Mainstream commentary will continue to harp on the unemployment rate as if it were some kind of lucky charm for protection against an increasingly unrecognizable and frightening (to the orthodoxy) world around it. That appeal dominates even where it has so little if any bearing, as in negative swap spreads that were in truth an easy and simple warning about liquidity that didn’t really require much sophistication or familiarity with interest rate swaps at all. The very fact of negative (highly so) swap spreads renders the informational content moot, leaving only the increasingly inarguable suggestion that “something” is very wrong even if it isn’t immediately understood exactly what. The unemployment rate at or near “full employment”, however, leaves no room for such disagreement; therefore there must be, for the inclined, a benign explanation for them no matter how absurd a form it must take to square the circle.

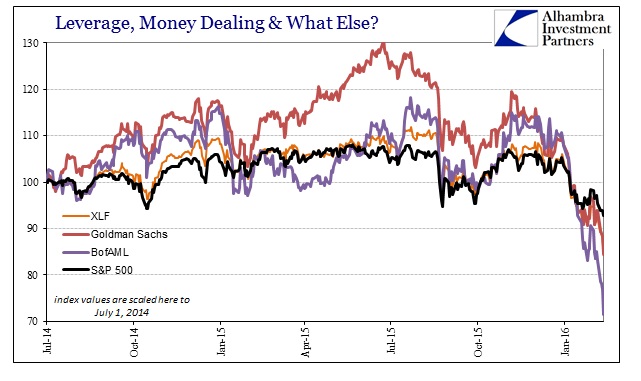

The naked withdrawal of balance sheet capacity in “dollar” terms instead becoming increasingly obvious leaves the search for harmlessness to also increasing generality. It’s no longer just swap markets and opaque but partial capacities in banking, we are now seeing grave concerns about banking itself. Not just overseas, either, though Deutsche Bank and Credit Suisse deserve their place on the front pages and at the vanguard of the firing squad. Increasingly, domestic banks are being driven toward “contagion”

As with swap spread, that just can’t be either as the unemployment rate has only improved while bank stocks have started to crash. Thus, revisions are necessary to contemplate the discrepancy as none at all.

The group’s underperformance — not to mention its current low valuation at 0.85 times book value — reflects fears that a recession is looming (an argument under much debate now). As these fears heighten, investors are moving into safer asset classes, and banks — typically seen as a proxy for risk tolerance — are feeling even more pain. Sovereign wealth funds are among those offloading these investments after being especially hurt by low oil prices.

Some Wall Street watchers have said that fear-induced selling in banks could itself pressure lending patterns and the economic system. But Wells Fargo equity strategist Gina Martin Adams doesn’t think this self-fulfilling recession prophecy will play out. When looking at underlying financial conditions, she said she’s not concerned…

Adams pointed out that bank stocks have historically been very sensitive to changes in the yield curve, which shows interest rates across different contract lengths. As quantitative easing ended, for example, bank stocks were battered, selling off 18% at the end of the first round in 2010 and down 16% after the end of the second round of quantitative easing in 2011.

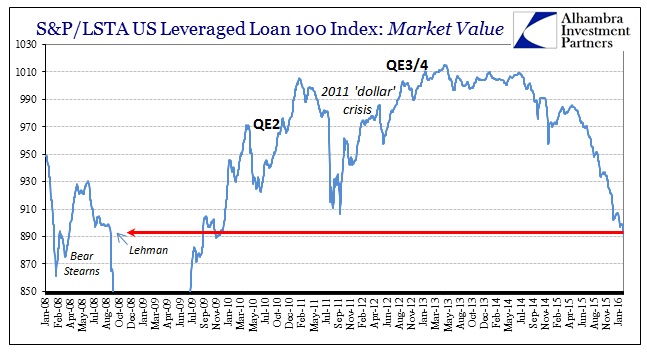

That last part is pure revisionism; bank stocks did not crack in 2010 and 2011 because of the yield curve or even QE. They tanked because, as now, both those years represented grave danger in replaying the illiquid circumstances of the panic that wasn’t all that far in the past. The word “contagion” itself was first propagated during this exact period, especially as nobody had any real idea of exposures even after having experienced that same impenetrability and information asymmetry as one of the primary causes of that prior panic.

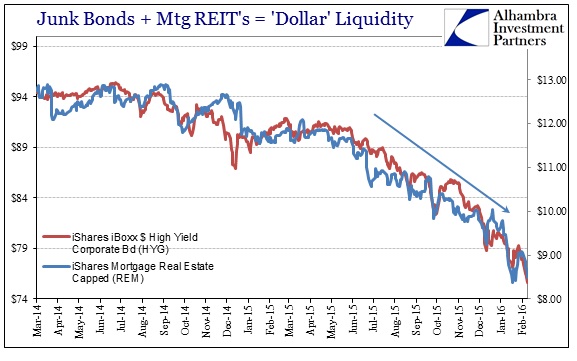

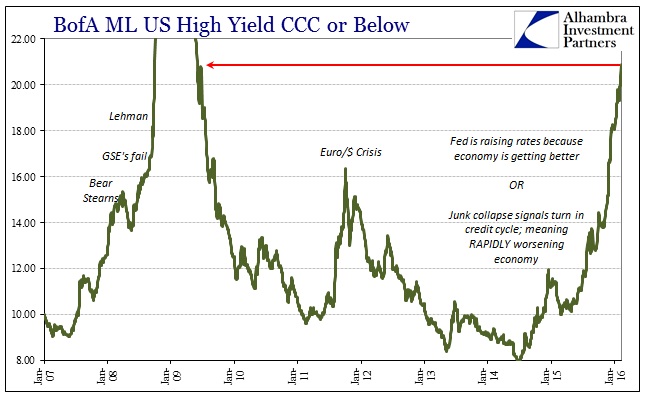

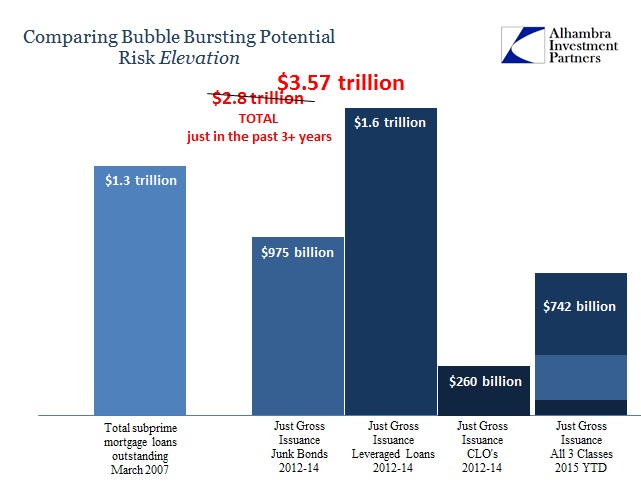

There is no difference today except that the focus on assets, driving the dearth of easily attainable liabilities, is emerging markets and corporate junk. A good many of these global banks had been quite enamored with these segments these past years, but the overriding truth is that nobody has any idea just how much so. That point is made all the more potentially dangerous because there is as much if not more junk now than “toxic waste” of the pre-2008 vintages. Someone has to own this stuff somewhere; and it can’t all be sitting with Deutsche Bank and Credit Suisse. The farther it all falls, the more potential necks for the nooses.

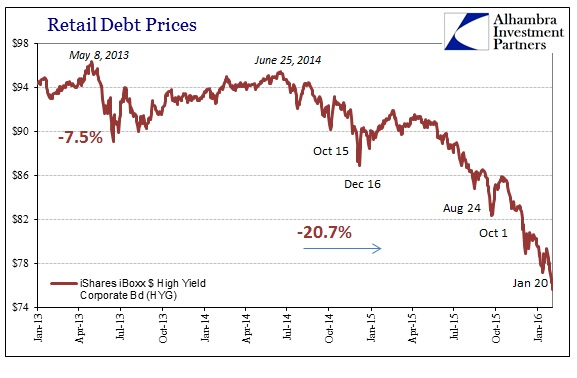

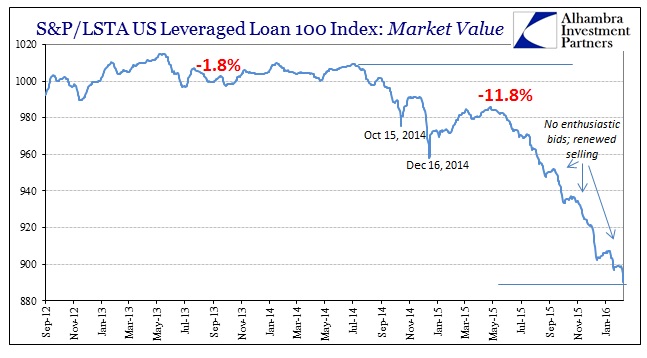

US bank stocks have exhibited a slightly higher beta, but the eurodollar banks (I selected Goldman and BofAML, but you can use any of the other dealer banks) far, far more so. We do know one conduit of just one segment of US junk, and it has performed atrociously tied especially to withdrawing liquidity.

What is left to the increasingly beset imagination is who owns the rest of it (and I won’t even include EM debt in this focus), which is entirely institutional in nature.

The leveraged loan market, depressed even by the index values calculated above, is almost purely a banking affair with syndicated pieces scattered throughout institutional portfolios in almost exactly the same manner as securitizations of mortgages were a decade ago (and even “require” the same kind of mathematical configuring through hedging capacity to maintain the wholesale liquidity of it all). The simple fact of the matter is, unlike what some claim disingenuously, the scale, and thus potential, is massive (and the estimates below are slightly dated).

To which banks will only ever reply, as they always have, “trust us.” We are supposed to believe there is no problem when anyone with eyes can see the pricing and yield figures and know that there is; it just isn’t clear yet with whom exactly. Naturally, the response is quite rational; sell the usual suspects especially the more vociferous and emphatic their non-denial denials and peripheral misdirections. The unemployment rate is no safeguard at all, and until there are more answers about who owns all these trillions in US junk, and the trillions more in Chinese, Brazilian, Canadian, Australian, etc., exposures, there won’t be any.

In fact, the consequences of the unemployment rate having it all wrong this whole time is where all these concerns are suddenly coming from.

Stay In Touch