Last Friday the Statistics Bureau of the Japanese Ministry of Internal Affairs and Communication reported some more bad news for Prime Minister Abe and really Bank of Japan chief Kuroda. Month-over-month, the consumer price index was down again, leaving it 0.48% less in June 2016 than June 2015. This was the third consecutive month of increasingly negative year-over-year CPI estimates.

When QQE was first implement back in April 2013, its staff economists guessed that it would take two years to get Japan back to 2% inflation; the standard target for almost all the central banks in the “developed” world. The point of QQE as apart from all prior QE’s, and there had been nine or ten before it depending on your definitions, was that it would be so big, powerful, and sustained that the “deflationary mindset” that had, according to orthodox economists, gripped Japan for decades would be forced to surrender to this new monetary regime. Two years was their conservative forecast.

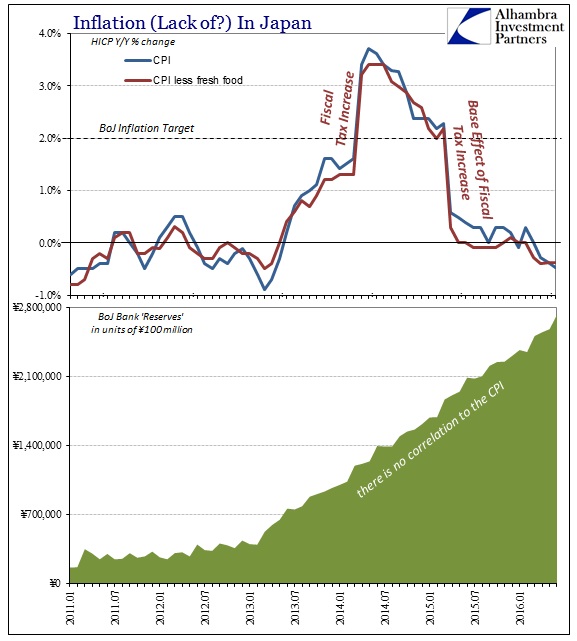

The Bank of Japan did achieve the first part; the central bank has, as of the latest balance sheet figures for June 2016, quadrupled the level of bank reserves in Japan. The end of month balance in March 2013 was ¥52.6 trillion, a number that at the outset of prior QE’s was already supposed to be impressive, further meaning that it wasn’t as if BoJ was starting from nothing. More than three years and an acceleration of QQE later, there are now ¥272.6 trillion of bank reserves in Japan, an increase of 418.2%.

These are numbers that should conjure images of Weimar Germany, but instead they bear absolutely no relation to either the narrow view of the CPI or, more importantly, the wider view of Japan’s economy. Nothing.

And so it would be entirely natural for anyone to begin to ask whether bank reserves actually count for anything other than myth and legend. QQE was supposed to be a massive “money printing” operation, so terrible that it was the final culmination of Paul Krugman’s late 1990’s criticism in actual economic “forward guidance” – to credibly promise to be irresponsible. The quite appropriate fear of money printing in traditional terms (of actual currency) is that once it gets out into public hands it is impossible to stop.

That isn’t entirely accurate, however, as the real trigger to uncontrolled inflation and even hyperinflation really doesn’t have much to do with quantity theory at all; it is entirely driven by psychology, more so in relation to public faith in those tasked with actually knowing what they are doing. In 1921 and then 1922 in Germany, the breaking point was truly when it became very clear that authorities had not only created a bad situation but far more importantly were in denial about it.

In other words, German monetary officials, particularly Reichsbank head Rudolf von Havenstein and Minister of Finance Karl Helfferich, denied that Germany had an inflation problem at all – right up until the end. Minister Helfferich declared that Germany had better gold coverage after the war than before it, despite that more than quadrupling of currency volume. One economics professor, Julius Wolf, wrote in 1922 that, “in proportion to the need, less money circulates in Germany now than before the war.” As much as the easy-to-see Versailles excuse played a part, there can be no doubt that beyond 1921 the German people themselves began to recognize that authorities had no idea what they were doing; worse, they came to see that even though policymakers were inept and incompetent, officials themselves would never admit as much and thus nothing would prevent Germany from its fate. That awakening meant an increase in danger that French occupation could never have unleashed on its own.

The Japanese people are not faced with actual money printing but rather the revelation of pseudo-money printing as a matter of economic and financial reverberation. So much has been made of QQE as that all-powerful engine of raw monetary fury that it is difficult if not impossible to predict how it would unwind after being so thoroughly discredited.

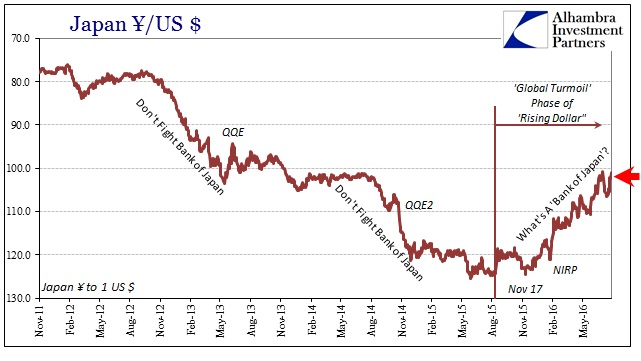

From this perspective, you can understand the sense of urgency at BoJ at least to start 2016. After ¥200+ trillion and nothing to show for it, what is at stake is much more than 2% inflation. The behavior of the Japanese yen since November is the best, most dangerous example of that possibility yet. It was amplified that much more by NIRP, especially in that the introduction of a negative rate policy, another supposedly powerful tactic, elicited at most a few days of conforming echo before the yen resumed its increasingly open defiance of BoJ policy as if NIRP never happened.

With the exchange rate threatening 100 to the dollar in the first week of July, someone had to do something to restore even the possibility of regaining just the semblance of orthodox order. And so it was “leaked” that BoJ was considering an even larger measure of “credibly promise to be irresponsible” that may have included the mythical Friedman “helicopter.” The rekindled “awe” lasted about a week, and brought JPY back down only to just shy of 107.

The love affair with imprudent statism was mainly a manifestation of the media (and stocks, redundant in some ways). Reaction was initially sharp in all markets, but overall quite tame and muted. Maybe that played a part in the eventual reluctance of BoJ to do much of anything at the end of July, greatly disappointing to the narrative that had been building all month. Could the BoJ finally be sensing that having shown themselves impotent there is no longer any benefit to definitively proving it?

Both Abraham Lincoln and Mark Twain have been attributed with an appropriate quotation for this possibility; “better to remain silent and be thought a fool than to speak and remove all doubt.”

On July 24, the Wall Street Journal published what was an open comment on dissent against further “easing” (another mainstream monetary term that so deserves the quotation marks) in Japan. Recognizing some urgency but really downplaying it overall, these now more reluctant policymakers appear to have won the argument, for the time being.

But other BOJ officials are signaling a reluctance to act, underscoring questions about whether the central bank has reached the limits of its powers to revive Japan’s economy. They note that monetary policy is already extremely accommodative, with bond yields and interest rates at or near record lows, and express doubts that additional easing would make fiscal stimulus much more effective, according to people familiar with the central bank’s thinking…

The BOJ may turn to new, “more targeted” approaches, one of the people said. “I’m not saying that we wouldn’t like to ease further, but it isn’t as simple as ‘the more, the better; the sooner, the better.’”

Indeed, what might have happened had JPY reacted to the “helicopter” with the same disdain shown NIRP? It could have been catastrophic, a risk that I doubt BoJ was prepared to take at this juncture without immediacy to necessitate drastic action right now (essentially paraphrasing the quote above). They can afford to wait since the most pressing issue is JPY in further “harmful” appreciation, which spells out a more negative but still uncertain future. The risks of monetary policy have been turned totally upside down.

In short, the month of July, the sudden rekindling of mainstream love for central bank “stimulus”, was all a dream. For even the BoJ to acknowledge reality is a drastic change, one forced upon them by circumstances they never anticipated – that they are, overall, quite powerless in the modern, wholesale format. QQE was essentially the Japanese central bank daring anyone in the world to bet against them, and for more than two years nobody did. Now almost everyone is and quite close to home, and their main reply is to punt where once it supposedly counted most?

JPY is back to within 100 again today, completing a full round trip. The CPI was published last week at -0.50% and still falling.

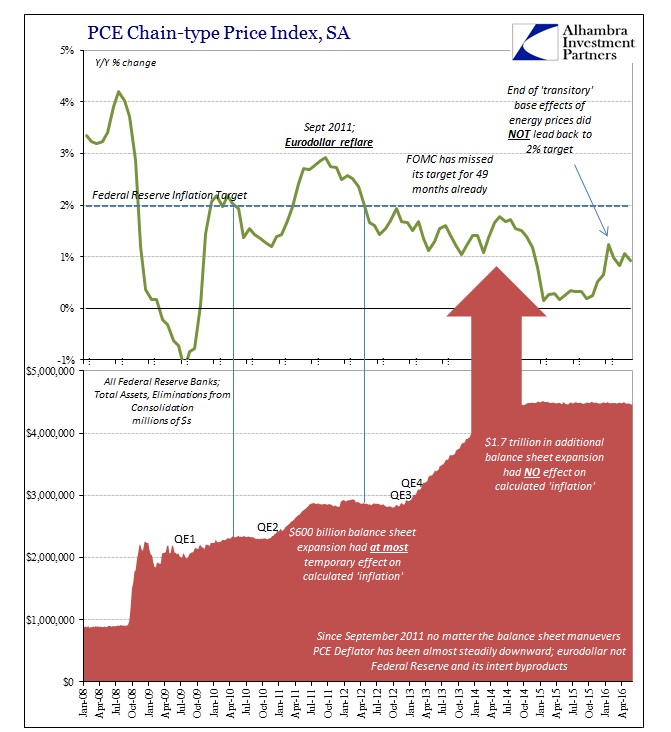

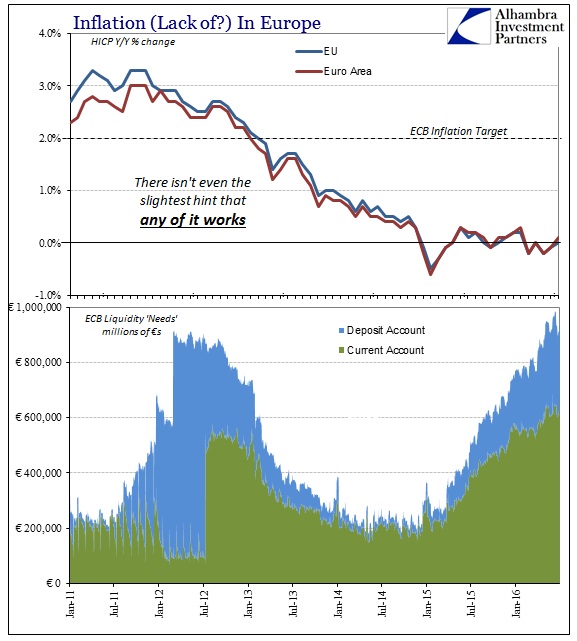

Central banks around the world were given mythical status a few decades ago based on what they didn’t do. At the time they were building those legends the Bank of Japan was already at work disproving them contemporarily. The data and ineffectiveness was, however, almost entirely dismissed as if it were a quirk of Japan or even the Bank of Japan fumbling the execution of otherwise brilliant construction and resolve. That excuse has been exposed by uniformity of result wherever QE is tried. The legend now seriously (mortally?) wounded, even the Bank of Japan hesitates.

The trap is sprung; JPY continues to mutiny not as an isolated case related to only Japan but as universal recognition of what might be to come. Central banks have essentially a rump choice; to let the economy continue to worsen under the “dollar’s” tightening noose, or continue on and risk being caught in “denial” too close to that which shoved Weimar Germany into lasting history. For now, Japan’s policymakers vote for the noose but only because the threat of slow death is in 2016 apparently the most palatable or least risky. There is no money in monetary policy, a statement that bears grave consequences in either direction as the world realizes it.

Stay In Touch