Top News Headlines

- Hillary debates aging hippie Sanders and some other guy.

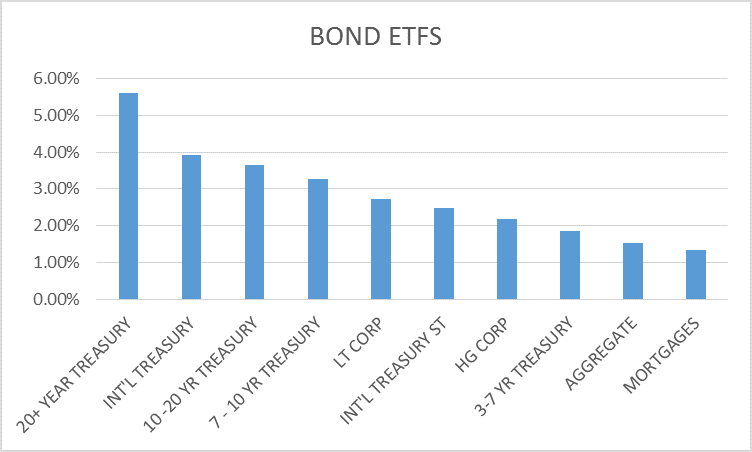

- Dell to buy EMC in biggest tech deal ever, assuming bond market is agreeable.

- Walmart earnings take a dive, stock follows.

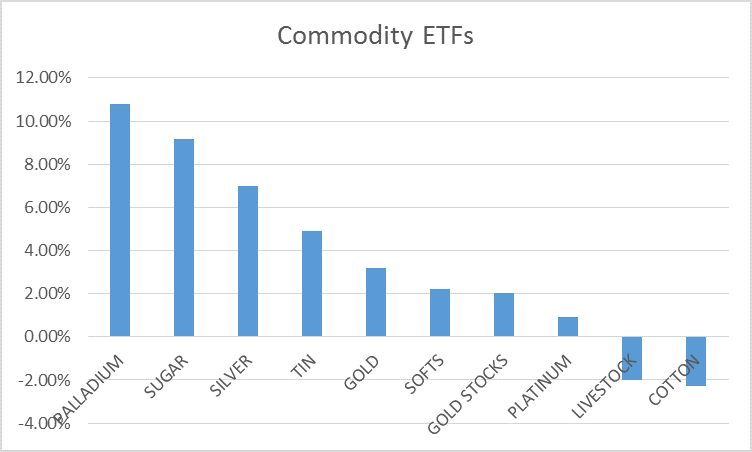

- Gold turns positive for the year.

Economic News

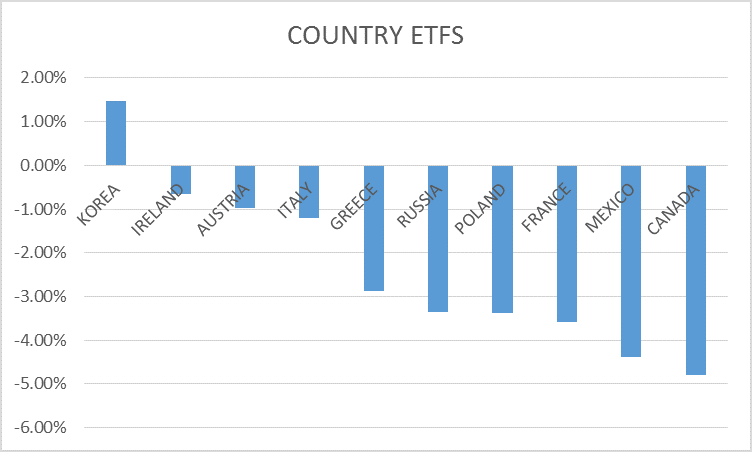

- China trade figures disappoint.

- US PPI and CPI both negative on the month. Inflation? What inflation?

- Retail sales up slightly, flat ex-autos and gas.

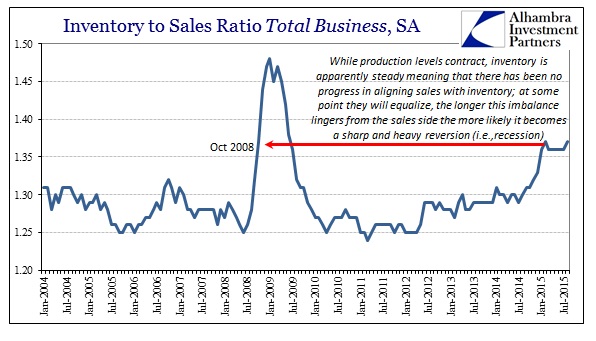

- Inventories flat, sales down, inventory/sales ratio ticks higher again.

- Manufacturing still weak; Empire State, Philly Fed & Industrial production all negative.

- Jobless claims lowest since 1973.

Random Thought Of The Week

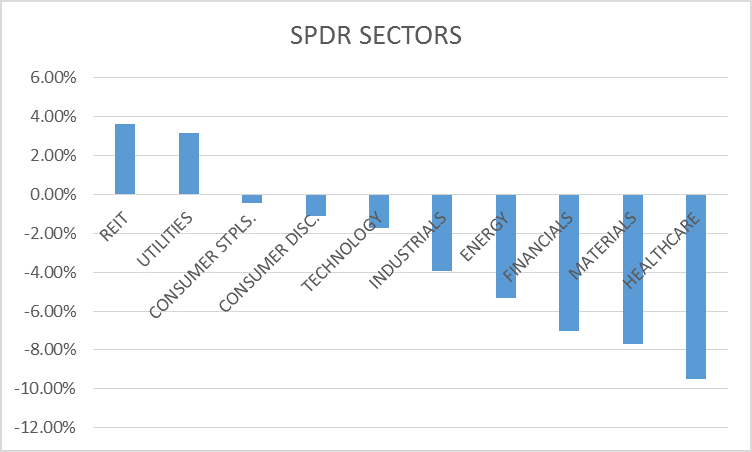

Stocks are reacting positively to weak economic data again. The idea I suppose is that weak data means the Fed won’t be hiking rates anytime soon and that is good for stock prices because if your discount rate stays at basically zero you can pay almost any price for future earnings. Of course, the so called Fed model for the stock market has been proven repeatedly to be so much hogwash, but Wall Street rarely lets a lack of evidence get in the way of being long. Call me crazy but I’m more concerned about the earnings part of the puzzle than the discount rate used to put a value on them. And on that front, the news isn’t particularly inspiring. Third quarter S&P 500 earnings will likely be down for the second quarter in a row, a kind of earnings recession one might call it. Whether that leads to the real thing is unknown but it certainly would appear to hike the odds.

Chart Of The Week

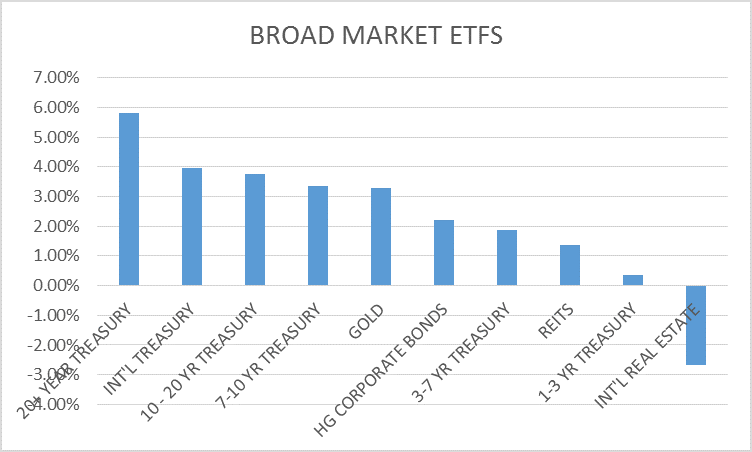

Broad Market Top 10 – 3 Month Returns

MOMENTUM ASSET ALLOCATION MODEL

Stay In Touch