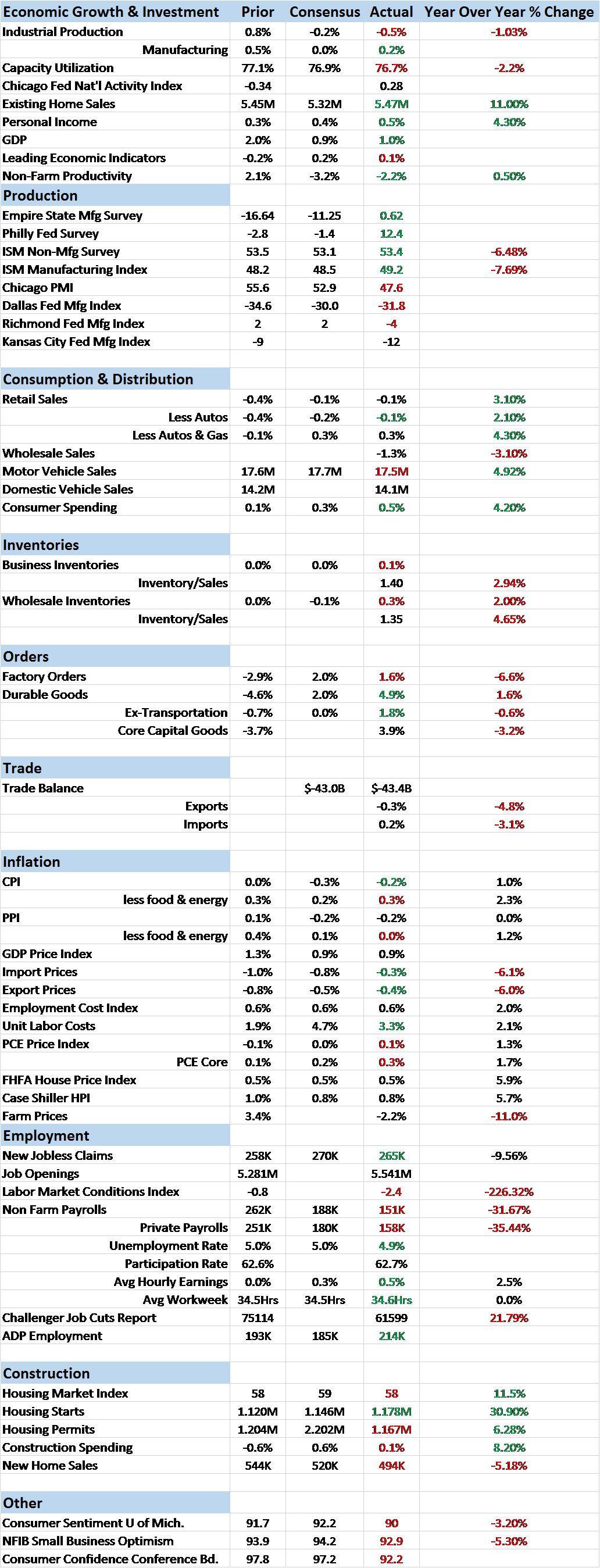

Economic Reports Scorecard

The economic data calendar has been light the last two weeks but the tone of the data has generally improved. On the whole though I find it hard to discern a big change in the US economy. The two manufacturing surveys were bright spots in the ongoing manufacturing recession. Empire State and Philly Fed both were much better than expected and flipped from negative to positive. More importantly, the strongest parts of the survey were for new orders. There were even some positive hints in the Industrial Production report although the overall report was still negative. The manufacturing part was up though and that is a good sign.

It is hard to get too excited by those small glimmers though with inventory/sales ratios still climbing. Wholesale inventories were up 0.3% in January while sales were down 1.3% and the inventory/sales ratio ratcheted up 2 ticks to 1.35. Total business inventories, reported this week, were also higher by 0.1% but sales fell 0.4% and the ratio jumped to 1.4, a reading comparable to October/November of 2008. About the best that can said about these inventory numbers is that they are for January leaving some hope that they may have already started to improve. Hope is the right word since retail sales for February weren’t all that great either, down 0.1% with January revised from positive to negative (+0.2 to -0.4). The ex gas and autos number was up 0.3% but one does wonder how many things one can remove from the number and still have something that provides anything like meaningful information.

Indeed, the fact that auto sales aren’t helping anymore certainly isn’t good news as that sector has been a big part of what growth we’ve had. Shale was another piece of the growth puzzle, one that is now kaput. Housing, which has been another positive may also be showing signs of aging as starts were up and ahead of estimates but permits were a big miss to the downside. Permits have flattened out over the last few months making me wonder what the builders know that I don’t. Even the JOLTS report, which has been a consistent positive surprise, managed to disappoint. Job openings were way up but from a very negatively revised previous number. Again, though, January data so there is hope…. Overall, the trend of the economy hasn’t changed much, growing at around 2% and not, so far, getting worse or better.

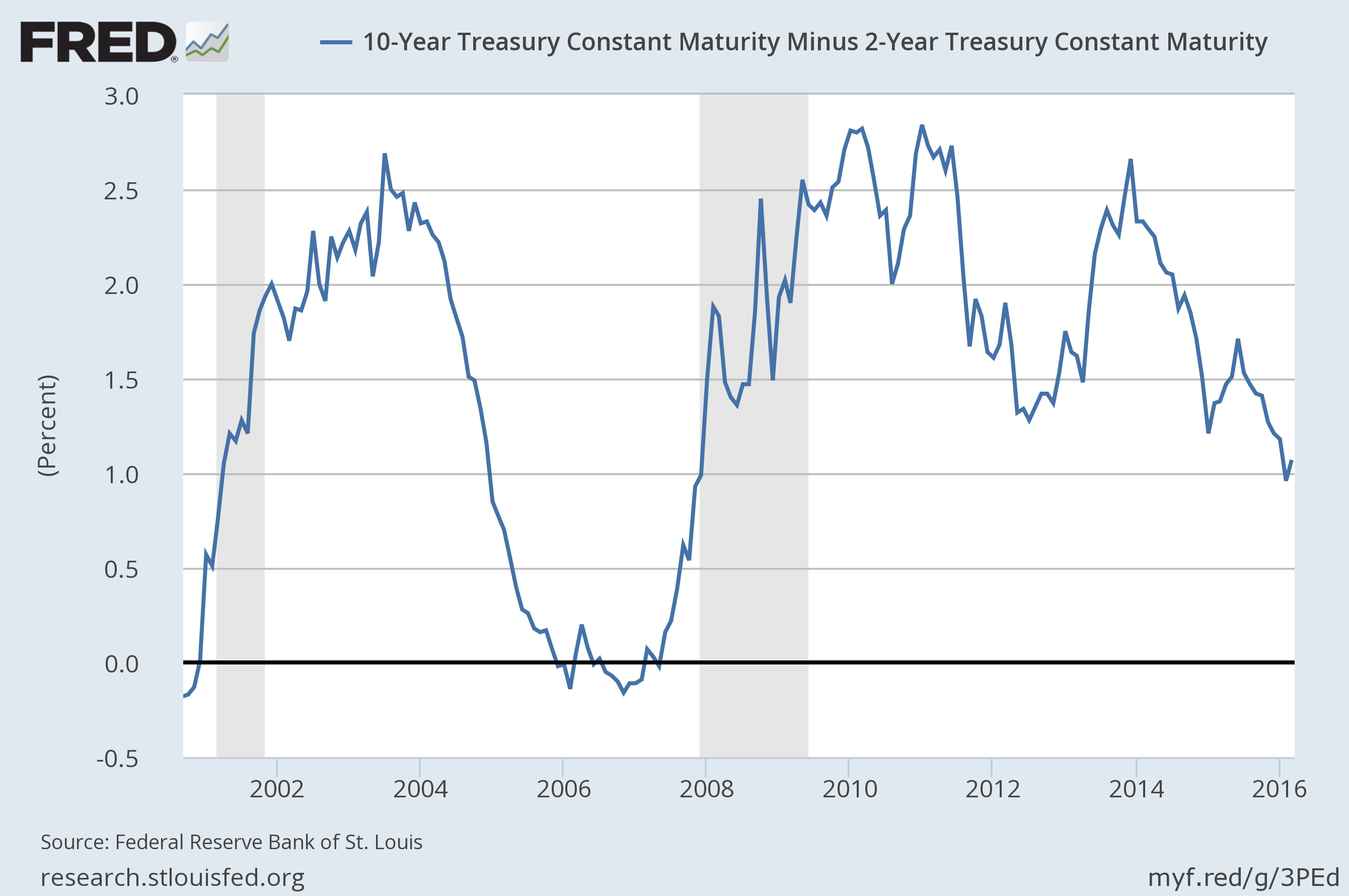

The market based indicators we follow are a little clearer than the data itself and point to improvement, albeit minor. The yield curve has steepened (as I discussed in this commentary) a result of the easing of expectations regarding Fed policy. A steeper curve is often interpreted as better growth expectations but one needs to be careful since it depends on how it steepens. Meaning that better might mean more inflation not more real growth. In any case, a steepening of the curve is associated with the Fed easing that normally takes place just prior to recession. But then this cycle has been a lot different than any we’ve witnessed so it is hard to say exactly where we are. If one assumes the curve will go completely flat or invert before recession then this is merely a blip on the way to the top of the cycle. You know I have my doubts about that.

If we do then take a look at the nominal 10 year Treasury and the 10 year TIPS we get a clearer picture of what the market is expecting. The yield of the nominal 10 year Treasury note has ticked higher over the last two weeks, indicating as the yield curve does that nominal growth expectations have risen.

TIPS, on the other hand, are moving in the opposite direction with the 5 year maturity dipping back into negative territory:

Which means the market expects the improvement in nominal growth to be in the inflation side of the ledger rather than real growth.

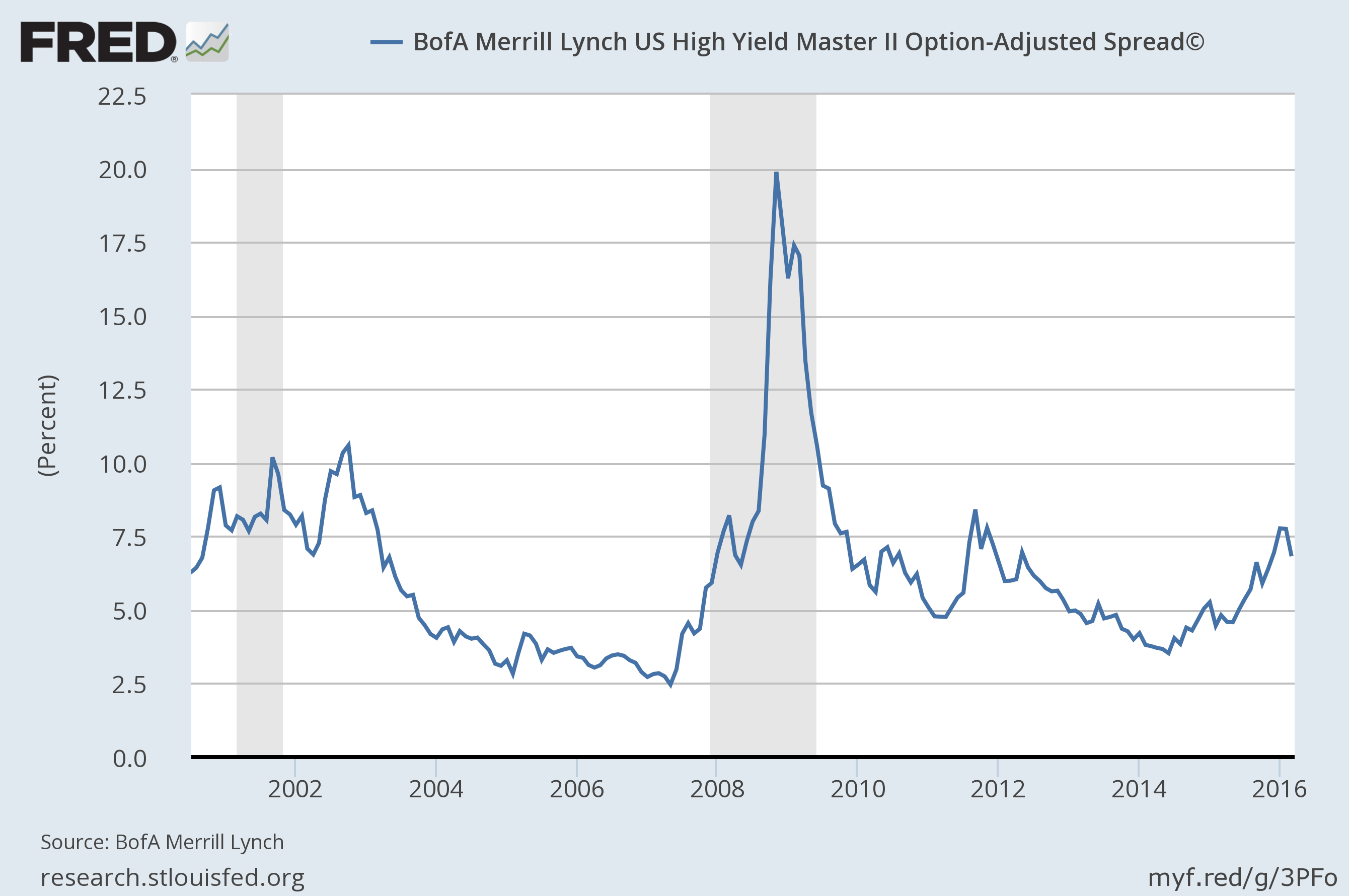

And it is that inflation – rising oil prices specifically – that is driving the recent narrowing of credit spreads I mentioned in the last economic update. The trend is still wider and I think this is merely a countertrend move, but that probably depends on whether the shale companies can use higher oil prices to stave off default. A WSJ article this week threw cold water on the idea that these companies can just ramp up production at will so the answer to that question is harder to answer than it first appears.

The narrowing did spill over more to the junkiest parts of the market in the last couple of weeks:

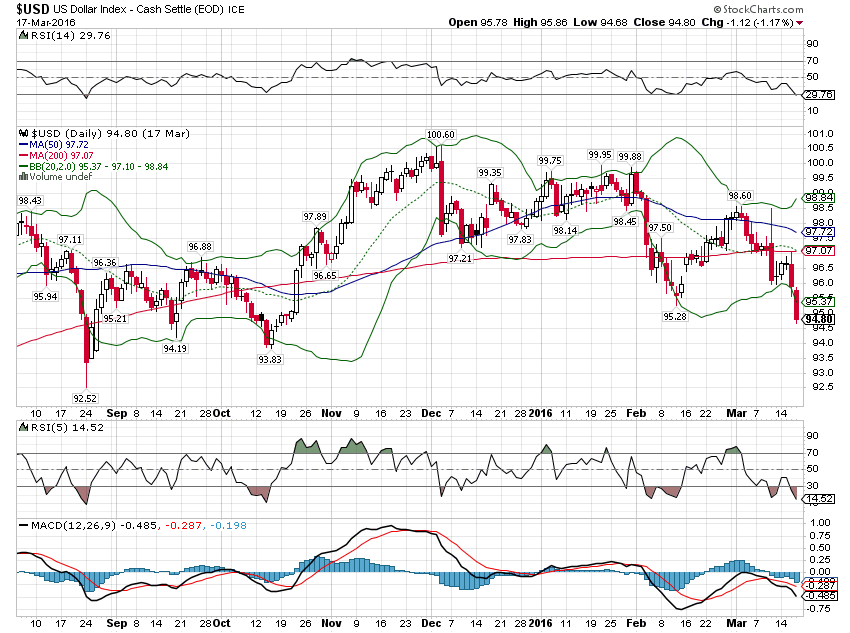

One place you won’t find any expectations for better growth is in the dollar index. The Fed’s dovish tilt at the FOMC meeting was a hammer to the dollar. It is the falling dollar which is feeding those rising inflation expectations.

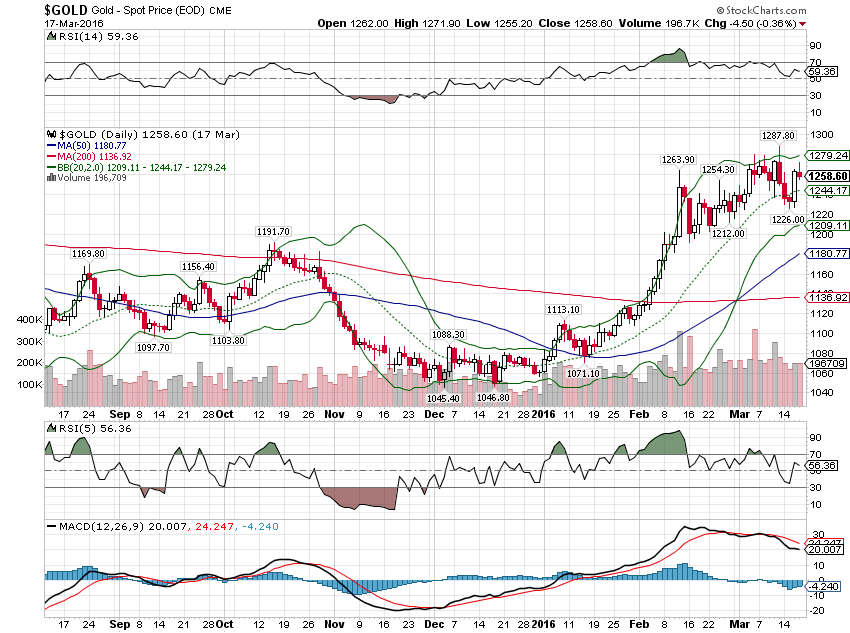

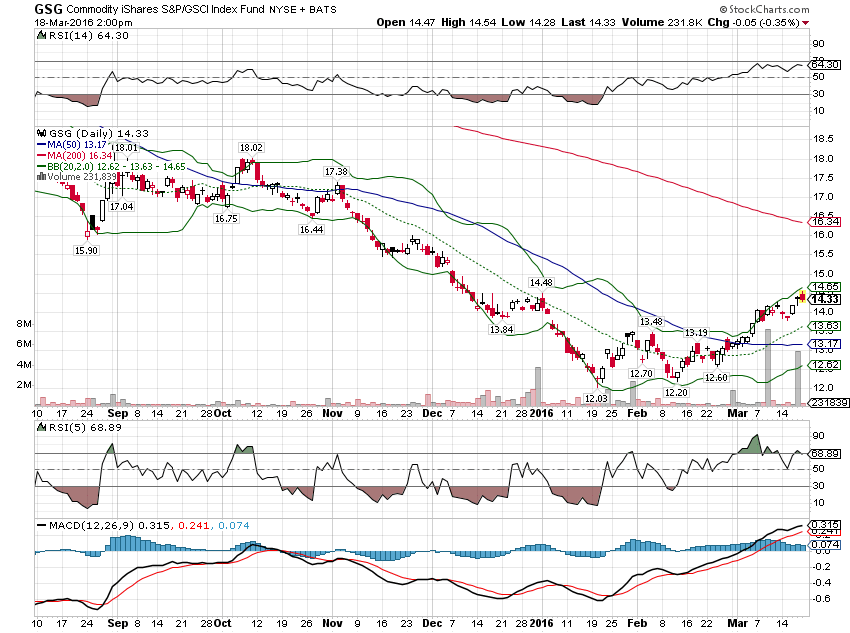

Gold is still being supported by falling real rates and the falling dollar but the rally seems to have stalled a bit. That’s not surprising given the size of the move already. Meanwhile, the general commodity ETFs are playing catch up:

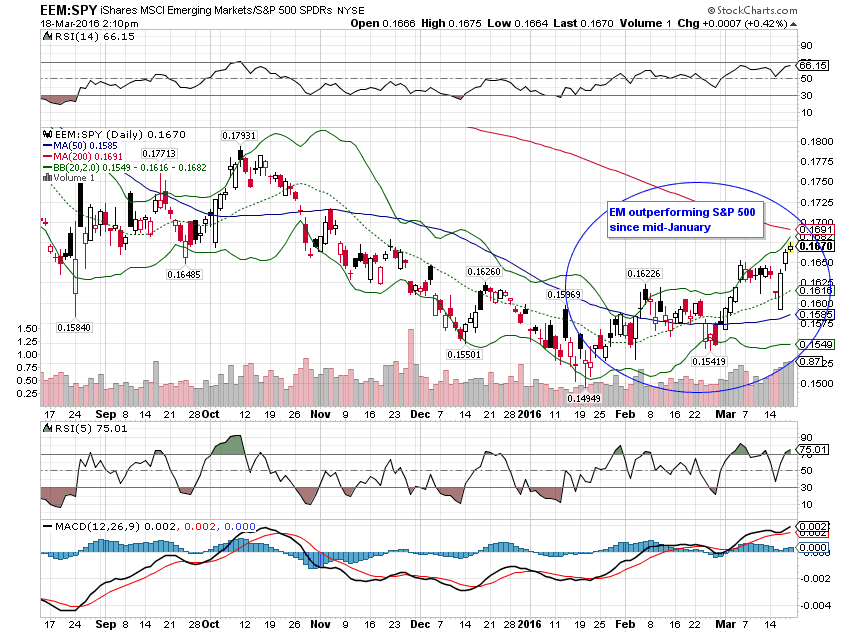

As I said in the last update, a falling dollar, rising gold and rising commodities are not good for US economic growth. They might, though mean better things in other countries as capital flows away from the falling dollar. The most sensitive are the emerging markets but foreign stock outperformance is often associated with a falling dollar. Something to keep an eye on for sure:

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch