Now that the FOMC has announced its intentions, it has to sit back and wait to see if it can actually do anything. This is the direct consequence of using the federal funds rate as the primary target, as it is a dead market that nobody really uses anymore. The only reason the Fed is still leaning on federal funds is you; namely the economist/policymakers don’t want you to get confused should they have switched to some other more relevant money market rate. Monetarism is psychology more than anything now, so the fact that the federal funds rate “communicates” what the Fed wants you to think about its intentions is all that matters to them.

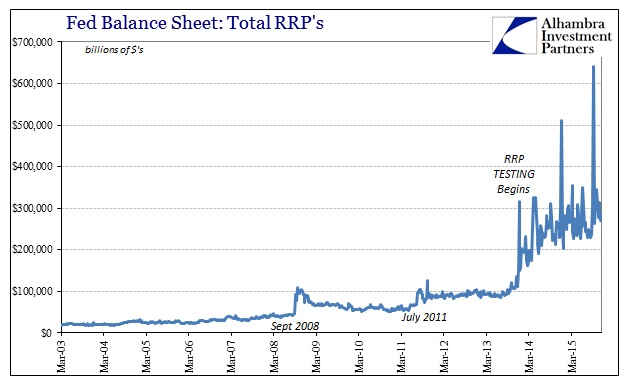

Well, not quite all, because money markets do exist and remain vital. To bridge this communication/practical trading divide the Fed has developed and tested a number of different programs. Primary among them was its reverse repo (RRP) update which now includes several categories of financial participants that were prohibited from monetary policy exercise prior. The idea of a reverse repo is relatively straight forward in its philosophy, as it amounts to private money market participants “lending cash” to the Fed in exchange for UST collateral sitting in the Fed’s SOMA portfolio; huge stockpiles of UST’s that showed up via the QE’s.

In terms of monetary policy, then, “lending cash” to the Fed is the same thing as the Fed “soaking up” money; idling it at the Open Market Desk and thus away from the private money markets. If that was the beginning and end of the potential considerations the Fed wouldn’t need so much testing and self-assurances. There are, as with all things in the real world, great complexities to consider.

If this seems entirely different from the last time that the FOMC wished to “tighten” policy that is because the system now is entirely unrecognizable to what it was in the middle of 2004 when Greenspan was so puzzled by a conundrum. In fact, Greenspan’s conundrum goes quite a long way toward explaining why the Fed in 2015 cannot act like the Fed in 2004; money markets had already undergone radical transformations by then but had at least kept prior faith and some pathology about more traditional operations. That operative environment was, understatedly, highly unstable as was revealed starting August 9, 2007 – the radical transformations were proved the operative condition/problem.

In other words, money markets weren’t actually behaving as Greenspan thought they should and would, leading to his conundrum and then to a total system reset (panic; but a panic, importantly, of only banks by banks within money dealing and market conduits). What happened starting in mid-2007 was that money dealers in this new(ish) money market construction simply stepped away from the global liquidity table. There were numerous factors at work leading them to do so (and I won’t list them all here), but that left a gaping hole in the monetary fabric of not just the domestic system but really the global financial system first.

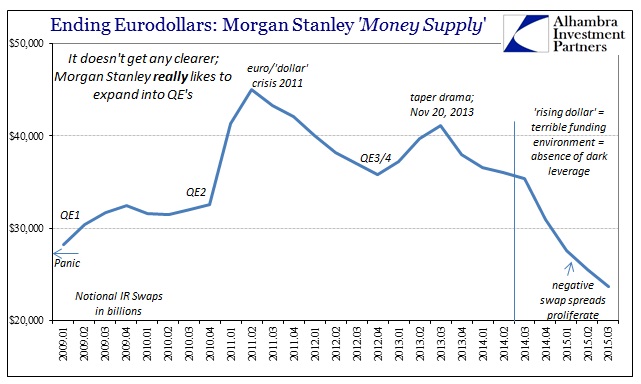

The end of Bretton Woods in 1971 was really the last step in a transformation that had begun in the 1950’s, and what replaced gold exchange was not the dollar but a credit-based eurodollar – all the emphasis you can possibly muster on the term “credit.” That leaves global trade and, after 1995, global debt speculation (bubbles) dependent upon bank balance sheet factors for liquidity and even what might fairly be called the true money supply of this arrangement.

When banks stepped out in 2007 and 2008, central banks were forced to step in. Obviously, that was not a smooth transition, nor would it ever be. Between A and B was a great chasm, one that we experienced as a panic and crash. Since then, encompassing now seven years, we are stuck at B though not for lack of trying. Central banks have here and there attempted to hand back “money supply” responsibility to A, the dealers, but the dealers have only intermittently and half-heartedly accepted it.

The reverse repo program is an acknowledged basis of that observation. RRP’s are intended to provide central bank intermediation in money markets as a means to recreate what private money markets (A) used to do all on their own; 2004-06 being the last example of the condition. Immediately there is a problem, since money dealers are largely (if not entirely by now) absent from this process – the chain is broken between how the Fed communicates its intentions and how the private money markets used to carry out the dirty work.

In order for the Fed to actually raise rates, more than just say the words, this continued central bank dominated condition (B) would likely require massive intervention on the part of the central bank – which is the opposite of what the FOMC is trying to accomplish. Thus, policymakers have had to prioritize their distaste. If they are forced to use the RRP in massive, open intervention just to raise “interest rates” to agree with the useless, volumeless federal funds rate, then they will have further cemented money market status at B rather than going back to A or even toward a next step C.

Accompanying yesterday’s rate hike announcement was exactly that; the FOMC is stuck at B, at least for the time being:

Taking these factors into account, the Desk anticipates that around $2 trillion of Treasury securities will be available for ON RRP operations to fulfill the FOMC’s domestic policy directive.

At its “worst”, the window dressing at the end of September, the RRP spiked to $641 billion. Now, the FOMC is not claiming that it will be “soaking up” $2 trillion in cash via the RRP, only that they are making $2 trillion (and possibly more, dependent on a couple other factors relevant to reverse repos and collateral lending elsewhere, more on that below) available. It is overkill, and it is intentionally so for the reasons I just specified.

What the Fed is hoping, however, is that as these money markets adjust to still more central bank money market resources (B) that private money markets will eventually restore themselves and take up the slack (either renewed A or some new form in C) over the entirety of this “normalization” process – which has been declared over and over to be a lengthy, careful and determined effort on the part of the Federal Reserve (which, by the way, was how they characterized going partially from A to B in 2007 to begin with before Bernanke realized that he was, in fact, actually being forced toward full-blown B).

The Fed is, unlike last time, at least aware of this issue. It was hotly debated in the middle of 2014 as to whether the RRP should be capped and at what level (ultimately $300 billion was decided appropriate) so that the Fed would not become the sole purveyor of money market resources. Anecdotally, the repo markets themselves have suggested that that has become the dominant case and view; banks are using the stepped up money market presence from the Fed’s RRP to further withdraw from repo money dealing that is a profit and resource loser under these conditions.

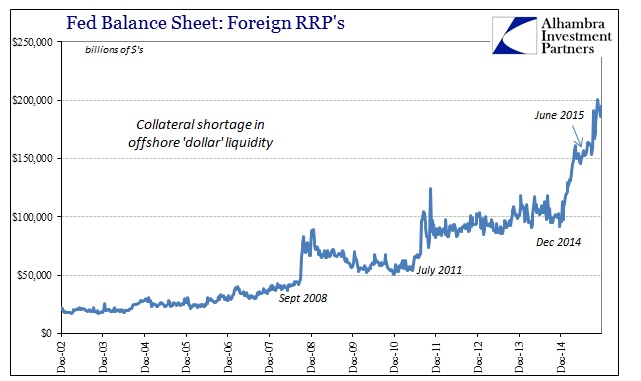

Worse than that, there is the prerequisite condition of “normalcy” to begin with, something that cannot be described of global money markets now or for the past year and a half (if not most of the last three; or five; or eight). One need only note the balance in one RRP component to see such disarray. One of the factors that might limit the $2 trillion available SOMA RRP is an existing RRP program dating back to the early 2000’s and the first major explosion in repo. Under the Fed’s balance sheet factors “absorbing” reserve balances, the Fed has conducted RRP’s with “foreign official and international accounts” as a “service to the holders of these accounts.” The reason for that “service” is collateral lending of UST’s in the Fed’s SOMA possession.

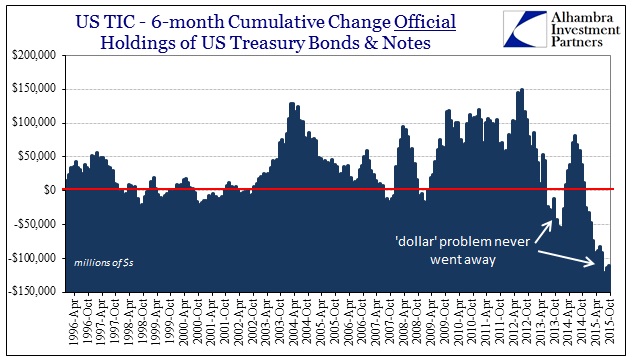

From that basic construction we can infer any large increase in foreign RRP’s as at least some difficulty in obtain US$ collateral in foreign, offshore “dollar” markets, if not a full shortage of it. There had been two major surges in foreign RRP’s prior to this “normalization” era, the first in September 2008 and the second at the end of July 2011; both conditions of massive eurodollar strain. It should be pointed out here that collateral usage onshore or offshore is not strictly a repo affair, as for the most part collateral “shortages” can and do more broadly relate to derivatives margin calls – when derivatives contracts shift wildly in value, forcing the unfortunate counterparty to ante up more UST’s to collateralize the position as it continues on toward maturity.

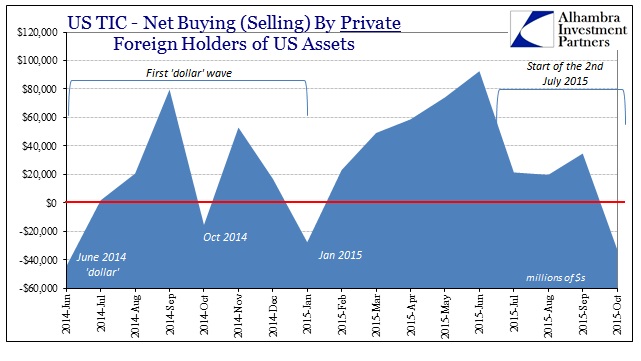

Starting last December, right at the week encompassing December 16 and the trough in the junk bond selloff to that point, foreign RRP collateral lending surged more than at either September 2008 or July 2011. In June, it started again and ran through early November. There is no shortage of possibilities that might explain derivative-based collateral shortages as we know quite well the condition of bank intentions regarding money dealing in dark leverage; what is unclear is why collateral might not be flowing freely under these conditions relative to that (performing yet another check upon “normalization” which would undoubtedly include the smooth and free flow of UST collateral onshore and off).

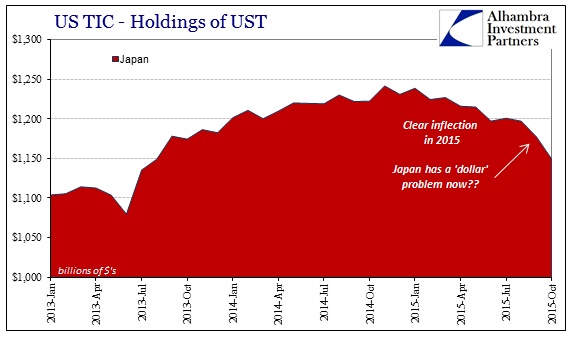

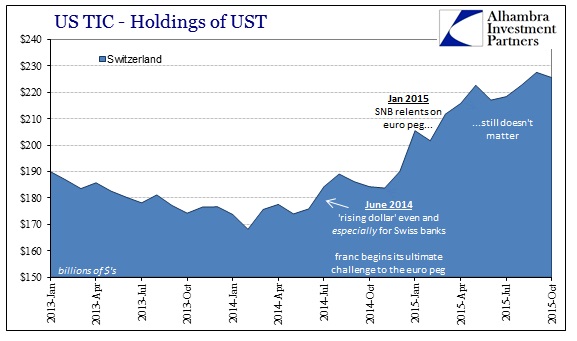

Further, we don’t know exactly where this collateral drain is coming from, specifically, having been conditioned to search through Europe (and especially Switzerland) first. Noting the Asian “dollar” might afford at least a place to start, especially as it doesn’t quite conform to China “selling UST’s”, for example, therefore perhaps only raising more questions than providing answers. It might even offer compelling, but clearly wholesale, avenues for understanding why Japan might be “selling UST’s” in such huge quantities during recent months (as Japanese banks maybe form a serious wholesale “dollar” conduit for Chinese banks).

Recognizing the importance of continuing to search for specific explanations and sources, the point of this piece is more general along the lines of money dealing broadly under the circumstances that the FOMC is clearly assuming. In short, if they are thinking a temporary basis for their shouldering a much, much greater money dealing role they are likely to be forced to some huge reassessment (again). What is perhaps more substantial, however, is that by doing so they may actually be making this transition much worse!

Private money dealing is not a straight-forward activity, it is multi-faceted and multi-dimensional in ways we cannot even fathom even now. The RRP’s, along with the TDF’s and term RRP’s and whatever else, are linear attempts to manage geometrically dynamical systems. Worse, they are designed and carried out in rigidly bureaucratic schemes. In short, a major mismatch between demand for money dealing and how it is going to be supplied, something I forewarned back in September 2013 when the RRP’s first testing was announced:

From the outside, the wholesale money system seems monolithic. However, there is no interbank market; there are several varied interbank markets. Monetary policy in the modern system, particularly in the interest rate targeting regime that developed sometime in the 1980’s (we don’t know exactly when), has relied on open market operations in only the federal funds market. From there, monetary intentions were transmitted via primary dealers and OTC bank transactions. That meant that global dollar markets, particularly eurodollars, had no direct pipeline to the Federal Reserve, relying instead on the big Wall Street and London banks (with US primary dealer subsidiaries) to bridge that geographical/system divide.

…

The weak link here is that the entire plan is dependent on the Fed being correct in its perceptions of market conditions and that it can tailor its response to actual functions. It would still be dependent on non-market, bureaucratic decisions, the kind made during the months of tension before actual panic in 2008. It would also introduce an additional collateral “rental” fee that might not be calibrated correctly. In short, this plan depends on the Fed to correctly surmise rough patches and their causes, and then correctly deal with them in effective doses of policy. I don’t see what confidence that inspires.

Furthermore, it is another case of fighting the last war. The next liquidity event might disrupt funding markets in new ways (derivative markets, for example), just like 2008 was something completely unanticipated by the policy infrastructure, and then unappreciated as it unfolded in real time. In fact, the Fed still may not have a firm grasp on that last crisis, owing in no small part to a real lack of usable information because of dramatic complexity and intentional opacity. Asymmetric information was certainly a problem then, and it will likely be a problem in future episodes.

…

The reverse repo facility is an attempt to address systemic weaknesses exposed five and six years ago, cloaked in the context of thinking about an exit from QE. Instead, it is a half of a liquidity bridge that still does not fully solve fragmentation, but at least the Fed will (theoretically) have more control over short-term money markets. That can’t be a bad thing, right?

As I think is being revealed more and more now, that has been shown to be the case – and I think it has reached the stage already where it has become self-reinforcing. The more the Fed takes over (B) from money dealers (A) the less money dealers do in totality, leaving the money markets not better covered but even more exposed; leading to the central bank doing more and money dealers further retreating, and so on. The $2 trillion figure was meant to be an overpowering guarantee that it will never get that far, but money markets are in distress far beyond what SOMA can provide. In sum, the $2 trillion sounds like a lot but it really is nothing more than the tragically underwhelming TAF program that the Fed first tried in December 2007 (to expand the collateral list and provide funding beyond the stigmatized Discount Window) – bureaucratic response to a dynamic and increasingly severe money market strain that wasn’t just a temporary disruption to function but rather a complete and ongoing systemic break.

Stay In Touch