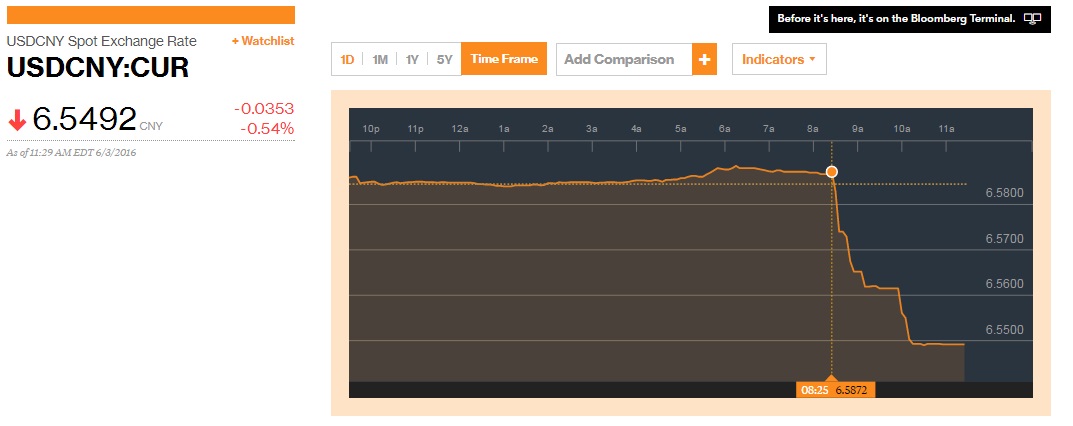

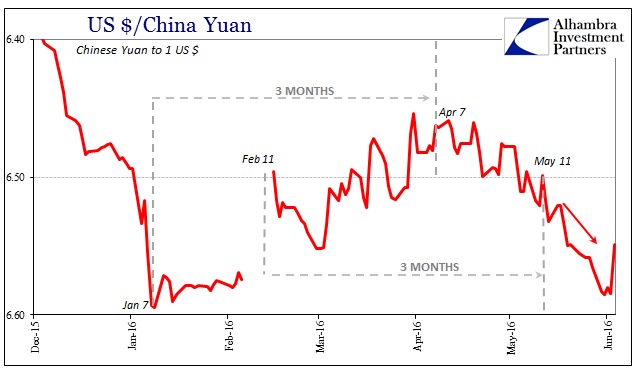

By any reasonable standard, today’s trading in “dollars” was highly unusual. The Chinese yuan had been trading its typical depreciation route all through the night and toward the US open. At about 6:15am, CNY was just about to touch 6.59 and a new low that would have put it back into early January territory (not good). It traded modestly higher from there, and was at about 6.5875 when the payroll report hit. The first burst of US trading took it up all the way to 6.574, and by the time US stocks opened at 9:30am CNY was up to 6.5615. It would end the day slightly above 6.55.

Aside from being such a large move, the reference rate, or middle rate, was published at 6.56, but the selling rate remained at 6.5977 as if the payroll report never happened. It suggests that the PBOC was content after the 8:30 to fix the middle rate as CNY appreciated; tacit approval, maybe, to run with it. And I am sure they were very happy to see it go that way.

Today is one of those days where wholesale still clashes with tradition. The huge run in CNY was not about China but (somehow) Janet Yellen. With the worst headline Establishment Survey figure of the “recovery”, the “market” decided there was no way the FOMC would follow through with all the “hawkishness” that its members have been displaying in recent weeks and days. Thus, there was heavy “dollar selling” by those who had them. The Chinese, being short of them, and increasingly so, were very likely the primary beneficiaries of such foolishness as believing in Yellen’s recovery agenda – “buying dollars” as much as they possibly could to help out all the chicken hawks.

With a surely unanticipated flood of “dollars” heading in that direction, the ticking clock was surely reset by this spark of policy generosity. But for how long?

We have seen this kind of knee-jerk before, notably just prior to the Bank of Japan’s worst-kept-secret introduction of NIRP in late January. Amidst the worst parts of the global liquidations, the yen was appreciating much to the consternation of BoJ policy. On January 20, it had surged to 116.38 to the dollar, before dropping back to 118.50 or so the day before the NIRP announcement. JPY was “sold” on the news all the way back down to less than 121, though it didn’t last but a few days. By February 4, JPY was above 117 into the 116’s again as if NIRP never happened.

It suggests that traders were selling JPY into something they didn’t really understand, expecting BoJ “stimulus” myth to match up in reality. The traditional framework surrounding these currencies is that interest rate differentials and monetary policy introductions and changes cause movements. From that view, the start of negative nominal rates in Japan “should” have meant “correcting” JPY back toward the gentle devaluation that is standing BoJ order. It didn’t stick because once the rush was over, the dominant wholesale trend reasserted control as the “dollar”, through JPY this time, went back to openly “defying” yet another central bank.

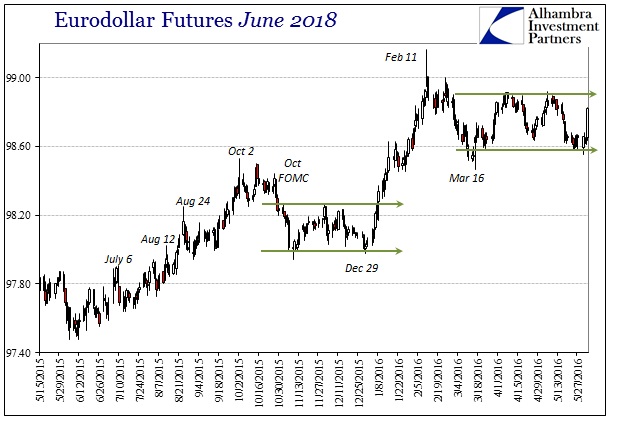

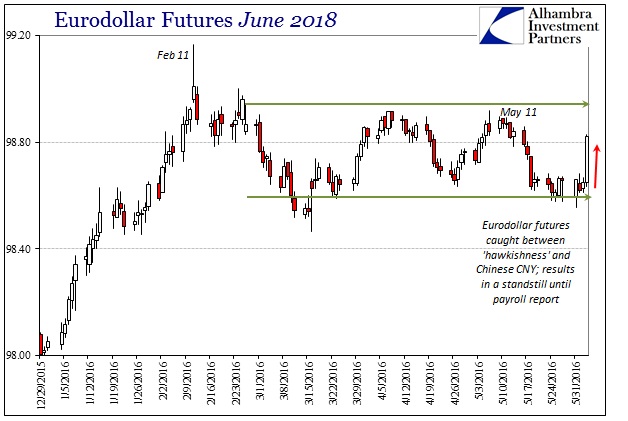

This time, today, the shift in perception was in the dollar itself (not “dollar”) where again there was surely a determined burst of “selling dollars” all throughout the system based not on wholesale fundamentals but traditional currency perceptions. We can observe that US-centric response in various places like eurodollar futures. The middle part of the eurodollar curve exploded higher in tandem with CNY’s sharp appreciation. The June 2018 futures contract finished the day up an impressive 17 bps, closing again back above 98.80.

Typically whenever eurodollar futures have been so heavily bid like that it has been during bouts of CNY “devaluation.” The correlation has been somewhat reversed of late, especially as CNY has been sliding again since mid-April and really mid-May. I believe that is a result of this tension between expectations for and about monetary policy (the “hawkishness” of late) and the realization of CNY as a renewed threat. Thus, like JPY after NIRP, I would expect that in short order (unless something else changes) the “dollar” system will again revert to what lower futures rates (higher prices) for eurodollars has meant – more and further fundamental economic problems ahead.

That is what all this mess centers upon, including today’s great upset that might remove the last economic excuse of the “recovery.” In other words, if the US economy is as bad as feared, or at least the possibility of that scenario rising significantly, then we are left once again with the same baseline that has caused CNY depreciation for the last year and a half – the “rising dollar.” It is the same result even if you wash these trends through the traditional perspective; slower US economy means slower still for the Chinese economy, increasing expectations for more “capital outflow” and thus “devaluation.”

Having suffered through more than three weeks of almost sustained “dollar” pressure, the PBOC and Chinese monetary system can only say “thank you” for today’s funding gift. And it wasn’t just CNY, though that was the most pressing and visible, as currencies throughout the EM’s were similarly bestowed a traditional, policy-driven reprieve. Unfortunately, the “dollar” is still the “dollar” and the genesis of the “rising dollar” got more bad news today; maybe even the worst. If there has been one proven fact throughout the past two years of “dollar” runs and waves, it is that central banks and monetary policy may hold temporary sway but in the end are no match.

Stay In Touch