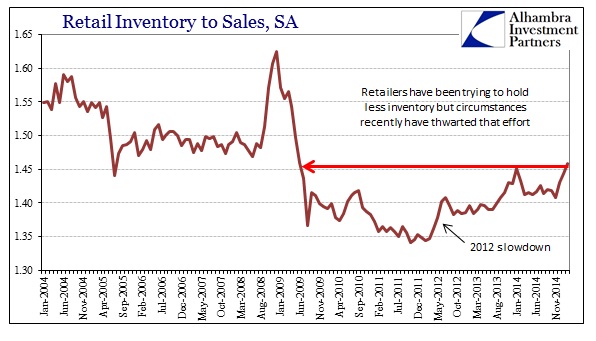

For the most part, retailers have been far more cautious about inventory than their wholesale counterparts. I don’t doubt that those two processes are actually related, with the inventory appetite swinging to wholesalers almost by default, but circumstances now dictate either a conscious break with that conduct or a convergence. With inventories already far too deep on the wholesale level, I don’t really see how it might swing back toward retailers.

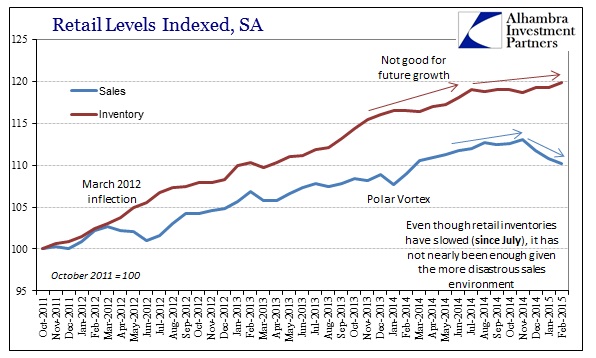

As it is, with retail sales dropping to some of the worst levels in the entire data series, retailers’ inventory strategy is already piqued. Just like wholesalers, the dramatic decline in sales has not (yet) been factored into inventory levels. Even if retailers were more likely (for whatever reason) to carry higher levels of inventory than earlier in the “cycle”, they are already there and not by choice (NOTE: inventory data only goes through February, not March).

There is clearly a slowing grade in inventory accumulation of retailers, marked right at July 2014. However, that is still an upward gain despite sales having dropped away. Given the size of this discrepancy, it would be reasonable to assume that any inventory adjustment will be far larger than anything we have seen since 2009 (and I wonder how much the GDP account of inventory will actually match that).

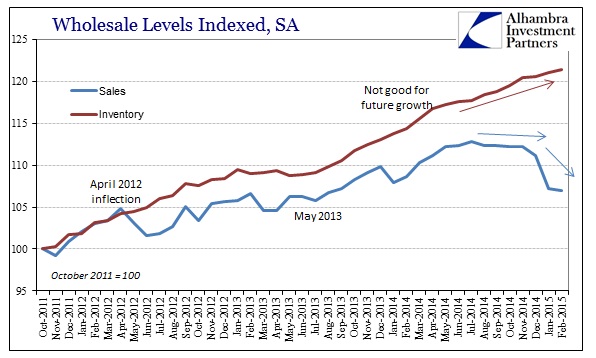

The ripples down the supply chain may have already begun, as wholesale results in sales are an almost direct reflection of dimming retailer enthusiasm for “stuff” (both including and excluding petroleum). In fact, the trajectory of wholesale sales and inventory is almost a perfect copy of the retailer version shown above.

It will take, at this point, a tremendous surge in sales activity from the top on down in order to restore more intended levels of inventory throughout the supply chain. That is a damning statement to make as this was supposed to be, right at this minute, just such a tremendous surge. With credit conditions increasingly cloudy in business terms, to say the least, it would seem all the ingredients are present for large-scale liquidations – the old school version of recession.

Stay In Touch