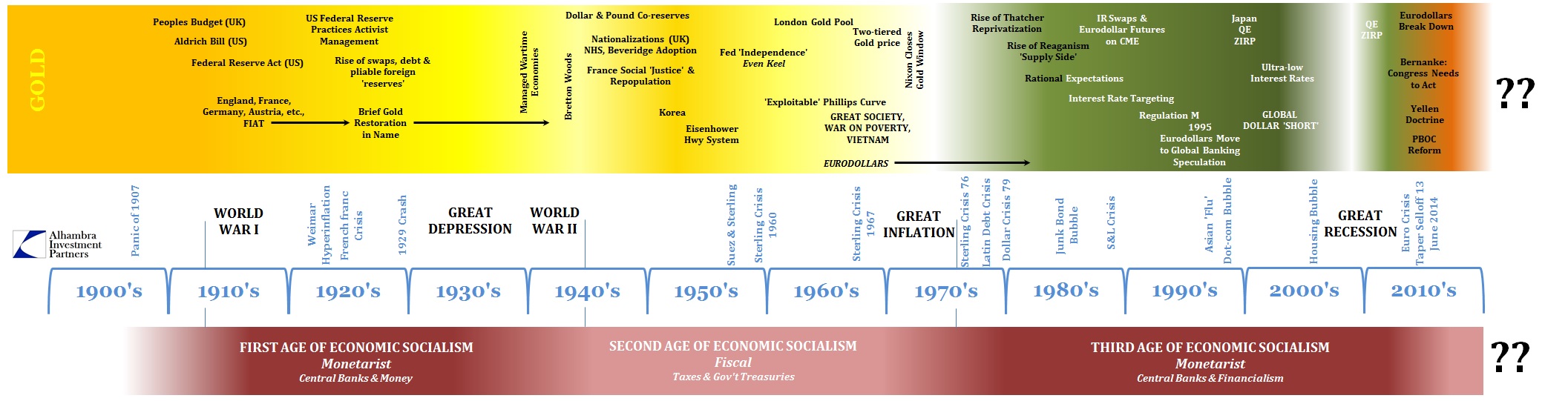

The early 1990’s saw the S&L’s fail on wholesale means but also to be displaced entirely by the GSE’s and securitizations of also wholesale monetarism. Indeed, when LTCM failed in 1998 rather than recognize the glaring limitations evident in the systemic pathology the Fed looked at it the way it wanted, preserving itself at the apex of political-economic planning and power, and stood by as the entire banking system instead transformed into wholesale hedge funds indistinct from LTCM. The FOMC and Greenspan as “maestro” even aided that transformation by the very means Janet Yellen described above – so long as it produced a stable GDP trajectory. Great and biblical financial imbalance was fine, even acceptable within the theoretical confines of post-modern “stability” because the very meaning has been redefined.

I have alluded to that before as the textbook definition of inflation. That was the entire goal of this transformation into monetary socialism from the start. The dollar as a true dollar is an impediment to central bank intentions because people have the very distinct option of going someplace else; if you didn’t like banking as it was, you withdrew currency or, in the true stable system, actual money. Deprived of money, the banking system withered into panic. Instead of taking that as “the people’s” judgment about monetary fairness, value really, central planners throughout the 20th century instead made war on “hoarding” which was really monetary freedom.

They have been wildly successful, and not just with TBTF in 2008. Anyone following Greece has by now heard about the ELA. That is a monetary tool by which banks can stay “liquid” even as they are deprived of basic deposit liabilities. In other words, Greeks are withdrawing cash from their banks (convertibility) but the banks instead of, as in the past, going out of business turn to the National Bank of Greece (really the ECB); one form of bank liability is substitutable for any other form. In this case, deposits which are still thought to be the basis for modern banking are revealed to have been so degraded as to be on par with a made-up central bank program.

That was the most significant aspect of banking in the 1990’s, as balance sheet liabilities became every bit as “money-like” as what deposits and even gold was in traditional formats. It was such a revolutionary upheaval that even the Fed and orthodox economists, proud of what they were doing at the time, missed it completely. They knew, of course, that they were in the process of upending financial forms but didn’t really care about how and where that was all leading because, as they saw it, it was leading in the direction they wanted. Now, it makes a huge difference because they have no idea and really do not know what they are doing as it no longer forms a seemingly stable platform for their central planning or socialist goals.

There can be no doubt that this is the third socialist economic age, as that was the entire point of monetarism going back to when the second age fell apart in the 1970’s; indeed, all the leading monetarists around the world have declared themselves in accordance with those views. The work of social “scientists” was to try to put that dream back together in a format that would at least be attainable; and that meant dismantling money and banking and redefining it all so that it would prevent actual markets and people from disrupting those goals. They achieved the upheaval but never really fathomed how and how far.

It is with religious zeal that these policymakers refuse to acknowledge the obvious; that in destroying the limitations of money, decentralized power to the people, they actually accomplished the opposite of what they had set out to do – the Great Recession and its “recovery” was instead shaved off peaks with an enormous and leveraged trough. At every point in at least the past seven years (if not all the way back in 2003, as Yellen’s “stubborn recovery” suggested then, and even 1998 in the LTCM affair incorporated properly within the larger and global Asian flu) monetarism and “fairness” doctrine has been totally refuted. But rather than admit the obvious, again ideology prevents open discussion, the social scientists remain committed to the first word at the direct expense of the second. What matters is not the overall health of the global economy, but that the global economy operates only in the manner they set for it; again, thinking somehow that controlled instability leads to grand and permanent utopia.

These monetarists would rather the world suffer under this brand of socialism than to accept a better economic result born from truly market function. The eurodollar system is their creation and they are stuck with it, so they remain wedded solely because admitting the mistake would mean displacing themselves from atop their priestly pedestal. What matters is the socialist ideal of “optimal outcomes”, and they will allow continued malaise and even depression rather than accept observation that declares forcefully they have been entirely wrong about it all this time. They will hold the world’s economy hostage to their 1960’s aspirations rather than give up the power that they never really had nor understood well enough to do what they set out to do.

In some ways there is more than a little positivity to take from that. If the FOMC wields only words, then when their words eventually hold little meaning the whole central bank axis will simply wither as a decaying weed blows apart easily in the smallest breeze. I greatly doubt that was the intention of their redefinition of money and all financial terms, but it may, in the end, become the practical result. If the Fed and all central banks do nothing but speak, then it is easy to simply ignore them and set expectations realistically. The problem, as with Greece and China and various other afflicted regions, is that waning power of words is not generic or uniform either. Distortions don’t just appear and then disappear; the process in either direction is quite lumpy and often violent (and this one, it appears, continuously so). That is why I have little doubt, and it has already begun, that fiscal agents will attempt to resurrect the second socialist age out of the ongoing wreckage of the third.

Trading one form of socialist expression for another does not alter the potential of the economy. Money must become money again, disenthralled from financial complexities and ephemera. You could make the favorable case that what has transpired more recently was impossible to foresee, though that is quite dubious on its face, but you can no longer assert the most obvious correlations don’t exist. By that I mean there is a clear relationship between the amount of financial intrusion and asset bubbles, as well as an inverse correlation between asset bubbles over time and economic potential and health – even stability.

There is no science that would deny the most obvious observations. Monetarism may have had more scientific roots, but those are long gone. Dedication is not to the discipline, nor is it to even the basic economic existence. This is purely socialism undertaken as if it were markets. But even that misdirection has been revealed by everything central banks have been doing. They counted on the eurodollar system to give them GDP through asset bubbles, but as that now fails the bubbles are no longer plausibly indirect – the central banks are the bubbles now.

Stay In Touch