Last week, the National Bureau of Statistics in China released what seemed like import levels that suggested “stimulus” was finally paying off and the economy had struck bottom. Among these more glowing results was an absolute surge in the importation of oil, which was blindly parroted as if Chinese demand due to the expected economic revival were the cause. Instead, we increasingly find only financial reasons for the surge in inbound petroleum.

Absent an actually stable currency regime, meaning external funding via “dollars”, the importation of oil makes perfect sense wholly unrelated to demand for it. It allows the Chinese to essentially convert their own “dollar short” into a liquid (in the “dollar” sense) commodity, thus transferring some (large) margin of their financing issue elsewhere in the world (mostly Africa that I can determine). Though updated financing figures for May will not be released until next week, the TSF estimates through April 2016 are a more than sufficient demonstration.

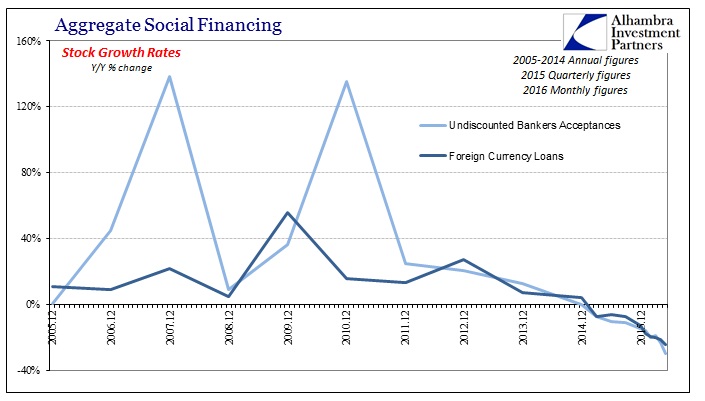

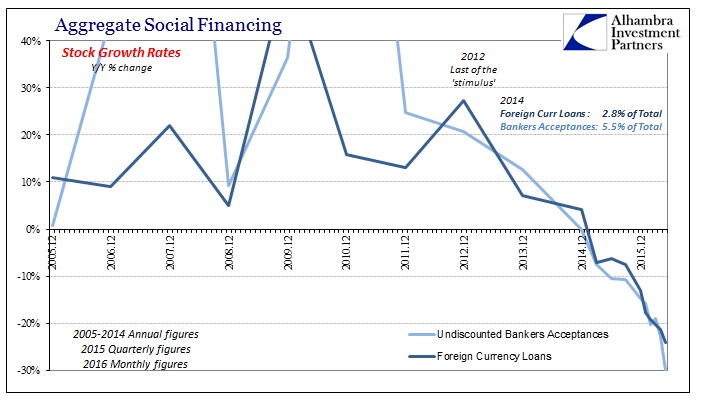

The TSF estimates for May were released today and they offer only further demonstration; in addition to reviving another charge from earlier in the year. At issue is foreign financing, mainly in “dollars.” Since the start of the “rising dollar” period we see that China’s chief sources of trade financing have fallen off precipitously. In 2016, contraction in both Bankers’ Acceptances and foreign loans has turned quite serious.

The update for May shows that Acceptances, in particular, were down sharply, double the pace of April’s decline. That would, again, seem to provide a basis for accepting oil in payment from Africa and wherever else it might be obtained in that fashion.

Some media outlets are suggesting that the dramatic drop in BA’s is due to official crackdowns on fraud, which was a problem in this area, but though that is likely part of the equation I don’t find it particularly convincing given the overall trend concurrent to the “dollar” and now inbound oil. It might suggest why the contraction in May was at such an extreme, but I think it reasonable to assume that financing flow would have been at least consistent regardless of any official intervention one way or another. China has a clear external financing problem, which is about the least surprising development in this “rising dollar” world.

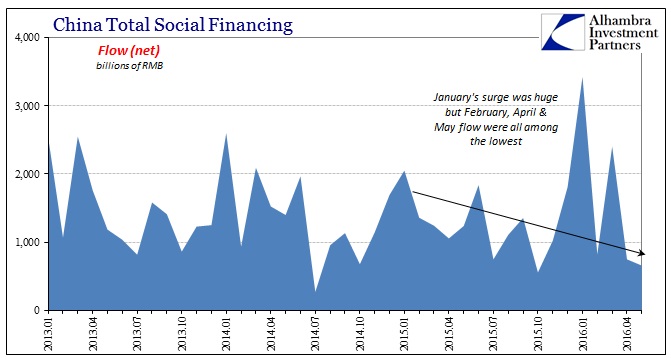

The other part of the TSF update seems to further confirm our internal financing thesis from February. To review, China “flooded” its financing markets, internal and external, starting in January which provided sufficient cover and incentive for Chinese banks and firms to go crazy. Lending and TSF flows were at record levels, which the mainstream unsurprisingly turned into another rebound narrative. Instead, it might have been more consistent with Chinese firms and banks getting as much funding done as they could while liquidity and volume were plentiful under very temporary, artificial calm.

TSF flows did fall off significantly in February, but surged again in March – both further months still under the auspices of PBOC liquidity (external and, to a lesser extent by then, internal) intervention.

For Chinese banks, it might be that they realize what the huge surge in liquidity in January actually means – it must be withdrawn at some point in the future (“when” depends on its exact form). Perhaps, then, Chinese banks are especially active ahead of time in anticipation of funding being less than suggested (in the mainstream) in the near future?

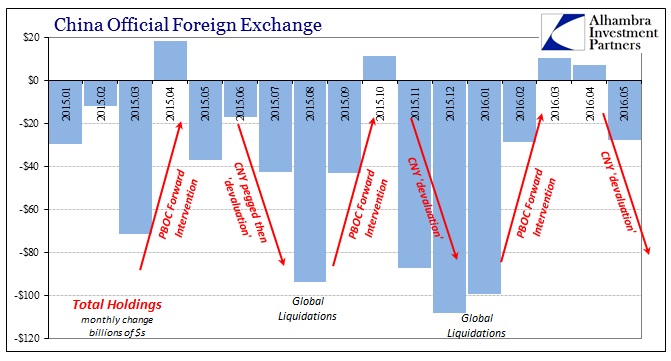

As we have observed via the inflection in CNY exchange starting in mid-April and the return of “selling UST’s” in another patterned reduction of China’s official foreign holdings of reserves, we can reasonably infer the affluent conditions of January-March have indeed wound down (corporate bond flow was net negative in May after sustained increases throughout). As such, in both April and now May, TSF flows have slowed dramatically.

If that does represent Chinese firms taking what they could while they could, then we should expect the effects of such a one-off increase to disappear relatively quickly, as well. Combined with the continued disarray in external financing, the outlook is still quite negative for not just China but really the global economy that is dependent upon it for transmission – either to growth or more contraction.

Stay In Touch