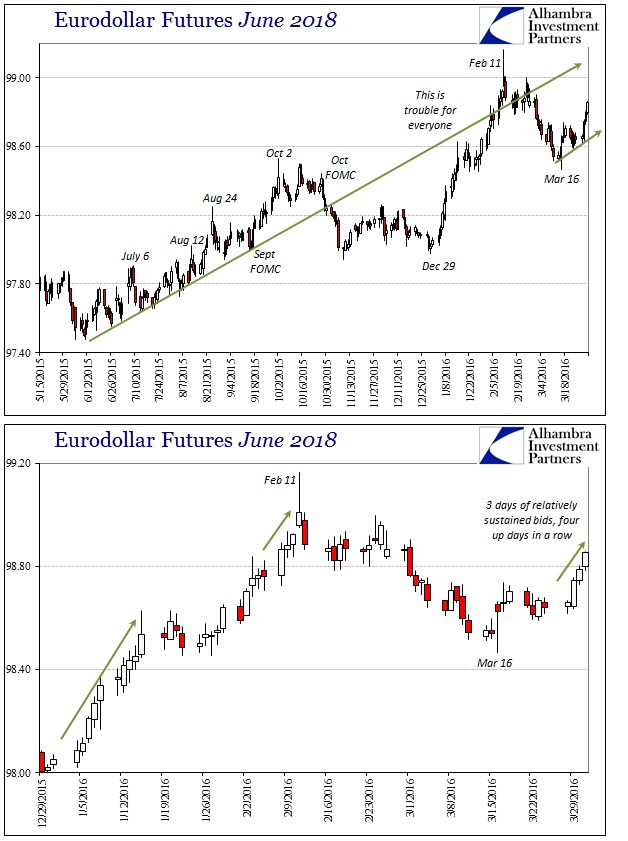

It is quarter end, so illiquidity irregularity is to be expected except that it isn’t irregular really. Eurodollar futures have been heavily bid for three days in a row now, leaving four consecutive up days for the first time since the liquidations.

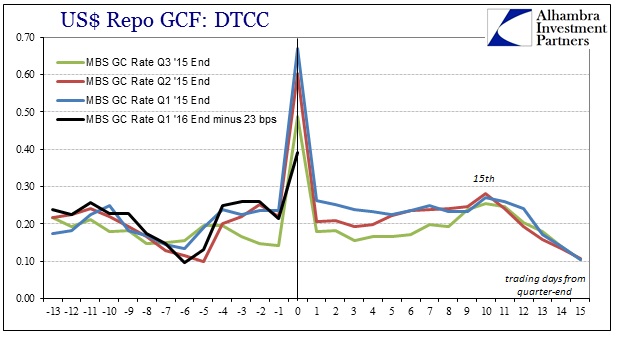

And because I am a sucker for fractal behavior, repo markets proved that quarter end is still what we think of it and that today’s fireworks (surging intraday GC rates and huge volatility) keep open the possibility of serious illiquidity last observed via fails not that long ago, further pegging the absurd protestations otherwise. From CNBC/Reuters:

A key overnight borrowing cost for Wall Street surged on Thursday to its highest level since the height of the global credit crunch in the fall of 2008, as investors slashed their lending to dealers and banks at quarter-end.

The interest rate on the $5 trillion repurchase agreement market jumped to 0.85 percent late on Thursday, nearly double the level at Wednesday’s close, according to data from interdealer broker ICAP…

According to Skrym, Thursday’s repo rate was quoted as high as 1.75 percent, well above its recent average of 0.57 percent.

DTCC reports an average GC rate of 62 bps MBS and 63.9 bps UST for today, thus in the same kind of pattern (adjusted for December’s rate action) observed over the past year or so. Dollar shortage still?

Stay In Touch